Are you ready to purchase your first home? It seems many fellow Australians are taking the plunge.

According to a recent Mozo survey of the 10.3 million properties in Australia, and six million have a mortgage.

While it’s exciting, the prospect of taking out a home loan can be intimidating.

However, learning a few simple banking terms, such as LVR (loan to value ratio) makes things far less stressful.

So, what is an LVR?

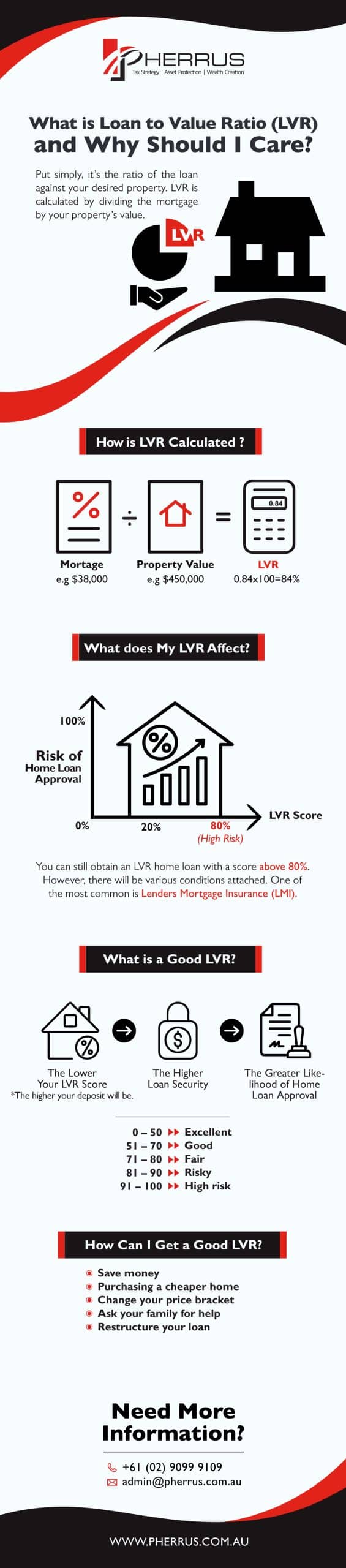

Put simply, it’s the ratio of the loan against your desired property. The LVR is calculated by dividing the mortgage by the value of your property.

This concept is explained further in the example below:

Taylor and Alison are purchasing a $450,000 home, with a $70,000 deposit.

So, their mortgage equates to $380,000 (fees and charges excluded).

To discover their LVR, Taylor and Alison must divide the mortgage by the property’s value, and then multiply this figure by 100.

As such, they require an 84% LVR. Since it’s above 80%, the couple must pay lenders’ mortgage insurance (LMI).

While it’s added to their mortgage, their LVR has obviously increased.

How is LVR calculated?

When taking out a mortgage, “what is LVR?” is one of the first questions you should ask.

This is vital as your LVR can greatly impact your borrowing capacity.

Before approving the loan, you will typically be asked to obtain an independent valuation of the prospective property.

From there, your lender calculates the LVR score on your home loan.

This is achieved by dividing the home loan by the property valuation.

Then, this figure is multiplied by 100, to create a percentage.

Here’s an example to explain the concept in more detail.

Tyler and Haley are purchasing their first home.

The property was valued at $500,000 and they have a $100,000 deposit.

Therefore, to buy the property, the couple needs to borrow $400,000.

In this scenario, Tyler and Haley’s LVR score is 80%. The equation is as follows: $400,000 / $500,000 x 100 = 80%.

Generally, the difference between your home loan and the valuation is your home deposit.

Therefore, the larger your deposit amount, the less money you will need to borrow.

This translates into a lower LVR score.

Conversely, the lower your deposit, the higher the home loan you’ll need.

This means your LVR will be much higher.

What does my LVR affect?

When considering your home loan application, your lender will take various factors into account.

One of the most important is your LVR. Essentially, your loan-to-value ratio informs your lender of the risks involved in approving your home loan.

You may be wondering, “how do I find my LVR?” Simply enter your information into an LVR calculator, and you’ll have an idea of how much you can borrow.

Remember to ask your lender, “what is an LVR home loan?”

As the name suggests, it prioritises your LVR, rather than your deposit amount.

The table below displays common house deposit sizes and their corresponding LVR scores.

Deposit LVR

20% 80%

10% 90%

5% 95%

Your LVR score greatly impacts your likelihood of being approved for a home loan.

Essentially, the lower your LVR, the lower the risk it will be for the bank to lend you money. Conversely, lenders consider an LVR greater than 80% to be high risk.

