Are you tired of complex payroll calculations? Say goodbye to this headache thanks to our user-friendly payroll calculator that simplifies the process for you.

This calculator uses the latest Australian Taxation Office payroll formulas to help you efficiently calculate your employees’ wages, taxes, and deductions with less chance of costly errors, as manual calculations are eliminated.

Are you an employee wondering, “How can I calculate my pay after tax?”.

You can use this calculator to clarify your net pay for budgeting and cross-reference your employer’s tax withholdings for accuracy.

Whatever boat you’re in, save time, money, and stress with the best payroll calculator in Australia.

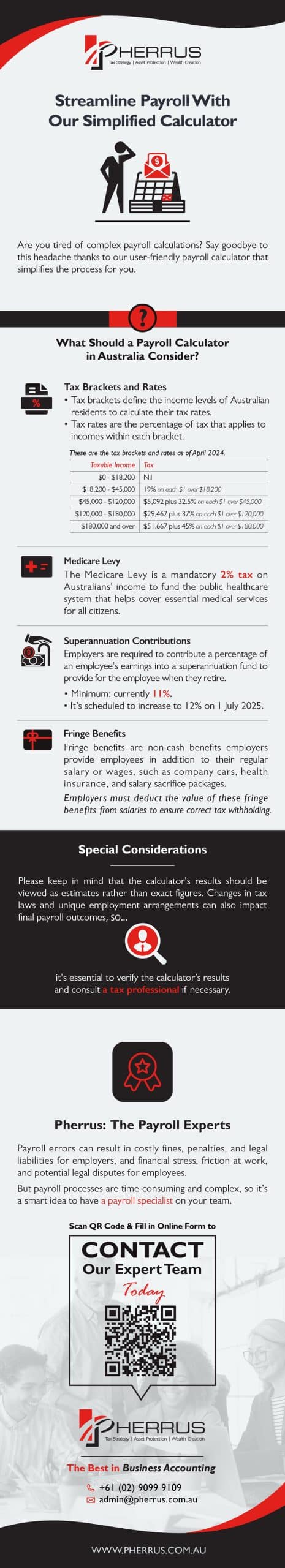

What Should a Payroll Calculator in Australia Consider?

Our payroll calculator takes into account the following factors and deductions to calculate how much tax should be withheld from an employee’s wage.

Tax Brackets and Rates

Tax brackets define the income levels of Australian residents to calculate their tax rates.

Tax rates are the percentage of tax that applies to incomes within each bracket. As a person’s income increases, they move into a higher tax bracket where they’re taxed at a higher rate.

These are the tax brackets and rates as of April 2024.

| Taxable Income | Tax |

| $0 – $18,200 | Nil |

| $18,200 – $45,000 | 19% on each $1 over $18,200 |

| $45,000 – $120,000 | $5,092 plus 32.5% on each $1 over $45,000 |

| $120,000 – $180,000 | $29,467 plus 37% on each $1 over $120,000 |

| $180,000 and over | $51,667 plus 45% on each $1 over $180,000 |

Medicare Levy

The Medicare Levy is a compulsory contribution Australians make to fund Medicare, the public healthcare system that helps cover essential medical services for all citizens.

It’s calculated as 2% of your taxable income.

Superannuation Contributions

Employers are required to contribute a percentage of an employee’s earnings into a superannuation fund to provide for the employee when they retire.

The superannuation guarantee rate (the minimum percentage of an employee’s earnings that their employer must contribute) is currently 11%, but it’s scheduled to increase to 12% on 1 July 2025.

Fringe Benefits

Fringe benefits are non-cash benefits employers provide employees in addition to their regular salary or wages, such as company cars, health insurance, and salary sacrifice packages.

Employers must deduct the value of these fringe benefits from employees’ salaries or wages to ensure the appropriate amount of tax is withheld.

Special Considerations

Our payroll calculator’s formulas are derived from data provided by the ATO for accuracy and compliance with tax regulations.

However, please keep in mind that due to individual circumstances and potential payroll complexities, such as varying deductions or allowances, the calculator’s results should be viewed as estimates rather than exact figures.

Changes in tax laws and unique employment arrangements can also impact final payroll outcomes, so it’s essential to verify the calculator’s results and consult a tax professional if necessary.

Pherrus: The Payroll Experts

Payroll is something you can’t afford to get wrong.

Payroll errors can result in costly fines, penalties, and legal liabilities for employers, and financial stress, friction at work, and potential legal disputes for employees.

Clearly, payroll accuracy is crucial for maintaining trust, compliance, and overall financial success.

But payroll processes are time-consuming and complex, so it’s a smart idea to have a payroll specialist on your team.

For streamlined, hassle-free payroll management, complete our online form or call +61 (02) 9099 9109 to book an appointment at our Bella Vista office in Sydney, NSW.