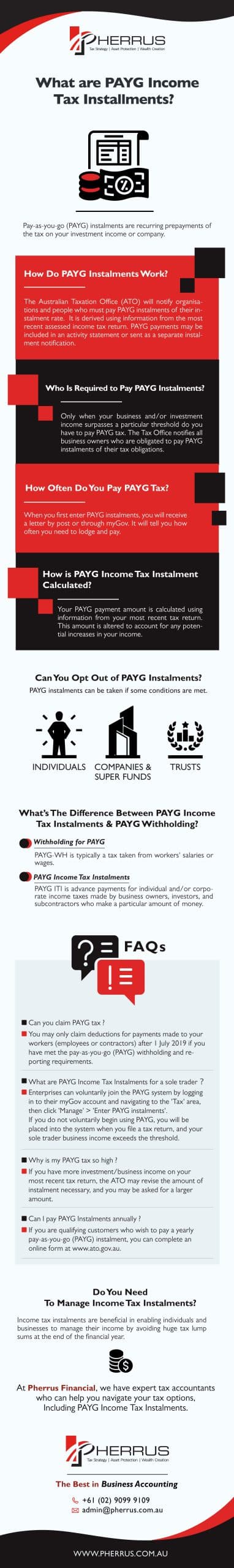

Pay-as-you-go (PAYG) instalments are recurring prepayments of the tax on your investment income or company.

Upon entering the PAYG Instalment System you will have to pay PAYG Installments every 3 months.

How Do PAYG Instalments Work?

What are PAYG Income Tax Instalments and how do they work?

Pay As You Go (PAYG) Instalments is a method of making monthly payments to an entity’s or individual’s projected tax bill on business and investment income during the financial year.

PAYG payments made during the year are used to evaluate and determine whether the organisation or individual owes more tax or is due for a tax refund.

The total tax liability is calculated when the yearly income tax return is assessed at the conclusion of the financial year.

The Australian Taxation Office (ATO) will notify organisations and people who must pay PAYG instalments of their instalment rate.

It is derived using information from the most recent assessed income tax return.

PAYG payments may be included in an activity statement or sent as a separate instalment notification.

Individuals

Individual PAYG payments are typically paid quarterly.

Where the most recent year’s tax due investment and business income is less than $8,000 and specific other requirements are satisfied, people can opt to make an annual instalment.

A unique two-instalment option is provided to select primary producers and particular professionals (e.g. sportspersons, inventors, artists and authors).

Companies

Corporate tax businesses having an annual turnover of above a certain amount are required to make monthly PAYG payments.

The limit is $100 million as of 1 January 2015.

Other corporate tax entities must make quarterly payments.

Companies may opt to make annual payments if they meet certain conditions, such as the criteria that apply to individuals described above.

Trusts and Partnerships

Generally, trusts and partnerships aren’t required to make PAYG instalments.

However, special rules apply to beneficiaries and partners while calculating their PAYG instalments.

Superannuation funds

Superannuation funds typically make PAYG payments quarterly.

If superannuation funds fulfil the conditions mentioned above, they might opt to pay an annual fee.

Who is required to pay PAYG instalments?

What are PAYG Income Tax Instalments and who is required to make payments?

Only when your business and/or investment income surpasses a particular threshold do you have to pay PAYG tax.

The Tax Office notifies all business owners who are obligated to pay PAYG instalments of their tax obligations.

If you must pay in instalments, you should be provided with an instalment rate.

Individuals and trusts are generally obliged to pay PAYG if their most recent tax return shows more than $4,000 in gross investment and/or company income.

There are a few instances where you do not need to pay for instalments, and they are as follows:

• If you have a notional tax of less than $500;

• If the tax due on your most recent notice of assessment was less than $1,000;

• If you qualify for the Seniors and Pensioners Tax Credit.

How often do you pay PAYG tax?

When you first enter PAYG instalments, you will receive a letter by post or through myGov.

It will tell you how often you need to lodge and pay:

• Most taxpayers pay quarterly instalments.

• Depending on your circumstances, the letter may offer you the option to pay two instalments per year or one annual instalment.

• Businesses with instalment income of more than $20 million are required to lodge and pay their PAYG instalments monthly.

The due date for your next PAYG instalment will be on your activity statement or instalment notice.

How is PAYG income tax Instalment calculated?

What are PAYG Income Tax Instalments and how is it calculated?

Your PAYG payment amount is calculated using information from your most recent tax return.

This amount is altered to account for any potential increases in your income.

The adjustment is dependent on fluctuations in Australia’s GDP (GDP).

The size of your PAYG payment is designed to represent your projected tax due for the year.

If you modify your instalment amount or file a tax return, the instalment amount on your following activity statement will be adjusted to reflect this new information.

