Payroll officers provide an invaluable service to businesses across Australia and worldwide, taking the headache out of paying your employees while ensuring every box is ticked for your legal obligations, this includes paying payroll tax, so it is important to understand what is payroll tax.

If you’ve ever wanted to know ‘what does a payroll officer do?’, or you want to know about payroll officer jobs or the average payroll officer salary, we’ve covered all you need to know.

Read on for our guide to what a payroll officer does, the top skills they need, and where they work:

Payroll Officer Educational Background

Considering becoming a payroll officer?

Want to know what’s involved in training?

You might be surprised to learn that there’s no need for a technical qualification when exploring ‘what does a payroll officer do to get hired?’.

In Australia, it’s possible to work as a payroll officer for an outsourced company or as an internal hire without completing a payroll officer course – but you may find it hard to find a job that accepts you without one.

Most payroll officers will go through formal qualifications to prove their expertise and knowledge of payroll and related accountancy services.

That qualification is usually a Certificate III in Accounts Administration (FNS30317) or a Diploma of Payroll Services (FNS50417).

These qualifications cover the fundamentals of payroll administration that payroll officers need to do their jobs.

Additional training in specific payroll systems, such as MYOB or Xero, may also be highly desirable.

Beyond the basics, a payroll officer looking to progress to senior roles may expand their learning with a Diploma of Human Resources Management (BSB50618) or bachelor’s degree in accounting.

This additional study provides the qualification needed to progress in a payroll and finance-based career.

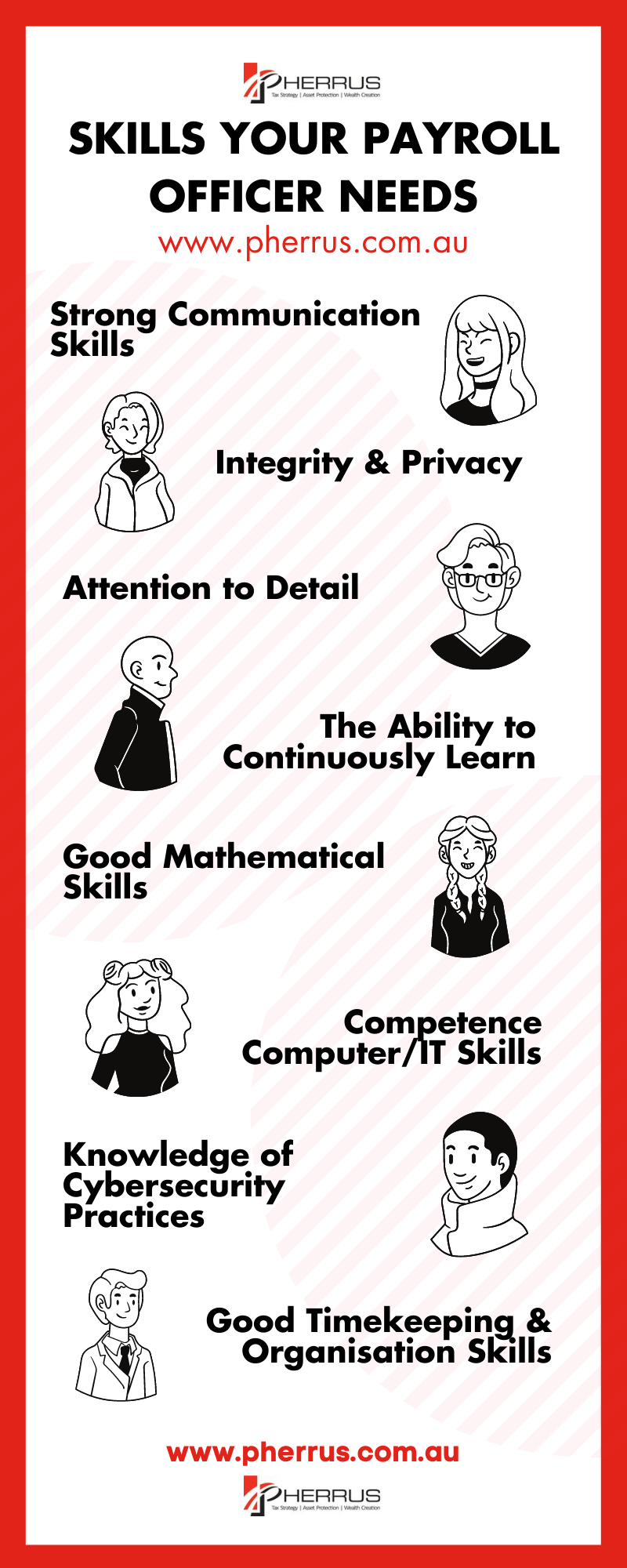

Payroll Officer Skills

For payroll officers to succeed in their careers in the long term, specific skills and masteries are needed.

By developing soft skills outside of technical knowledge, understanding the types of payroll methods, payroll accounting specialists can provide a better service to businesses whether they are working externally or as hired professionals.

Some of the critical soft skills a payroll officer should have include:

Soft Skills

- Strong communication skills: Payroll officers need to be able to communicate effectively both within their team and with other employees within the company. They may also have to report directly to management teams or provide support in answering employee questions on taxes, pay, and other sensitive topics.

- Integrity: Integrity is vital in handling payroll, as a significant amount of confidential and sensitive information is involved in ensuring everyone is paid on time. Privacy is a top concern, and payroll officers should understand the need to meet all necessary security standards as they carry out their work.

