Do you have questions about Single Touch Payroll (STP), the revolutionary payroll system for Australian business owners?

You’re in the right place! We’re here to help you understand

- What is Single Touch Payroll?

- How does Single Touch Payroll simplify my payroll process?

- How do I start a Single Touch Payroll?

- How do I check my Single Touch Payroll?

- How do Single Touch Payroll Phase 1 and 2 differ?

Let’s get started!

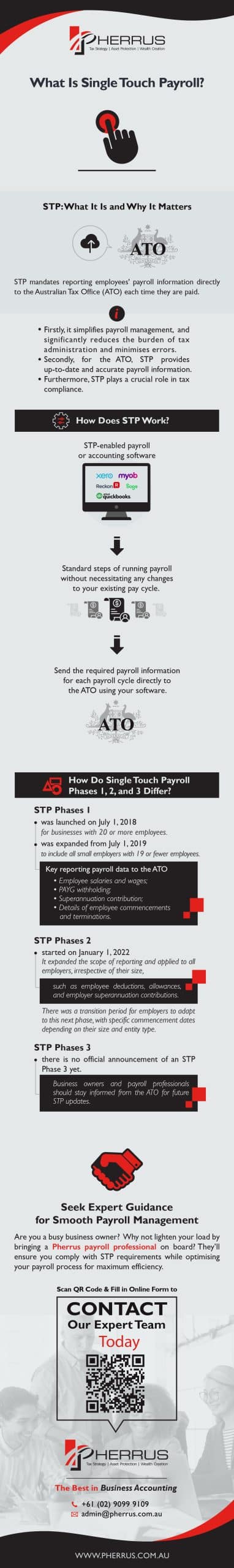

STP: What It Is and Why It Matters

STP mandates reporting employees’ payroll information directly to the Australian Tax Office (ATO) each time they are paid.

Such information encompasses salaries and wages, pay-as-you-go (PAYG) withholding, and superannuation liability information.

The introduction of STP Phase 2 further expanded the payroll data collected to include the following:

- Tax file number declarations.

- Specific income types for concessional reporting.

- Lump sum E payments (those made to employees for back payments of salary or wages accrued in a previous income year).

- Changes in software or payroll ID.

- Voluntarily child support deductions or garnishees through STP.

STP is not just a compulsory reporting mechanism; it’s a significant step towards more efficient, transparent, and compliant payroll and tax processes in Australia, benefiting both businesses and the ATO.

Firstly, it simplifies payroll management, with the necessary details sent directly to the ATO as payroll is completed weekly, fortnightly, or monthly.

This significantly reduces the burden of tax administration and minimises errors.

Tax reporting is also simplified, making tax season less stressful for business owners.

For the ATO, STP provides up-to-date and accurate payroll information for enhanced compliance monitoring and policy decisions.

Furthermore, STP plays a crucial role in tax compliance.

Real-time STP reporting closes loopholes previously allowing businesses to evade certain tax obligations, like failing to pay superannuation or PAYG instalments.

How Does STP Work?

STP operates through STP-enabled payroll or accounting software, like Xero, MYOB, and QuickBooks.

The software transmits necessary details like salaries, PAYG withholding, and superannuation liability information to the ATO each payroll cycle.

The process involves the standard steps of running payroll (paying employees and providing payslips) without necessitating any changes to your existing pay cycle.

Other payment types you may need to report, depending on your employees’ situations, include

- Payments to company directors

- Payments for returning to work

- Severance or termination payments

- Compensation for unused leave

- Payments during parental leave

- Compensation under specific labour mobility schemes

- Financial support to religious leaders

- Remuneration for positions such as Defence Force officeholders

To start using STP, follow these steps:

- Choose STP-enabled payroll software. If you already have payroll software, check if it’s STP-enabled or needs updating.

- Configure your payroll software for STP. This generally involves setting up company and employee details correctly.

- Send the required payroll information for each payroll cycle directly to the ATO using your software. Additionally, your software will allow you to access and review current and past STP reports for monitoring and record-keeping.

How Do Single Touch Payroll Phases 1, 2, and 3 Differ?

STP Phase 1

Stage 1 of STP was launched on July 1, 2018, for larger businesses with 20 or more employees and expanded to include businesses with 19 or fewer employees from July 1, 2019.

The key elements of this phase include reporting payroll data to the ATO every time you pay your employees.

Such data includes

- Employee salaries and wages

- PAYG withholding

- Superannuation contribution

- Details of employee commencements and terminations

STP Phase 2

Starting January 1, 2022, STP Phase 2 expanded the scope of reporting and applied to all employers, irrespective of their size.

There was a transition period for employers to adapt to this next phase, with specific commencement dates depending on their size and entity type.

Phase 2 changes include the following:

- Expanded reporting, such as employee deductions, allowances, and employer superannuation contributions.

- Employers must offer employees digital access to payroll information, including year-to-date payroll data, to help them track their earnings and deductions. Employees can view their STP information by logging into their myGov account linked to the ATO.

- Small business employers (with one to four employees) can report quarterly instead of each payday.

STP Phase 3

While there is no official announcement of an STP Phase 3, it’s possible the ATO could introduce future phases or updates to streamline payroll reporting further, enhance compliance measures, or introduce new functionalities based on emerging needs and technological advancements.

Business owners and payroll professionals should stay informed from the ATO for future STP updates.

Seek Expert Guidance for Smooth Payroll Management

What is Single Touch Payroll?

It’s an Australian government initiative requiring employers to report salaries, wages, PAYG withholdings, and superannuation directly to the ATO each time they pay their employees.

Are you a busy business owner? If so, juggling the complexities of this mandatory payroll system might feel like one task too many!

Why not lighten your load by bringing a Pherrus payroll professional on board?

They’ll ensure you comply with STP requirements while optimising your payroll process for maximum efficiency.

Give yourself peace of mind and extra time to focus on growing your business by letting the experts at Pherrus handle your payroll process with precision.

Fill out our online form or call +61 (02) 9099 9109 to book an appointment at our Bella Vista office in Sydney, NSW.