Payroll taxes are the financial obligations you and your employees are required to pay.

There are various types of payroll taxes – some paid to the federal government and others paid to the state or territory authorities.

There is a specific tax called the payroll tax that is paid to state and territory authorities on the money employees earn.

As an employer, you are responsible for calculating an estimate of those taxes and paying them directly to government authorities on behalf of your employees.

Many employers use employer payroll taxes calculators.

What is payroll tax? (+ why is it important?)

Contrary to what some people think, payroll tax is not a tax your company is paying but a tax your company is collecting from your employees’ earned wages.

Payroll tax is one of the largest obligations your company has to consider when employing people in your business.

Employees rightfully have the expectation that your company will calculate, deduct and process their payroll taxes accurately and on a timely basis.

Employees can access payroll tax calculators online to verify the amounts being assessed by their employers.

A payroll tax example is a levy assessed by the state or territory where your employees earn their wages.

It is paid to the respective authority on a regular basis and is the obligation of your company to calculate and transfer payments.

Companies are obligated to collect payroll taxes when their weekly payroll meets or exceeds the designated threshold.

You can find out what this threshold is by reviewing the regulations of your state or territory.

It should be noted that if payroll taxes are not calculated, levied and submitted properly, fines may be imposed on the employer as well as the employee, so it’s important that companies have adequate payroll tax systems in place to ensure payroll taxes are handled properly.

It’s important to be across the different types of payroll systems that are available to you.

Why is it important and what are payroll taxes used for?

When you think about payroll tax in Australia, they are fundamental to the proper functioning of the tax system and state, territory and federal authorities depend on employers to properly calculate, assess and submit taxes to make sure the tax system functions properly.

Some of the specific reasons why payroll taxes are important are:

- Payroll taxes finance the state or territory’s budget where your employees work.

- Because payroll taxes are a financial obligation your company and your employees have to state and territory authorities, there are associated penalties for inaccuracies and lack of timeliness in the submission of payroll taxes.

- Payroll taxes ensure that employees don’t have to pay a lump sum of taxes at the end of the year.

Who pays payroll tax in 2021? (+ other FAQs)

You may be wondering who is responsible for paying payroll taxes.

Well, because taxes are paid to states and territory authorities, this answer will differ depending on where your company is located and where your employees earn their wages.

Typically, only those businesses that exceed the designated threshold need to pay payroll taxes.

Payroll taxes are paid from employee wages to governmental authorities by the employer.

However, there are some types of taxes that are paid by the employer, such as fringe benefit taxes that are paid by employers on the fringe benefits they give to their employees.