The LVR your lender allows you to borrow depends on various factors.

These include:

• The LVR home loan amount you require

• Where your property is located

• Your credit history

• Your employment history

• Your income, and;

• The type of loan you’re applying for.

The lower your LVR score, (i.e. 80% or less) the more likely your home loan will be approved.

By contrast, if your LVR score is higher (i.e. above 80%), lenders will likely consider you a high-risk applicant.

You can still obtain an LVR home loan with a score above 80%.

However, there will be various conditions attached. One of the most common is Lenders Mortgage Insurance (LMI).

Essentially, LMI acts as an insurance policy for lenders.

It protects lenders in the event a borrower is unable to meet their mortgage repayments.

With an LVR above 80%, you will probably be charged LMI.

This can either be paid as an upfront fee or be part of your home loan.

If you select this option, you will be charged interest.

It’s important to keep in mind that LMI is quite expensive to obtain.

The ultimate cost will depend on the lender you choose and your LVR score.

As a rule, the higher your LVR, the more expensive your LMI premium.

Here’s a quick guide to the industry average you can expect to pay, based on your LVR score.

Est Property Value 95% LVR 90% LVR 85% LVR

$200,000 $4,727 $3,498 $1,550

$400,000 $11,897 $8,575 $3,777

$600,000 $23,954 $13,284 $6,463

$800,000 $31,939 $17,712 $8,617

However, there are several steps you can take to reduce your LVR.

These include: lowering your property budget, saving a larger deposit, revising your household budget, saving on regular purchases and placing your savings in a high-interest account.

What is a good LVR?

LVR is one of the most important factors your lender will consider when they evaluate your home loan application.

As a general rule, the lower your LVR score, the higher your deposit will be.

From a lender’s perspective, this equals higher loan security.

For borrowers, this means a far greater likelihood that your home loan will be approved.

As a rule, many lenders look favourably on an LVR of 80% or below.

As this is at the higher end though, it should be coupled with a house deposit of at least 20%.

In most cases, if you have an LVR of 80 or less, your lender will not require you to take out an LMI. However, some lenders will require you to pay LMI unless you have an LVR score of 60 or less.

This requirement is in place for two key reasons:

• For borrowers who wish to qualify for a low-interest home loan, or;

• For properties which are considered high-risk purchases (i.e. properties which may significantly decrease in value).

Of course, there is a way to gauge whether or not your LVR score will help you attain a home loan.

This table shows LVR scores and their level of risk.

LVR Risk level

0 – 50 Excellent

51 – 70 Good

71 – 80 Fair

81 – 90 Risky

91 – 100 High risk

How can I get a good LVR?

A high LVR can prevent you from obtaining a loan or getting a favourable interest rate.

However, it’s not permanent.

There are actions you can take to lower it.

Doing so will enable you to access better interest rates.

To reduce your LVR score, you can:

Save money – A fantastic way to increase your LVR score is to save for a larger house deposit. Looking at your budget to add more to your deposit can enable you to significantly lower your LVR.

This, in turn, will lead to better housing options, lower interest rates and no LMI premiums.

Purchasing a cheaper home – Many first home buyers are struggling to get onto the property ladder.

A major barrier they face is skyrocketing house prices.

To lower your LVR and purchase your home sooner, we recommend buying a cheaper property.

Change your price bracket – Many future house buyers have a specific image (and price bracket) in mind when property hunting. If you have a high LVR, this can work against you.

Adjusting your property budget will open you up to many more options while decreasing your LVR.

Ask your family for help – If your LVR score is too high, you can ask your family for assistance.

Many lenders have programs that allow immediate family members to become your guarantor.

The program enables them to purchase a home with no upfront deposit.

Instead, a mortgage is taken out on the guarantor’s home, which provides equity to purchase your new property.

Restructuring your loan – Another way to reduce your LVR is by changing the structure of your loan.

For instance, you may use the equity in your current property to increase your deposit.

The larger your deposit, the smaller your mortgage. Also, a smaller mortgage will lower your LVR.

LVR Summary

In summary, your LVR is something every borrower should know.

This score is a vital component of your home loan application.

It shows lenders the level of risk involved, and also helps determine your interest rate.

Ultimately, your LVR impacts your borrowing capacity.

With a low LVR, you can potentially receive a lower interest rate and be eligible for a high-risk property.

However, if your LVR is high, you’ll have to pay LMI or potentially be declined for the loan.

Thankfully, there are ways to reduce your score.

You can save for a higher deposit, ask a family member to be your guarantor, change your price bracket, and more.

To learn about your LVR score and understand your borrowing capacity, simply contact the Pherrus Accounting team today.