- Attention to detail: Being able to spot problems and resolve issues swiftly is vital for payroll officers. By having strong attention to detail, a payroll officer can fix problems before they occur and ensure everything is completed correctly for new employees with a far smaller margin of error.

- Continuous learning: The technology and software used by payroll specialists are continually evolving and changing, as well as the tax requirements placed on payroll. Being willing and able to learn, train and develop new skills is vital for any payroll officer that wants a long career within their particular field.

Hard Skills

Alongside less-tangible skills, payroll officers will need a selection of hard skills to complete their work.

As a finance-based role, it’s essential to have the knowledge and background to complete the work to the highest standards every time.

Some of the hard skills that payroll officers need include:

- Mathematical skills: A solid knowledge base in mathematics can be incredibly useful to payroll officers to check and double-check facts and figures manually. An analytical, logic-based way of thinking can help payroll officers complete their work with high standards of accuracy

- IT competence: With the introduction of Single Touch Payroll, most businesses use digital systems and software to carry out their payroll functionalities. Payroll officers need to have a strong level of competence in IT to ensure they can carry out their everyday work tasks and responsibilities.

- Cybersecurity knowledge: Integrity may be a vital soft skill, but it is just as important for payroll professionals to have a good understanding of the cybersecurity measures and risks they may encounter while carrying out their work. Good knowledge of cybersecurity can help to keep sensitive data and information safe.

- Timekeeping and organisation: As a role that requires timely submissions, reporting and completion every single month, it’s a requirement for payroll officers to have robust timekeeping and organisation skills. They need to meet deadlines as required by law consistently and for the payment of employees each payday.

Payroll Officer Job Description

What does a payroll officer do?

The payroll officer job description involves managing day-to-day payroll for employees, keeping information up-to-date, and scheduling payments for each pay period month after month.

As a consistent year-round role, payroll officers need to stay on track to make sure new data is entered, new information is calculated, and employees are paid on time every time.

Some of the critical responsibilities of a payroll officer include:

- Collecting and collating timesheets from employees: One of the core responsibilities of a payroll officer is to ensure all employees are paid on time for every pay period. Collecting timesheets can allow the correct information to be entered, so employees receive the right pay each month.

- Calculating working hours: Employees on hourly contracts or irregular working hours may use a timeclock or similar system to track hours worked. Payroll officers use this information to calculate total working hours for accurate pay.

- Calculating deductions and benefits: Some employees may have deductions or benefits that affect their salary, such as mileage pay for driving or deductions for workplace schemes. Payroll officers need to use software to accurately figure out what they need to pay to the employee each month.

- Preparing employee compensation: Bonuses, overtime and other incidents where an employee received extra pay must be calculated carefully by payroll officers. This extra step ensures all necessary tax is paid and bonuses are paid out alongside regular pay in the correct time scale.

- Handling superannuation and annual leave: Businesses are obligated to contribute a set amount to a super fund for each employee. Payroll officers need to calculate this amount accurately and account for annual leave or other paid holiday alongside this.

- Carrying out tax compliance: Payroll is sent directly to the ATO every month without fail under the STP system. Payroll officers need to ensure all tax is completed correctly for employee pay, including all withholdings paid as part of tax at the end of the tax year.

- Scheduling electronic payments and delivering payslips: Payroll officers need to ensure all employees are set up to receive their pay, usually through direct deposit. On payment completion, payroll officers must also send out detailed payslips, either in electronic or physical paper form.

- Creating payroll and tax reports: Both the ATO and internal business practices may require creating different reports and analytics for payroll and taxes. Payroll officers will need to create these reports from existing data, which should be stored for seven years for every employee.

- Answering queries from employees: Employees may contact payroll officers with queries about changes in their pay, taxes, or any other questions. Payroll officers should answer those questions quickly and resolve or flag issues as swiftly as possible if an error has been found.

- Entering new employee information: When a new employee is hired, payroll officers need to enter their personal data into the payroll system to receive their wages, including their choice of super fund and bank account details. This process is typically carried out as part of employee onboarding.

- Working with the wider finance department: In larger businesses, payroll officers will work directly with a larger finance department to deliver reports and analysis throughout the year. This practice requires open communication, and in cases where roles overlap, liaising with other financial specialists.

Where Does a Payroll Officer Work?

Payroll officers work primarily with individual companies and businesses in one of two ways.

Either they are hired as an in-house resource as a part of an accounting department, or they are part of an agency that allows businesses to outsource their payroll to trained professionals.

There are benefits in either case, but working with a qualified outsourced agency for small businesses or those without a significant budget for new hires can achieve the best results possible.

What is a Payroll Officer Salary?

The average payroll officer salary in Australia is anywhere between $65,000 and $80,000.

The exact salary for each payroll job will depend on various factors.

For example, someone with no training entering into a business as an apprentice may have very different pay to a highly trained and experienced payroll officer.

Salary also depends on differences in industries and the size and scale of a business.

For example, a small business may pay a lower wage than a large-scale financial institution.

But there may also be less pressure and day-to-day work required in comparison.

Senior payroll officers in multinational companies may also manage a team of payroll specialists, which has a different set of responsibilities and increased pay as a result.

Summary

If you’re searching for a payroll officer, our guide is the best place to start to find out which skills and qualifications your new payroll specialist should have.

At Pherrus, our trained team has extensive experience in delivering payroll for businesses of all shapes and sizes.

Get in touch today to discuss how to run payroll or how to make payroll better for your business.

Want to know more about what does a payroll officer do?

We can help you with that, too.