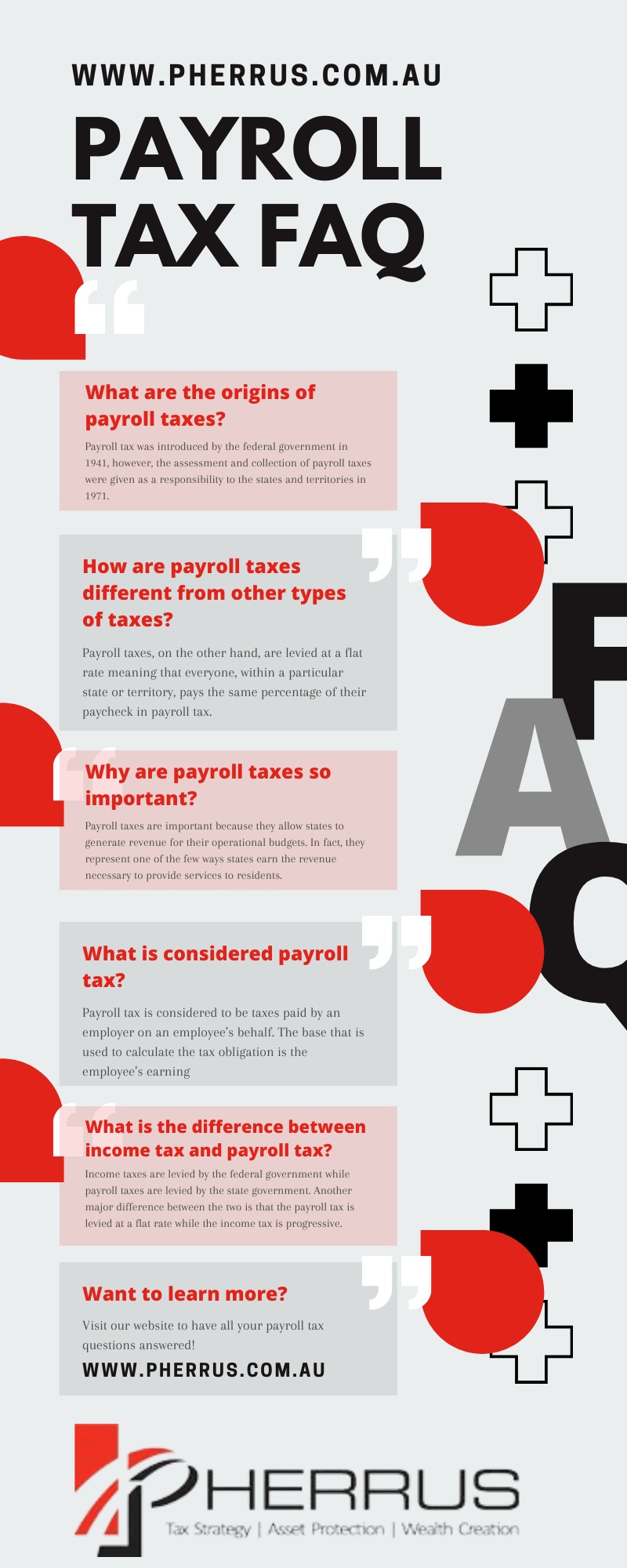

What are the origins of payroll taxes?

Payroll tax was introduced by the federal government in 1941, however, the assessment and collection of payroll taxes were given as a responsibility to the states and territories in 1971.

When the responsibility of payroll taxes was handed over to the states, the uniform levy of 2.5% was changed to reflect the needs of the individual states.

Now payroll taxes range from around 2% to over 6% depending upon where the income is earned.

States work collectively to ensure there are some commonalities between how they manage payroll taxes.

This is called tax harmonisation.

Because the constitution limits the types of taxes that can be levied, this payroll represents a significant source of income for the states.

How are payroll taxes different from other types of taxes?

Payroll taxes differ from other types of taxes in many important ways. In this section, we’ll discuss payroll tax vs income tax.

One of the taxes most people are familiar with is the income tax.

Income taxes are paid to the federal government and are progressive, meaning the more money a person makes the more taxes they are obligated to pay.

Payroll taxes, on the other hand, are levied at a flat rate meaning that everyone, within a particular state or territory, pays the same percentage of their paycheck in payroll tax.

Another difference between income tax and payroll tax is that income tax offers a tax-free threshold that is exempt from tax.

Payroll tax, however, is levied on all wages once a company’s payroll meets or exceeds a certain threshold.

Another difference in payroll taxes is that they are paid by employees on the money they earn.

In contrast, there are other types of taxes that are paid by other people and entities, for example, within Australia, businesses are also responsible for paying taxes.

In many cases, these costs are passed on to shareholders through capital gains taxes and taxes on dividend payments.

An additional tax revenue that the government collects is GST, or the Goods and Services Tax.

This tax is collected on the purchases of items and services.

Why are payroll taxes so important?

Payroll taxes are important because they allow states to generate revenue for their operational budgets.

In fact, because of limitations in the Australian constitution, they represent one of the few ways states earn the revenue necessary to provide services to residents.

One of the other ways states are able to earn money for their budget is through stamp duty.

What is considered payroll tax?

Payroll tax is considered to be taxes paid by an employer on an employee’s behalf.

The base that is used to calculate the tax obligation is the employee’s earning, whether through their hourly wage, their salary or other forms of payment by the company.

If a company meets the payroll threshold, they are responsible for collecting payroll tax from their employees and paying it to the respective governmental authority – either state or territorial – where the money was earned.

Some companies find that they fail to meet their payroll tax obligation because they do not levy payroll taxes for all of the places where their employees’ income is earned.

It is important to be familiar with the federal regulations as well as the state or territorial authority to understand where you have a tax obligation.

What is the difference between income tax and payroll tax?

Income tax and payroll tax are easy to confuse because they are both calculated on the same basis from an employees wages, salary or other benefits.

