If you are like most people, when you hear of a tax agent, you probably think of an accounting professional who can assist you with lodging your tax return.

This is true, to an extent.

While there are many tax agents whose sole skill-sets are taxation and tax law, there are also those whose knowledge and expertise go far beyond taxes.

Yes, they can help you with your tax obligations, some of which include:

Preparing your annual tax return

Advising on how to minimise your tax obligations

Providing advice on compliance with the ATO’s requirements.

But did you know there are tax agents for small businesses?

If you are running a small business, then you can partner with a tax agent who can not only competently perform all of the above but advise you on how to help your business survive and thrive.

This post will explore how tax agent services can make it easier for you to run a small business in Australia.

Additionally, you will learn what tax agent services are available depending on your needs.

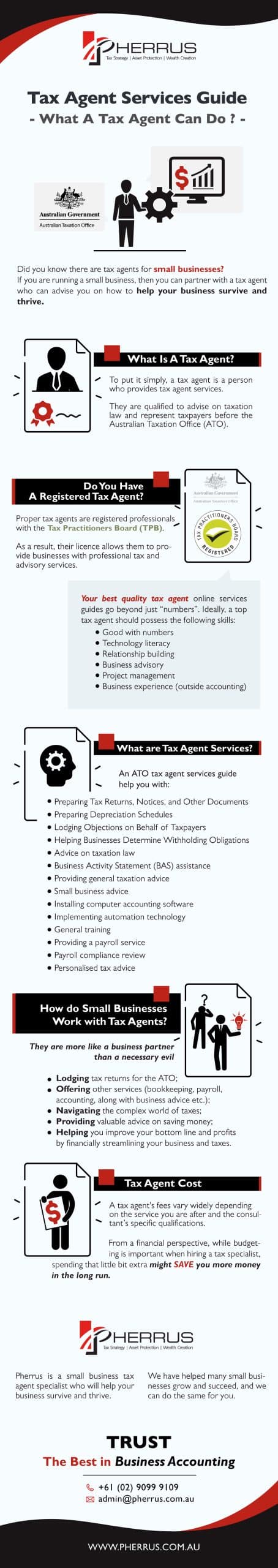

What is a tax agent?

To put it simply, a tax agent is a person who provides tax agent services.

They are qualified to advise on taxation law and represent taxpayers before the Australian Taxation Office (ATO).

The tax agents services we are discussing, also known as Public Accountants, specialising in tax accounting.

They can perform all the duties of an accountant and have the authority to represent small businesses and organisations when handling tax authorities like the ATO.

These types of tax agents are specialists with further qualifications, qualifying them to deal with business tax compliance and law. (link: https://www.pherrus.com.au/pherrus-services/business-taxation-compliance-services/)

Do you have a registered tax agent?

It’s essential to ensure your tax agent is above board and just not some cowboy who punches numbers. Proper tax agents are registered professionals with the Tax Practitioners Board (TPB).

As a result, their licence allows them to provide businesses with professional tax and advisory services.

Tax agents can assist businesses in all tax-related matters, including any issues related to tax returns, payments, and other financial advice.

The best tax agents will learn your business inside and out and be able to provide business development services, (link https://www.pherrus.com.au/pherrus-services/business-taxation-compliance-services/), perform business analysis and asset protection strategies and business structure services, among other services benefitting the operating of your business.

Your best quality tax agent online services guides go beyond just “numbers”.

They identify areas where you can either save money or make more money for your business. Ideally, a top tax agent should possess the following skills:

Good with numbers

Technology literacy

Relationship building

Business advisory

Project management

Business experience (outside accounting)

What are Tax Agent Services?

An ATO tax agent services guide help you with:

Preparing Tax Returns, Notices, and Other Documents:

By preparing tax returns for individuals and businesses, quality tax agents can also advise how to avoid paying too much tax.

Preparing Depreciation Schedules:

This tedious task that requires a lot of time and effort. The process starts with identifying the assets that are going to be depreciated. The next step is to determine the useful life of each asset and the salvage value at the end of its useful life. The last step is to calculate the annual depreciation expense for each asset.

