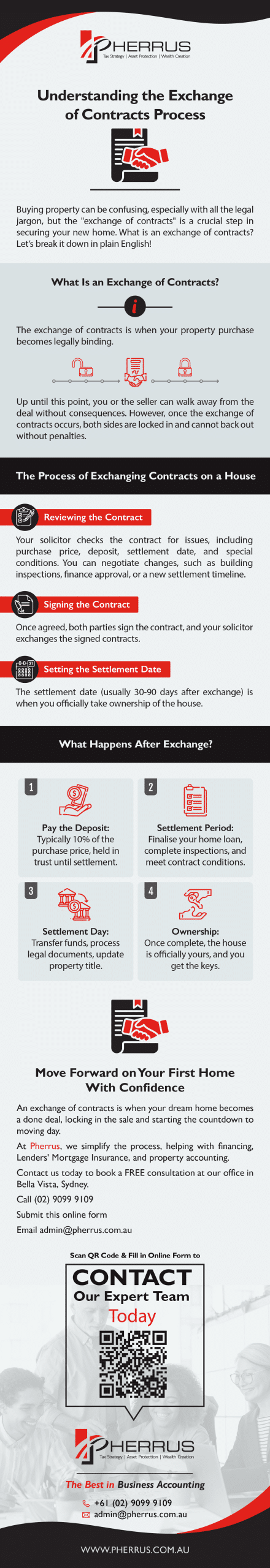

A lot of real estate and legal jargon gets thrown around when buying a property.

If you’re buying for the first time, it can be confusing and overwhelming.

Have you heard your real estate agent mention the “exchange of contracts”?

This is one of the most crucial steps in securing your new home.

What is an exchange of contracts?

Let’s break it down in plain English!

What Is an Exchange of Contracts?

The exchange of contracts is when your property purchase becomes legally binding.

Up until this point, you or the seller can walk away from the deal without consequences.

However, once the exchange of contracts occurs, both sides are locked in and cannot back out without penalties.

The Process of Exchanging Contracts on a House

Reviewing the Contract

Your solicitor or conveyancer will review the contract of sale before you sign it to check for any issues.

A contract of sale is a legal document that outlines the terms of a property sale, including the purchase price, deposit amount, settlement date, and any special conditions.

You have the right to raise concerns and negotiate changes before exchanging contracts.

Key areas to consider include

- Building and pest inspections. You may request the contract to be conditional on passing these checks.

- Finance approval. If your home loan isn’t final yet, consider negotiating a subject-to-finance clause.

- Settlement period. Need more time to move or organise finances? You can ask for an adjusted timeline.

If something doesn’t seem right, don’t hesitate to speak up! Once you exchange contracts, the sale is legally binding.

Signing on the Dotted Line

Once everything looks good, you and the seller each sign a copy of the contract.

Your solicitor or conveyancer then handles the exchange, swapping signed contracts with the seller’s legal representative.

Setting the Settlement Date

The settlement date is the day you officially take ownership of the house.

It’s agreed upon in the contract of sale and is usually 30 to 90 days after you exchange contracts.

What Happens After Exchange?

After exchanging contracts on a house, it’s time to pay the deposit—typically 10% of the property’s purchase price.

The seller’s real estate agent or solicitor holds this amount in a trust account until settlement

The period between exchange and settlement, known as the settlement period, is when you’ll need to finalise your home loan, complete any remaining house inspections, meet all contract conditions, and prepare for the big move.

Settlement day is the final step in the process.

Your solicitor or conveyancer will work with your home loan lender to complete the final transfer of funds to the seller.

Once the payment is confirmed and all legal documents are processed, the property title is updated in your name.

Once settlement is complete, the property will officially be yours, and you’ll receive the keys to your new home!

Move Forward on Your First Home With Confidence

What is an exchange of contracts?

It’s the moment your dream home becomes a done deal—legally locking in the sale so you can start counting down to moving day!

Don’t let confusion over the property purchasing process take the excitement out of buying your first home.

As financial experts here at Pherrus, we want to make this process straightforward and stress-free for you.

We can help you secure financing, understand Lenders’ Mortgage Insurance requirements, and take care of all your property accounting needs.

Contact us today to book a FREE consultation at our office in Bella Vista, Sydney.

📞Call (02) 9099 9109

✏️Submit this online form

📩Email admin@pherrus.com.au