However, income taxes are levied by the federal government while payroll taxes are levied by the state government.

While payroll tax was established in 1941, the responsibility for payroll taxes passed from the federal government to the state government in 1971.

Along with that responsibility also came the benefit of the money collected.

Another major difference between the payroll tax and the income tax is that the payroll tax is levied at a flat rate while the income tax is progressive.

Income taxes offer a tax-free threshold and then a person’s income is taxed progressively at higher rates, the more money they earn.

Payroll tax, on the other hand, is taxed at the same rate for employees who earn money within a particular state or territory.

Because each state or territory is responsible for collecting payroll tax, they are each able to determine the amount of tax they will assess, therefore the rate ranges from 2% to over 6%.

Even with this difference in tax rates, states work to harmonise or find commonalities in the system, like when the taxes are assessed.

Do you have to pay taxes on payroll?

As an employer, you are obligated to pay taxes on payroll if your total payroll meets or exceeds a threshold that’s determined by your state or territory authority.

While the tax is collected and paid by the employer it is actually coming from the wages of the employees.

Therefore, the employer doesn’t have to pay payroll tax in excess of the wages they are paying, rather the payroll tax is taken from the wages the employer pays.

Because each state or territory is responsible for levying its own payroll tax, it’s important to familiarise yourself with the regulations of the tax authorities where your employees earn their wages.

Why do employers pay payroll taxes?

Employers pay payroll taxes because they are the intermediary between the employee and the authority who levies the taxes.

This creates a system of efficiency for the employers to collect and distribute the payroll taxes directly to the governmental authority.

This system of employers collecting and withholding payroll taxes also creates a way for employers to help their employees meet their end-of-year tax obligations.

In a sense, when employers pay payroll taxes on behalf of their employees they are providing a service to them.

This also helps employees avoid a lump-sum payment at the end of the year.

How do I withhold payroll taxes?

There are several obligations an employer has when they are withholding payroll taxes.

The largest obligation depends on the size of the employer and the amount of withholding they have on hand.

The system of withholding taxes for your employees is known as the PAYG system, or the Pay As You Go system.

It requires employers to make payments to the Australian Taxation Office or ATO, report the amounts on activity statements and lodge an annual report.

Depending on the amount on your payroll, you may be obligated to transfer payments on a weekly, monthly or quarterly basis.

How does a company pay payroll taxes?

Using PAYG, a company will withhold payroll taxes from each payment it makes to its employees and then send the payment to the state or territory authority to whom it belongs, or to the ATO.

In essence, the company is making payments for the employee instead of the employee having to pay a lump sum of taxes at the end of the year.

This service can be useful for all industries trade, including hospitality, retail, medical, agencies and legal.

Does your employer pay part of your federal income tax?

While an employer is responsible for withholding taxes from an employees wages, they are not responsible for paying the federal tax income obligation for the employee.

The money paid to the government is money the employee actually earned through their work that is then transferred to the government.

There is, however, a type of tax that an employer is obligated to pay on employee compensation and it is called the fringe benefit tax.

When an employer pays an employee in kind, by paying school fees or giving a reduction in interest on a loan or paying for a gym membership, it is considered a fringe benefit.

When an employer pays a fringe benefit to an employee, the employer is obligated to pay taxes on that benefit.

What does it mean to withhold payroll taxes?

Withholding payroll taxes is a way you help your employees and certain contractors avoid having to pay a lump sum of taxes at the end of the year.

By withholding payroll taxes, your company is calculating the tax obligation of your employees and then transferring it directly to the tax authority.

Taxes are most often paid through the PAYG system so that taxes are paid along the way.

In reality, when employers withhold taxes they are making an estimate of the tax obligation their employee has and paying it to the tax authority.

When the employee pays their taxes at the end of the year, further considerations, like deductions, are taken into account and can often result in a tax refund.

Need help with payroll tax?

Ensuring the accuracy and timeliness of payroll taxes can require an extensive amount of knowledge.

If you would like to ensure that your company is calculating and submitting your payroll taxes accurately, employing a firm with expertise in the area, using adequate payroll management software or even hiring a bookkeeper or CPA would be beneficial for your company.

To find out how Pherrus Financial Services can help you, call us today on 02 9099 9109.