Lodging Objections on Behalf of Taxpayers:

Good tax agents are experts in the field of taxation and they know how to lodge objections on behalf of taxpayers. They can also help with the process of lodging objections.

Helping Businesses Determine Withholding Obligations:

An employer is required to withhold taxes from their employees’ wages and send them to the ATO. A quality tax agent helps determine the amount but sends it to the ATO on your behalf.

Advice on taxation law:

This helps you realise your taxation obligations and offers peace of mind that your business is above board.

Business Activity Statement (BAS) assistance:

Automate and lodge your BAS every quarter and ensure everything is in order come EOFY.

Providing general taxation advice:

This can help save money on your taxes tailored to your personal circumstances.

Small business advice:

A good agent can identify areas where your business can save money. For example, cutting down on overheads and paying less tax.

Installing computer accounting software:

Your tax agent can help install and implement SaaS such as Xero, Quickbooks and Reckon, among others.

Implementing automation technology:

Accounting is becoming ever-more crucial for automation. Your tax agent can help set up technology to automate processes.

General training:

They can also assist in training your team in using software and utilising automation with books, invoices, etc.

Providing a payroll service:

Interpreting and applying taxation law and reporting employee payroll information through single touch payroll (STP) enabled software.

Payroll compliance review:

Undertaking an assessment and opinion on whether the client is compliant with their taxation obligations.

Personalised tax advice:

In relation to PAYG withholding liability, fringe benefits tax laws, Superannuation Guarantee obligations, and termination and redundancy payments.

How do Small Businesses Work with Tax Agents?

We already know that tax agents are professionals who specialise in tax law and lodging tax returns for the ATO.

Furthermore, we established they can also help small businesses with their taxes. But how exactly?

Besides helping you with your taxes, they also offer other services such as bookkeeping, payroll, and accounting, along with business advice.

Tax agents can be an excellent resource for small businesses because they have the knowledge and expertise to help you navigate the complex world of taxes.

They can also provide valuable advice on saving money on your taxes.

By finding a quality small business tax agent that you can work with for years on end, they will get to know your business inside and out.

Along the way, they financially streamline your business and taxes, helping you improve your bottom line and profits.

As a result, the right tax agent becomes more like a business partner than a necessary evil to handle your tax obligations!

With the right small business tax agent, they can become an extension of your office, someone you can rely on and trust to have your best interests at heart.

In this new world of remote work, a relationship can be maintained anywhere.

However, we advise first meeting face to face before committing to your new tax agent relationship. It’s important to get a gauge on them to ensure they are the right fit for you.

While most of the communication and work can be done online, your tax agent should also be on hand for meeting onsite when required and attending in-person meetings.

Tax agent cost

A tax agent’s fees vary widely depending on the service you are after and the consultant’s specific qualifications.

Before selecting your tax agent, ask for precise information about their price schedule for different services.

Also, meet with a few first and compare prices before deciding.

.

More complex taxes and advisory services throughout will often charge by the hour.

Exploring your options and considering what you want and what is a worthwhile expense is essential.

From a financial perspective, while budgeting is important when hiring a tax specialist, spending that little bit extra might save you more money in the long run.

Summary

As you can see, a tax agent goes far beyond taking care of your taxes for the ATO.

You can take a massive weight off your shoulders by easing the running of your business in Australia by partnering with the right tax agent.

However, you should practice due diligence when selecting your small business tax agent specialist.

The right one can become an extension of your team, helping your business survive and thrive with expert business advisory and experience.

Their skills should range from technological literacy to good relationship skills and extensive business experience.

One of the additional benefits of partnering with such tax agents is their extensive network of like-minded business owners.

As a result, tax agencies are not uncommon to help expand your company through necessary introductions and business relationships.

If you’re in the market to expand your current client base, quality tax agent services could be able to assist.

About Pherrus

Pherrus is a small business tax agent specialist who will help your business survive and thrive.

We are experts in the field of taxation, with years of experience in the industry.

We have helped many small businesses grow and succeed, and we can do the same for you.

Trust, the Best in Business Accounting.