Has your business overpaid tax or made tax payments in advance?

If so, you likely have deferred tax assets.

This is a line on your balance sheet which reduces your future taxable income.

The accumulation of deferred tax assets can occur for various reasons.

These include incurring losses during the financial year or tax law changes. This blog outlines:

• What is a deferred tax asset?

• What is deferred tax asset and liability?

• Deferred asset calculation

• What is deferred tax asset with examples

• Common deferred tax assets FAQs

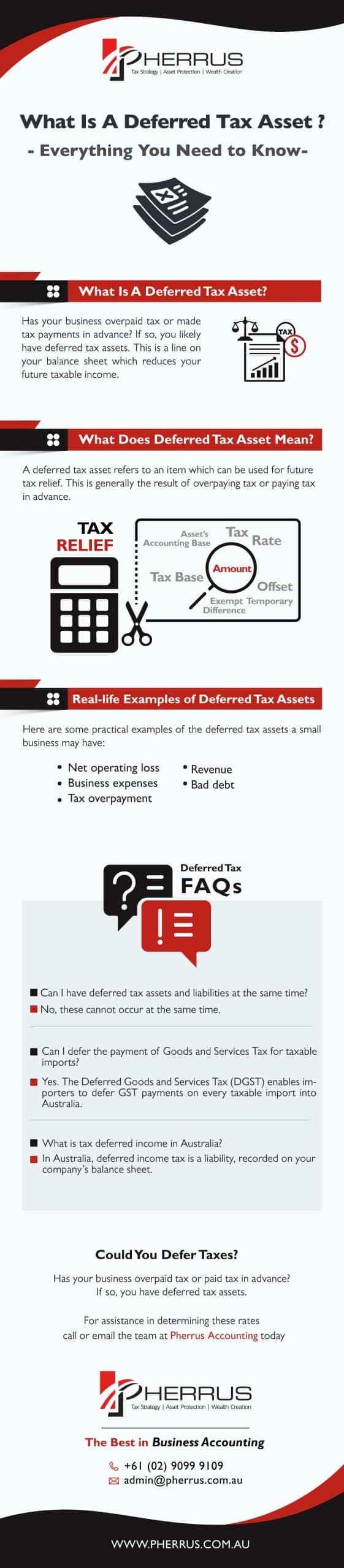

What does deferred tax asset mean?

A deferred tax asset refers to an item which can be used for future tax relief.

This is generally the result of overpaying tax or paying tax in advance.

As such, your business will recoup this income later in the year.

Deferred tax assets arise when there’s a discrepancy between your accounting and your tax income.

It can occur if the tax rules change or your business incurs a loss since a loss can be used to offset future taxable profits.

While often confused, deferred tax assets and deferred tax liability are entirely different.

As mentioned previously, a deferred tax asset is a tax overpayment which will be reclaimed.

By contrast, deferred tax liability is underpaid tax which must later be repaid.

During every tax period, your company’s deferred tax assets must be calculated.

This is done by applying the expected future rates.

These future periods are when your deferred tax assets are to become realised.

The below table illustrates how deferred tax assets should be calculated:

Step 1: Establish the asset’s accounting base

An asset’s accounting base is defined as the carrying amount of the asset in the financial statement position. In most instances, this is fairly straightforward. However, IAS 12 requires the deferred tax calculation to factor in the expected manner of recovery for the asset.

Step 2: Calculate the asset’s tax base

An asset’s tax base is: “the amount to be deducted for tax purposes, against taxable economic benefits which will flow into the entity when the carrying amount of the asset is recovered.”

Step 3: Identify and calculate exempt temporary differences

Temporary differences arise when the asset’s accounting base and tax base are different. These differences are described as taxable amounts when determining taxable profit of future periods when carrying the asset amount is recovered.

Step 4: Identify the relevant tax rate and apply it to calculate the deferred tax rate

Deferred tax assets must be measured at the tax rates which are expected to apply in a particular tax period. As the precise tax rate will not be clear until the laws change, it’s important to use good judgement.

To estimate the future tax rate, the following factors should be considered:

• Legal processes in your State involved in changing tax laws

• The status of any proposed tax changes

• The extent of remaining procedures to be performed, and;

• Whether the remaining procedures are administrative or ceremonial

Step 5: Calculate the amount of deferred tax assets

To recognise (i.e. include in the financial position statement) deferred tax assets, you must expect a sufficient future taxable profit, so the deductible temporary differences are utilised. Keep in mind, though, your business will only benefit from reduced taxes if your business earns significant profits from which deductions can be offset.

Step 6: Determine whether to offset the deferred tax assets

There are certain scenarios in which deferred tax assets must be offset. They must be recognised as gross income in your business’ financial position statement, unless:

• Your business has the legal right to set off its tax assets against its tax liabilities, and;

• The deferred tax assets relate to income taxes levied by the same tax authority

Real-life examples of deferred tax assets

Here are some practical examples of the deferred tax assets a small business may have.

Net operating loss

This occurs when your business incurs a financial loss for that tax period. More specifically, a net operating loss can occur when your business’ allowable deductions exceed its taxable income.

Tax overpayment

As the name suggests, an overpayment of tax occurs when your business has paid more tax than you were liable to. If you have overpaid tax, you will receive a refund from the ATO. However, you must claim the refund within four years of the tax overpayment.

Business expenses

When your company expenses are recognised in one accounting method, but not the other. An accounting method is the rules used to report expenses. These include accrual accounting and cash accounting. So, you may recognise an expense using cash accounting, but not accrual accounting.

Revenue

When revenue is collected in one accounting period and recognised in another. This method is commonly known as accrued revenue. This revenue is recorded as “receivable” on the company balance sheet to reflect the money customers owe the business for goods and services.

Bad debt

Before being written off as “uncollectible”, bad debt is reported as revenue. A bad debt is created when a customer is unable to pay an outstanding debt due to bankruptcy, for instance. When it is finally recognised, the bad debt becomes a deferred tax asset.

Deferred tax FAQs

Here are some of the most commonly asked questions regarding deferred tax assets.

Can I have deferred tax assets and liabilities at the same time?

No, these cannot occur at the same time.

The reason is, deferred tax appears on your balance sheet as either positive (asset) or negative (liability).

Depending on whether tax is overpaid or owed will determine whether you have an asset or a liability.

Can I defer the payment of Goods and Services Tax for taxable imports?

Yes. The Deferred Goods and Services Tax (DGST) enables importers to defer GST payments on every taxable import into Australia. To be eligible, you must:

Have a current ABN

Be registered for GST

Lodge monthly activity statements, and;

Ensure goods are for home consumption

However, you will be ineligible if you:

Are not up to date with your tax payments, or

Have been penalised by the Court for specific offences in the past three years.

If you are eligible, simply complete the “Application for Approval to Defer GST on Imported Goods” form (NAT 75136) for DGST status.

What is tax deferred income in Australia?

In Australia, deferred income tax is a liability, recorded on your company’s balance sheet. It is the result of a difference in income recognition between your company’s accounting methods and current tax laws.

As such, your payable income tax may not equal the tax reported on your return.

Could you defer taxes?

Has your business overpaid tax or paid tax in advance?

If so, you have deferred tax assets.

As a business owner, you may be carrying a net operating loss, have business expenses, revenue recognised in one accounting method, or bad debt.

If you have any of these, you have deferred tax assets.

These drastically reduce your income tax and offset future taxable profits.

However, they are realised, deferred tax assets must be calculated using expected future tax rates.

For assistance in determining these rates, call or email the team at Pherrus Accounting today.