Are you having trouble deciding on the best trustee business structure to choose for your startup journey or why it’s even important to consider setting up a trust vs a company? Establishing the correct base at the beginning is imperative because if you fail to do so, major (and expensive) setbacks could affect the future of your business.

Some models might seem similar to one another or confusing, so we’ve broken it down for you here. If you need any assistance, the team as Pherrus Financial Services are here to help with consultations and professional advice.

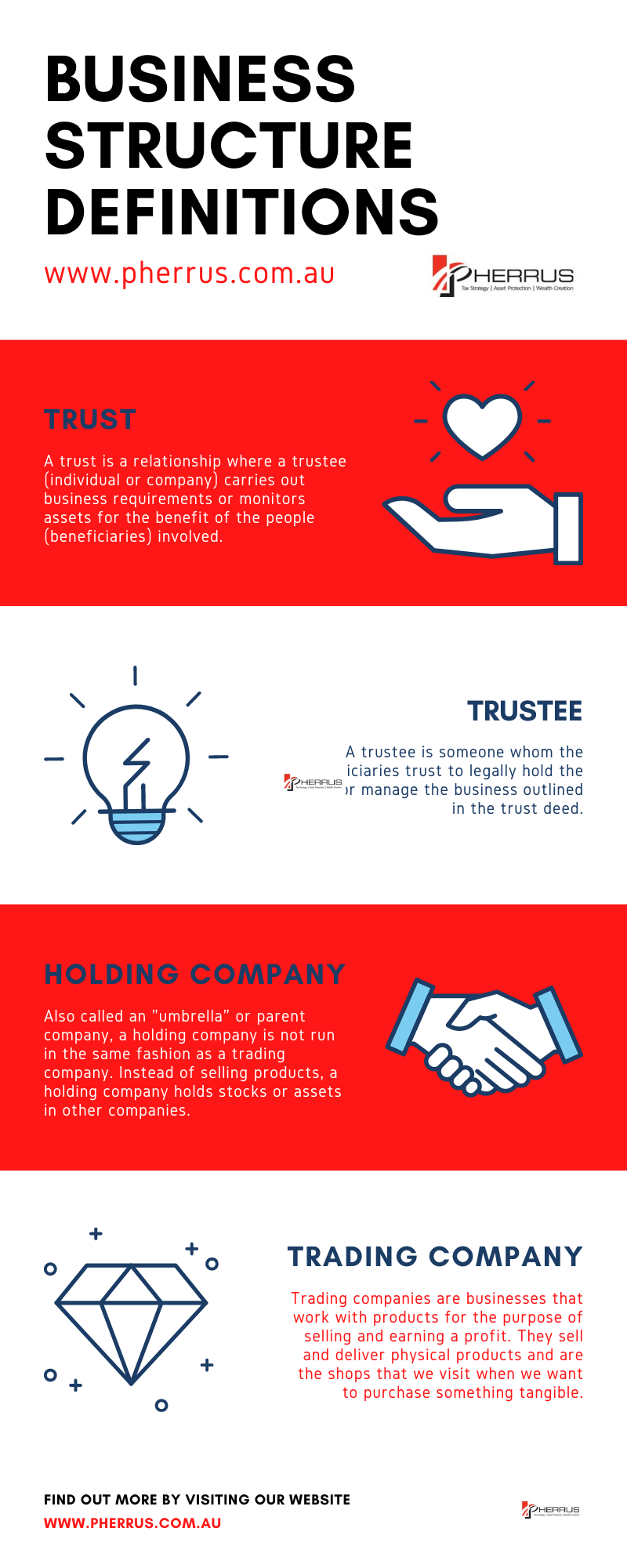

Before we discuss the types of trusts you can choose, the pros and cons of said trusts and how they differ from holding and trading companies, first we must understand the meaning of three major terms :

TRUST

A trust is a relationship where a trustee (individual or company) carries out business requirements or monitors assets for the benefit of the people (beneficiaries) involved.

TRUSTEE

A trustee is someone whom the beneficiaries trust to legally hold the assets or manage the business outlined in the trust deed.

BENEFICIARY

A beneficiary is a person or persons whose assets or business are held in trust for.

Let’s break down the two main types of trusts that exist in Australia.

1. A discretionary trust (trust vs trustee model)

Also known as a family trust, a discretionary trust is not a separate legal entity but allows a trustee to delegate the flow of profits to the beneficiaries as per the trust deed. The beneficiaries are often directors (or corporate trustees), their associates and family members, hence the term ‘family trust’.

Another form of a discretionary trust is a trust corporate (a trust company). In this regard, a corporation trust company acts as a trustee of a trust corporate rather than a single person. A corporate trustee is a registered company, however, only for the purpose of being a company rather than conducting business (such as the selling or trading of physical products).

2. A unit trust

In a unit trust, the profit in the trust is divided into a certain number of units and their distribution is determined by the number of units each beneficiary holds. Units refer to the number of assets or the percentage of business you own. Therefore, if you own 75% of the units, you own 75% of the assets or business and gain 75% of the profit the trust receives.

Note: Beneficiaries can sell and buy units amongst themselves in this trust.

Trusts are different to companies, though they might look similar in some regards. The two main companies in Australia are :

1. A holding company

Also called an “umbrella” or parent company, a holding company is not run in the same fashion as a trading company. Instead of selling products, a holding company holds stocks or assets in other companies.

The biggest difference between this company and the trusts listed in this article is the fact that, while it holds stocks, it doesn’t delegate the profits. In this manner, a holding company is more like a beneficiary. This company differs from a trading company in that it doesn’t control the everyday running of a company, only oversees management of assets.

2. A trading company

Trading companies are businesses that work with products for the purpose of selling and earning a profit. They sell and deliver physical products and are the shops that we visit when we want to purchase something tangible.

Now we know the differences between the two major trusts and company types, let’s move onto the pros and cons of having a trust set up.

Setting up the foundations for your business is important and understanding why a trust is necessary is part of this process. While this article is helpful, it is merely a guide. For the best advice, please take advantage of our free consultation.

The major pros of setting up a trust are:

- A trust ensures assets are protected and limits liability when it comes to a business

- A trust separates the control of an asset from the owner of the asset, which protects the assets of a young person or family

- When it comes to tax, trusts are flexible (especially in a discretionary trust)

- Beneficiaries of a trust pay tax on income they receive from a trust as their own marginal rates

- Beneficiaries don’t own the trust assets, which makes it harder for creditors to obtain them

The major cons of setting up a trust are:

- The establishment of a trust is costly, unlike the cheaper rates of establishing sole traders and partnerships

- A trust is a complex legal structure

- A trustee has a strict obligation to hold and manage the property for the exclusive benefit of the beneficiaries (if it is in the trust deed, it is the rule)

- The way a business is run is outlined in the trust deed and cannot be changed

- Losses derived in a trust cannot be distributed or offset by beneficiaries against the other income they may have

If this article has helped you decide which trustee business structure you would like to back your startup, please contact us for advice on how to start your journey. We are a group of experienced business tax accountants, agents, and consultants based in Sydney.

Pherrus Financial Services offer free consultations and can assist with any questions you might have.