Can you opt out of PAYG Instalments?

Individuals

You are automatically taken off of PAYG instalments if you:

• Can claim the seniors and pensioners tax pardon on your tax return.

• Report investment and business income of $4,000 or less (for residents) or $1 (for non-residents) on your tax return.

• Have a tax obligation of less than $1,000 (after making adjustments in PAYG instalments and voluntary contributions) in your tax assessment.

• Have a PAYG instalment rate of 0%.

• Have a estimated tax liability of less than $500.

• Are under the age of 18, and your Division 6AA income is smaller than the lowest marginal threshold, or

• File a final tax return or non-lodgment advice, or your tax agent files a ‘further return not required.’

PAYG instalments are also eliminated after the death of a taxpayer.

Companies and Super Funds

If all of the following conditions are met, a super fund or company is automatically removed from PAYG instalments:

• It has a computed PAYG instalment rate of zero or a tax obligation of less than $500.

• It has less than $2 million in instalment income (excluding capital gains) in its most recent income tax assessment.

• It is not the controlling entity of a consolidated group.

Trusts

If a trust fails to meet the following criteria, it is automatically withdrawn from PAYG payments:

• Has a tax liability that is projected to be less than $500

• Reports less than $4,000 in instalment income on its tax return.

• Has a tax liability in its tax assessment of less than $1,000 (after adjustments for PAYG instalments and voluntary payments), or

• Has a computed PAYG instalment rate of 0%.

What’s The Difference Between PAYG Income Tax Instalments & PAYG Withholding?

PAYG Income Tax Instalments (PAYG ITI) and PAYG withholding (PAYG WH) tax types have significant differences, as outlined below.

Withholding for PAYG

PAYG-WH is typically a tax taken from workers’ salaries or wages.

It can also be deducted from suppliers who have not given you their Australian Business Number (ABN) or contractors with whom you have engaged in voluntary agreements to withhold portions from your payments to them.

PAYG Income Tax Instalments

PAYG ITI is advance payments for individual and/or corporate income taxes made by business owners, investors, and subcontractors who make a particular amount of money.

Paying PAYG ITI helps you fulfil your income tax requirements by allowing you to make quarterly payments rather than a single lump sum payment at the end of the year.

This helps with cash flow.

When you file your income tax return, your PAYG ITI reduces the amount of tax you owe.

If you didn’t pay enough tax throughout the year, you’d have to pay the difference, but if you paid too much, you’d get a refund.

Can you claim PAYG tax

You may only claim deductions for payments made to your workers (employees or contractors) after 1 July 2019 if you have met the pay-as-you-go (PAYG) withholding and reporting requirements.

If the PAYG withholding regulations compel you to deduct money from a payment you make to a worker, you must do the following:

• Withhold the amount from the payment before you give it to them

• report it to the tax department

Non-compliant payments are any payments made to a worker for which you have not deducted or submitted the PAYG amounts.

What are PAYG Income Tax Instalments for a sole trader

You are not automatically registered for PAYG instalments as a sole trader.

Enterprises can voluntarily join the PAYG system by logging in to their myGov account and navigating to the ‘Tax’ area, then click ‘Manage’ > ‘Enter PAYG instalments’.

If you do not voluntarily begin using PAYG, you will be placed into the system when you file a tax return, and your sole trader business income exceeds the threshold.

Why is my PAYG tax so high?

Your PAYG Instalment amount is recalculated each time you file your tax return.

Therefore, if you have more investment/business income on your most recent tax return, the ATO may revise the amount of instalment necessary, and you may be asked for a larger amount.

All of this is done to guarantee that you have paid your projected tax due on your business/investment earnings before filing your tax return. It is beneficial in avoiding a large “bill shock.”

Can I pay PAYG Instalments annually?

If you are qualifying customers who wish to pay a yearly pay-as-you-go (PAYG) instalment, you can complete an online form at www.ato.gov.au.

New PAYG instalment clients

New PAYG instalment clients need to submit the “Choosing to pay an annual PAYG instalment” form before the due date on their activity statement for their first quarter’s PAYG payments.

Existing PAYG instalment clients

If a current PAYG instalment customer becomes eligible to pay yearly, they must complete and return the Choosing to pay an annual PAYG instalment form before the due date of their first quarterly activity statement of the income year.

Do You Need To Manage Income Tax Instalments?</h2

Income tax instalments are beneficial in enabling individuals and businesses to manage their income by avoiding huge tax lump sums at the end of the financial year.

Instalments are applicable to individuals in various professions and businesses of numerous niches.

Consider applying for PAYG Income Tax Instalments to reap the benefits today.

At Pherrus Financial, we have expert tax accountants who can help you navigate your tax options, Including PAYG Income Tax Instalments.