Whether you’re purchasing a home for the first time or planning to relocate to New South Wales, understanding all the costs attached to buying a new property up-front is the best place to start.

Like every state in Australia, NSW stamp duty is a `specific fee or cost you will pay when purchasing a home.

With up to tens of thousands of dollars of additional cost on top of your standard property price, you don’t want to end up blindsided by a big bill on the day of purchase.

Want to know more about what stamp duty NSW means, the NSW stamp duty rates, or interested in NSW stamp duty exemption?

We’ve covered all you need to know to be fully informed about stamp duty across New South Wales before you complete your property purchase:

What is stamp duty in NSW?

If you’ve never owned or purchased a property or land before, the concept of NSW property stamp duty may be something you’ve never considered in detail.

But for many first-time buyers, or those moving from a state with different exemptions, it’s important to understand what NSW stamp duty entails. Also referred to as ‘transfer duty’, your stamp duty is a cost you pay to the government when you purchase any form of property within that specific state.

There are a few specific exemptions and reductions in stamp duty that you may be eligible for. Read on to find out more about what is included under these exemptions and determine whether you fall under those specific requirements.

How do I find out how much stamp duty I’ll pay?

The best way to find out exactly how much you’ll pay on stamp duty is to research and find out ahead of time. No one likes to be left with a large, unexpected bill on the day of purchase.

Online stamp duty calculator services can give you a great idea of exactly how much you may need to pay. We’ve also listed the rates below to provide you with a good idea of what you’re likely to need to pay out for.

NSW Stamp Duty Calculator

New South Wales Charge:

Fee Mortgage: $0.00 Transfer: $0.00 Stamp Duty: $0.00 Foreign Buyers Duty: $0.00Total : $0.00 Concessions First Home Grant: $0.00 Other: $0.00

Total : $0.00

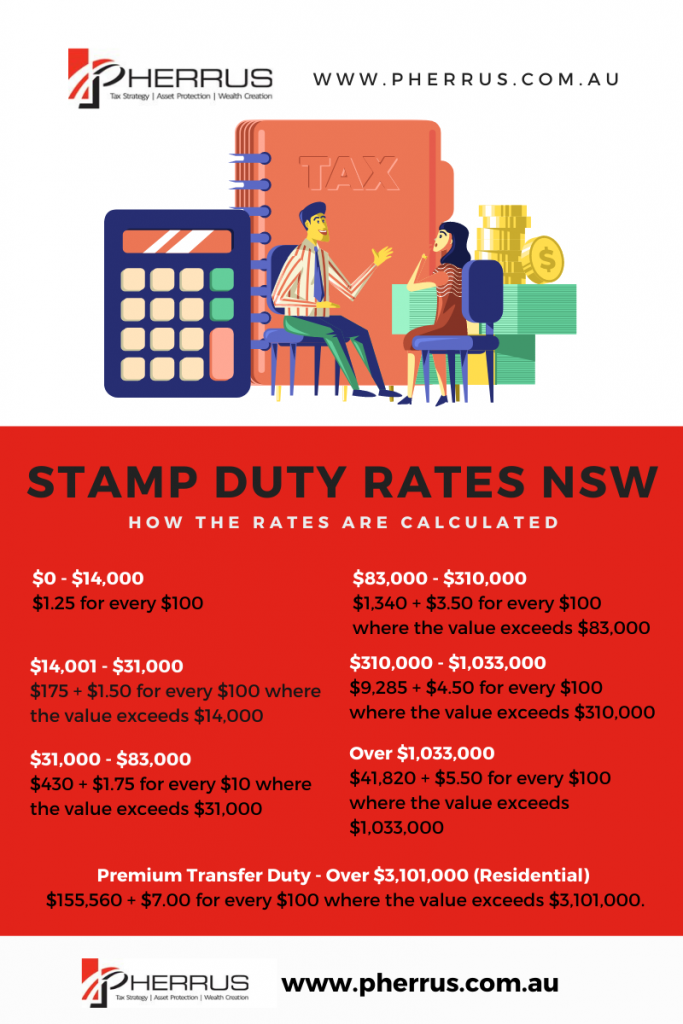

What are the rates for stamp duty?

As with many states, NSW stamp duty rates are separated into specific tiers to ensure fair and affordable pricing for anyone looking to buy a home. Still wondering ‘how much is stamp duty in NSW?’

The current rates for stamp duty in NSW are as follows to give you a general idea of exactly what you may need to pay for your new property:

$0 – $14,000

$1.25 for every $100

$14,001 – $31,000

$175 + $1.50 for every $100 where the value exceeds $14,000

$31,000 – $83,000

$430 + $1.75 for every $10 where the value exceeds $31,000

$83,000 – $310,000

$1,340 + $3.50 for every $100 where the value exceeds $83,000

$310,000 – $1,033,000

$9,285 + $4.50 for every $100 where the value exceeds $310,000

Over $1,033,000

$41,820 + $5.50 for every $100 where the value exceeds $1,033,000

Premium transfer Duty

Over $3,101,000 (residential)

$155,560 + $7.00 for every $100 where the value exceeds $3,101,000.

How does stamp duty in NSW need to be paid?

When you enter settlement on a property, you will likely be asked to pay your stamp duty upfront.

From there, you can choose to pay directly from your funds or have the amount deducted from a loan. Should you choose the latter, you’ll then need to make up the extra yourself.

If you’d prefer to not go through your conveyancer to pay your stamp duty, you can choose to pay directly to the government within three months of the settlement in New South Wales.

NSW stamp duty exemptions

If you’re planning to purchase a house or apartment in NSW and you want to know if you’re eligible for any kinds of exemption, there are a few options that may apply to you:

First Home Buyers Assistance Scheme

Under the Scheme there are different exemption thresholds which apply, mainly for New Homes $800,000 or less, Existing Homes $650,000 or less and Vacant Land on which you intend to build a home $ 400,000 of less.

You can find out the full details of the current NSW First Home scheme on the government site here.

Exemption through divorce

If you transfer the ownership of a home or land from one person to another due to a court order in a divorce, no transfer duty will apply.

However, this is under a specific set of circumstances, and you will need to seek expert legal advice and financial advice to ensure this applies to you.

Can I get a pensioner exemption?

While some states offer a pensioner exemption for the purchase of homes, stamp duty exemption in NSW for over 60s currently doesn’t exist.

You will be required to pay the standard stamp duty on any property you purchase unless you fall under either of the two exemptions above.

Do I pay stamp duty on land?

If you’re purchasing land in NSW, you will need to pay stamp duty in the same way you would for a pre-built property. The only exception to this is if you’re purchasing land and are eligible for the First Home Buyers Assistance Scheme.

Do I pay stamp duty if I’m refinancing an existing NSW property?

In most cases, you will not need to pay stamp duty in NSW if you’re planning on refinancing.

Speak to Pherrus Financial Services today

Have questions about buying property in NSW, or want expert advice on stamp duty? Pherrus Financial Services is here to help. Get in touch with our expert team today for any property accounting and property finance-related questions.