Just as you wouldn’t drive through unfamiliar terrain without a GPS, you shouldn’t navigate the rocky roads of taxation laws and obligations without the guidance of a tax agent!

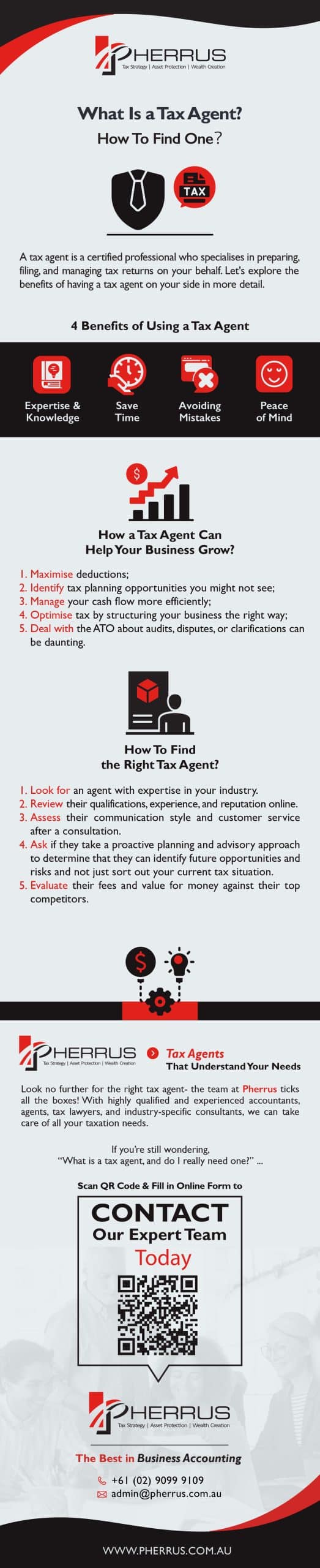

A tax agent is a certified professional who specialises in preparing, filing, and managing tax returns on your behalf.

They understand tax laws, so they’ll keep your taxes above board while helping you make the most of tax deductions and credits.

With an agent’s tax advice and expertise, you’re less likely to make errors and more likely to save money.

Let’s explore the benefits of having a tax agent on your side in more detail.

Key Takeaway BoxWhat is a tax agent? A certified expert who prepares, files, and lodges your tax returns. Their knowledge and expertise will save you time and reduce the risk of costly mistakes. All in all, having a tax agent will give you invaluable peace of mind. |

4 Benefits of Using a Tax Agent

1. Expertise and Knowledge

Registered tax agents are experts in the tax field, staying up-to-date with the ever-changing tax laws so you don’t have to.

Updated knowledge like this is essential because one small mistake or oversight can cost you a lot in penalties.

Tax agents are also skilled in identifying deductions and tax-saving strategies you might overlook.

They can pinpoint areas where you can save, from education credits to home office deductions, to ensure you don’t leave money on the table.

Lastly, a tax agent uses their expertise to minimise your tax liabilities legally.

They know the ins and outs of the tax system and can structure your returns to reduce your tax burden while staying within the bounds of the law.

2. Save Time

Time is money, and tax agent services will help you save both.

Tax preparation involves a mountain of paperwork, from income statements and expense reports to receipts and forms named after every letter of the alphabet!

A tax agent takes this burden off your shoulders, handling all these documents and making sense of which forms need to be filed and when.

You won’t have to dig through drawers or scan through files; they’ll tell you exactly what they need from you and take care of the rest.

This streamlined process will save you considerable time, which is especially valuable if you’re running a business.

Instead of juggling tax forms and deadlines, you can focus on your day-to-day operations, client meetings, and growth strategies.

3. Avoiding Mistakes

It’s easy to make mistakes when lodging your tax return.

Common mistakes include

- Incorrect income reporting.

- Filing under the wrong status.

- Miscalculating expenses.

- Missing out on deductions.

These mistakes can lead to penalties, audits, or missed financial benefits.

A registered tax agent will help you sidestep these pitfalls by meticulously reviewing your forms for accuracy.

In the process, they’ll be able to spot and correct past errors to avoid future issues for you.

The best strategy, of course, is to get it right from the start with an expert tax agent at the wheel.

4. Peace of Mind

With a tax agent, there’s no second-guessing or last-minute scrambling– your taxes will always be filed accurately and on time.

And you won’t have to lose sleep over whether you’re missing deductions or potentially triggering an ATO audit.

A tax agent will also ensure you’re tax-compliant and tax-optimised– avoiding legal issues and maximising your financial benefits within the law.

How a Tax Agent Can Help Your Business Grow

A registered tax agent can be a game-changer for your business growth.

They can maximise deductions for your business, and you can then funnel those savings back into your business. Whether it’s claiming for equipment or work-related expenses, every dollar saved can be reinvested to expand your operations.

Next, they can identify tax planning opportunities you might not see, like timing income and expenses to reduce your tax burden.

Such savvy planning and tax advice can substantially impact your year-end profits.

Cash flow is the lifeblood of any business, and a tax agent can help manage yours more efficiently.

They can set you up with income tax instalment arrangements to smooth out payments so you’re not hit with a large bill at once.

The results? Better financial planning and resource allocation.

Structuring your business the right way is crucial for tax optimisation.

Your agent can provide invaluable advice on the best structure for your business type for legal compliance and financial gain, whether a sole proprietorship, partnership, or corporation.

Lastly, dealing with the ATO about audits, disputes, or clarifications can be daunting.

A tax agent will act as your liaison, resolving issues effectively so you’re in good standing with tax authorities.

How To Find the Right Tax Agent

Now, the question is, how do you find the right registered tax agent so you can benefit from everything we’ve discussed?

Use this list to guide you.

- Look for an agent with expertise in your industry.

- Review their qualifications, experience, and reputation online.

- Assess their communication style and customer service after a consultation.

- Ask if they take a proactive planning and advisory approach to determine that they can identify future opportunities and risks and not just sort out your current tax situation.

- Evaluate their fees and value for money against their top competitors.

Pherrus: Tax Agents That Understand Your Needs

Look no further for the right tax agent- the team at Pherrus ticks all the boxes!

With highly qualified and experienced accountants, agents, tax lawyers, and industry-specific consultants, we can take care of all your taxation needs.

We’ll help maximise your personal and business tax returns and reduce your stress at tax time.

Let us show you how we can make your money work smarter, not harder.

And not just at tax time, but all year round!

If you’re still wondering, “What is a tax agent, and do I really need one?”, fill in our online form today or call +61 (02) 9099 9109 to book an appointment at our Bella Vista office in Sydney, NSW.