Real estate development accounting has plenty of unique complexities and challenges that make it entirely unlike other areas of accounting. Whether you’re exploring hiring a property investment accountant or attempting to grapple with real estate development accounting software, understanding the financial obligations and accounting styles involved in this process is invaluable.

We cover everything you need to know about what’s different about accounting for real estate development costs, with specific information about accounting for property development in Australia below.

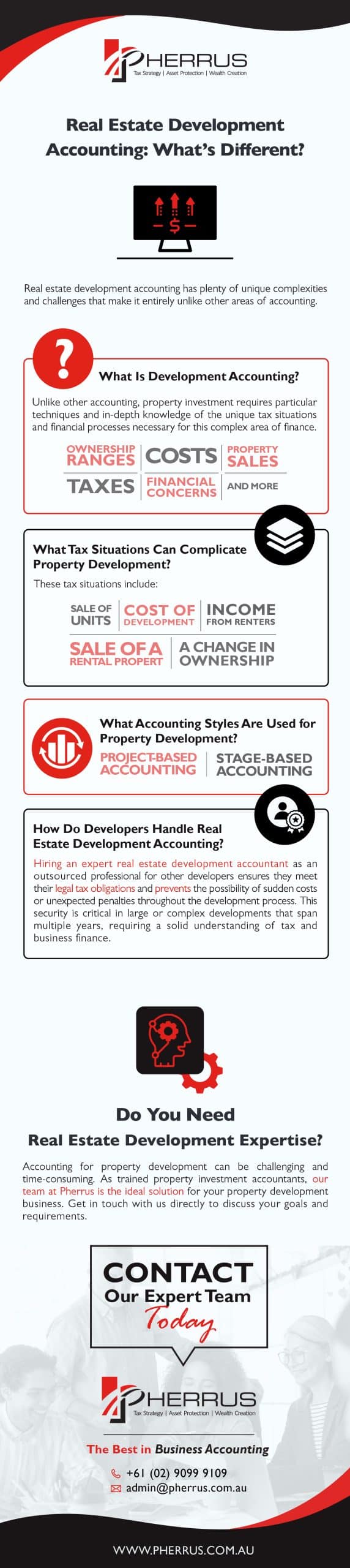

What Is Development Accounting?

Accounting for property development involves more than just managing the basic ins and outs of the average business. Unlike other accounting, property investment requires particular techniques and in-depth knowledge of the unique tax situations and financial processes necessary for this complex area of finance. Development accounting includes any of the various taxes, costs and financial concerns that can arise from development, ownership ranges, renting, property sales and more.

What Tax Situations Can Complicate Property Development?

Unlike businesses with a straightforward route for income and outgoings, real estate development accounting is more complex. Because of how ownership and property change hands, accounting for property development costs also needs to include an array of potential taxes and financial fees a developer needs to pay for day-to-day business transactions. These tax situations include:

Sale of Units

When you sell an apartment, unit or townhouse, you need to pay relevant taxes on that sale to ensure your accounting is accurate and your obligations are met. Both capital gains tax and goods and services tax can apply to the sale of units in a developed property, requiring accountants to have the knowledge and skill to calculate these costs for business tax returns carefully.

The Cost of Development

The costs involved in development are also subject to GST. This tax makes it essential to keep track of the ins and outs of materials, labour and more to ensure you meet your tax obligations and don’t make any costly mistakes on your tax return.

A Change in Ownership

When a property changes hands from one person to another, the cost of stamp duty is a consideration and often a significant tax on changing the ownership of a property of any shape and size. Knowing how stamp duty works and what you owe is integral to avoiding unexpected costs during and after development.

Income from Renters

If you receive an income from renters in a developed property, you’ll need to pay income tax on the rent that they pay you. This process is similar to how landlords are required to pay income tax on money from renting properties, making this an essential consideration if you plan to retain and rent out properties following the completion of development.

Sale of a Rental Property

If you choose to sell a property that already has renters in place, you’ll typically be responsible for the payment of capital gains tax, or CGT. Ensuring you prepare for this tax and understand what percentage of the property value you’ll need to pay is an essential component of real estate development accounting, preventing unexpected costs if you do choose to sell.

What Accounting Styles Are Used for Property Development?

Property development accountants use a few different styles of accounting to manage the day-to-day running of development finances. Depending on the number of projects and the size of the development, different accounting styles are chosen to suit the scale and purpose of the project. Two of the most common accounting styles for property development include:

Project-Based Accounting

Project-based accounting involves looking at the development as a single entity for tax and financial obligations from start to finish. Developments that fit within a single accounting year, or are primarily within that year, are typically managed on a project-by-project basis. This method allows all accounting to be contained within a single package, making it easier to gain perspective on the whole of a development and understand your financial obligations through to completion. Project-based accounting also helps with other financial decisions and reporting, providing a clear view of what a project costs and insight into what could be improved for future developments.

Stage-Based Accounting

Larger-scale developments or combined developments that feature multiple builds may use stage-based accounting to provide more granular insight into the cost of each part of a project. Developments that span multiple years may use stage-based accounting as a way for businesses to understand their financial requirements year-on-year. For example, if the same company rents out a planned development after construction, it may divide accounting into stages to reflect on differing tax requirements.

How Do Developers Handle Real Estate Development Accounting?

Most developers use specialised accountants to handle the complex requirements of development finances. For large developers, this may mean hiring a specialist accountant in-house to work exclusively for them. Hiring an expert real estate development accountant as an outsourced professional for other developers ensures they meet their legal tax obligations and prevents the possibility of sudden costs or unexpected penalties throughout the development process. This security is critical in large or complex developments that span multiple years, requiring a solid understanding of tax and business finance.

Do You Need Real Estate Development Expertise?

If you’re planning to explore real estate development or want to expand your business, requiring more complex financial management, working with a trained professional is the ideal solution. Accounting for property development can be challenging and time-consuming. Using a professional service gives you the freedom to understand your tax obligations and ensure your finances are in order throughout the project.

As trained property investment accountants, our team at Pherrus is the ideal solution for your property development business. Get in touch with us directly to discuss your goals and requirements. Whether you’d like to outsource all of your accounting or you want to ensure you’re ready for upcoming taxes, our expert team are on hand to help you. We help you avoid confusion while reducing the burden of tax concerns for your property developments. Contact us today to get started.