Knowing the answer to ‘what percentage of tax do I pay in Australia?’ is key to ensuring you meet your legal obligations and responsibilities. If you’re curious about ‘how do I know what percentage of tax I pay?’ as a business owner or you’re interested in working in Australia as a foreign resident, we’ve covered everything you need to know in detail below.

Read on to find out more about the most commonly asked questions for tax, including ‘what percentage of tax do I pay on my wages?’, self-employed taxes, under-18 taxes and more:

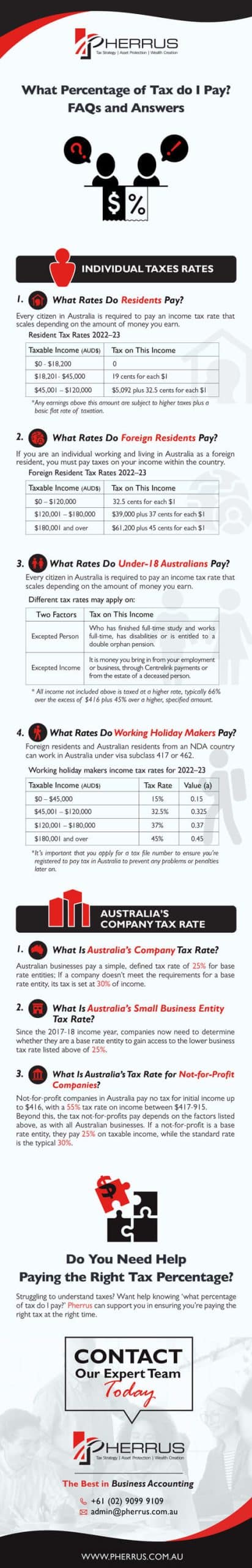

Individual Taxes: What Rates Do Residents Pay?

If you are an individual citizen in Australia, you likely are already aware of the basic taxes you need to pay, whether you’re an employed person or working as a self-employed professional. Every citizen in Australia is required to pay an income tax rate that scales depending on the amount of money you earn. Up to $18,200, you pay no tax. Beyond this point, you pay an increase in income tax as your pay increases. For example, between $18,201-$45,000, you pay an income tax rate of 19 cents per $1. Any earnings above this amount are subject to higher taxes plus a basic flat rate of taxation.

If you are employed and worried about ‘what percentage of tax do I pay weekly in Australia?’, in most cases, your employer has already removed your income tax from your pay before you receive it. While you’ll still need to complete a tax return, being paid through a payroll system makes this process much easier. In addition to basic income tax, you’ll also need to pay a 2% Medicare levy to support public health services, with a surplus if you earn over a certain amount and don’t have private medical insurance.

Individual Taxes: What Rates Do Foreign Residents Pay?

If you are an individual working and living in Australia as a foreign resident, you must pay taxes on your income within the country. It’s essential to have clarity on whether you’re considered a foreign resident, a working holiday maker or a citizen, as this affects the amount of tax you’ll have to pay.

Much like citizens of Australia, the answer to ‘What percentage of tax do I pay on ABN?’ is scaled based on the amount of money you earn. However, unlike resident Australians, you’ll need to pay taxes for every dollar you earn with no initial threshold. For instance, if you earn anything from $0 to $120,000 in Australia, you’ll need to pay a tax of 32.5 cents per $1. This amount increases to a higher percentage of your income beyond this amount, with an additional flat fee to pay of between $39,000 and $61,200.

Individual Taxes: What Rates Do Under-18 Australians Pay?

Different tax rates may apply if you are under 18 and earn an income in Australia. Whether or not you’re taxed as an adult on your income depends on two factors – whether you are an excepted person or if you receive an excepted income. An excepted person has finished full-time study and works full-time, has disabilities or is entitled to a double orphan pension. An excepted income is money you bring in from your employment or business, through Centrelink payments or from the estate of a deceased person.

The reason that under-18s are taxed differently and at a higher rate for non-excepted income is to prevent adults from diverting their income to their children to reduce the tax they pay. As such, all income not included above is taxed at a higher rate, typically 66% over the excess of $416 plus 45% over a higher, specified amount.

Individual Taxes: What Rates Do Working Holiday Makers Pay?

Foreign residents and Australian residents from an NDA country can work in Australia under visa subclass 417 or 462. This visa classifies you as a working holiday maker, with different tax rates that apply. If you’re planning to work in Australia and want to know ‘what percentage of tax do I pay?’, it’s important to note that, like foreign residents, you’re taxed on your income from $0 upwards.

For the first $45,000 you earn, you’ll be taxed a simple 15% on your income. Above this figure, you’ll need to pay a flat fee across several different tiers of taxing, with up to 45 cents per $1 at the top end of the scale. It’s important that you apply for a tax file number to ensure you’re registered to pay tax in Australia to prevent any problems or penalties later on.

What Is Australia’s Company Tax Rate?

Australia’s tax rate for companies is relatively straightforward compared to individual taxes. Instead of including additional taxes that are a certain percentage of each dollar plus a flat fee, Australian businesses pay a simple, defined tax rate of 25% for base rate entities, which is determined by the assessable income within the business. If a company doesn’t meet the requirements for a base rate entity, its tax is set at 30% of income.

What Is Australia’s Small Business Entity Tax Rate?

In previous years, the ATO required companies to define themselves as small business entities to achieve a lower tax rate. However, since the 2017-18 income year, companies now need to determine whether they are a base rate entity to gain access to the lower business tax rate listed above of 25%. To meet these requirements, businesses need to have an aggregated turnover that’s less than the threshold for the year, and 80% or less of their income should be base rate entity passive income. These include royalties, rant, interest, security gains and more.

What Is Australia’s Tax Rate for Not-for-Profit Companies?

Not-for-profit companies in Australia pay no tax for initial income up to $416, with a 55% tax rate on income between $417-915. Beyond this, the tax not-for-profits pay depends on the factors listed above, as with all Australian businesses. If a not-for-profit is a base rate entity, they pay 25% on taxable income, while the standard rate is the typical 30%.

Do You Need Help Paying the Right Tax Percentage?

Struggling to understand taxes? Want help knowing ‘what percentage of tax do I pay?’ Pherrus can support you in ensuring you’re paying the right tax at the right time. Get in touch with our team today to discuss your requirements and learn more about how we can help you.