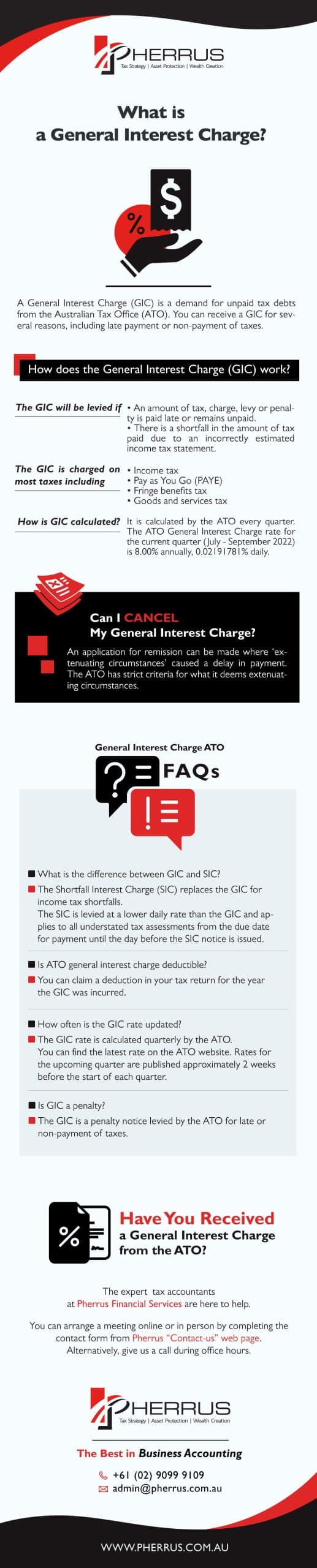

A General Interest Charge (GIC) is a demand for unpaid tax debts from the Australian Tax Office (ATO).

You can receive a GIC for several reasons, including late payment or non-payment of taxes.

Receiving a GIC can be shocking and you most likely have a lot of questions about what is about to happen.

So in this blog, we’re going to answer the question, what is a General Interest Charge?

We’ll also look at the GIC process to explain how it works, explain how the ATO calculates GIC interest and whether your GIC can be cancelled or reduced.

How does the General interest Charge (GIC) work?

The ATO General Interest Charge was introduced in July 1999 to streamline the complex system of interest and penalty notices that were previously imposed for late or unpaid tax liabilities.

The GIC will be levied if:

• An amount of tax, charge, levy or penalty is paid late or remains unpaid.

• There is a shortfall in the amount of tax paid due to an incorrectly estimated income tax statement.

The GIC is charged on most taxes including:

• Income tax

• Pay as You Go (PAYE)

• Fringe benefits tax

• Goods and services tax

How is GIC calculated?

The General Interest Charge is calculated by the ATO every quarter.

The ATO General Interest Charge rate for the current quarter (July – September 2022) is 8.00% annually, 0.02191781% daily.

You can find the rates for the current quarter here.

The rate compounds daily, so to find out how much you will be charged, you must multiply the number of days by the daily calculated rate.

Can I cancel my General Interest Charge?

An application for remission can be made where ‘extenuating circumstances’ caused a delay in payment.

A remission of the General Interest Charge is a reduction or cancellation of the penalty.

The ATO has strict criteria for what it deems extenuating circumstances.

They will look more favourably at situations that are outside your control.

Examples include natural disasters, industrial action or sudden ill health.

If the ATO deems that you were at fault for the delay, they will look at whether the situation could have been avoided.

In some circumstances, such as if payment would cause severe financial hardship, they may consider a reduction in payment or put forward a payment plan.

If you find yourself querying whether a GIC has been levied correctly, or you are struggling to pay your tax demand, it would be wise to consult an experienced Taxation specialist as early as possible.

They can help put forward your case for cancelling the GIC or may be able to reduce the amount levied.

General Interest Charge ATO FAQs

What is the difference between GIC and SIC?

The Shortfall Interest Charge (SIC) replaces the GIC for income tax shortfalls.

The SIC is levied at a lower daily rate than the GIC and applies to all understated tax assessments from the due date for payment until the day before the SIC notice is issued.

The GIC applies to all other tax liabilities.

Is ATO general interest charge deductible?

You can claim a deduction in your tax return for the year the GIC was incurred.

This falls under the Cost of managing tax affairs – Interest charged by the ATO.

You must also disclose any remitted GIC in the year of remission.

How often is the GIC rate updated?

The GIC rate is calculated quarterly by the ATO.

You can find the latest rate on the ATO website here. Rates for the upcoming quarter are published approximately 2 weeks before the start of each quarter.

Is GIC a penalty?

The GIC is a penalty notice levied by the ATO for late or non-payment of taxes.

Receiving a GIC is a serious matter that should be dealt with as soon as possible. Because interest incurs on the GIC debt daily until payment is fulfilled.

So ignoring the request will result in unnecessary interest payments.

Have you been charged a GIC?

Have you received a General Interest Charge from the ATO?

The expert tax accountants at Pherrus Financial Services are here to help.

We will assess your tax affairs to establish if the GIC demand is correct.

We can also help you submit a remission request if discrepancies are found or if extenuating circumstances prevented payment.

Get in touch with Pherrus Financial Services today to arrange a consultation with one of our tax experts.

You can arrange a meeting online or in person by completing the contact form here. Alternatively, give us a call at (02) 9099 9109 during office hours.