Property fringe benefits are like the icing that turns a plain cake into an enticing treat.

A standard employment package includes salary, annual leave, and standard benefits.

While adequate, it might not stand out in a competitive job market.

On the other hand, property fringe benefits make your employment offer more appealing to help you attract and retain the top talent in your field.

Property fringe benefits refer to specific extra non-cash benefits provided to your employees as part of an employment compensation package.

Such benefits can include

- A laptop

- A company car

- An apartment or home

- Shares in your business

If you’re offering property fringe benefits, you must fully understand the rules surrounding them, including the tax obligations.

Let’s uncover the basic rules of these benefits and how to report them so everything is above board.

We’ll use the Australian Taxation Office website for reference as it provides the most accurate and up-to-date information on this subject.

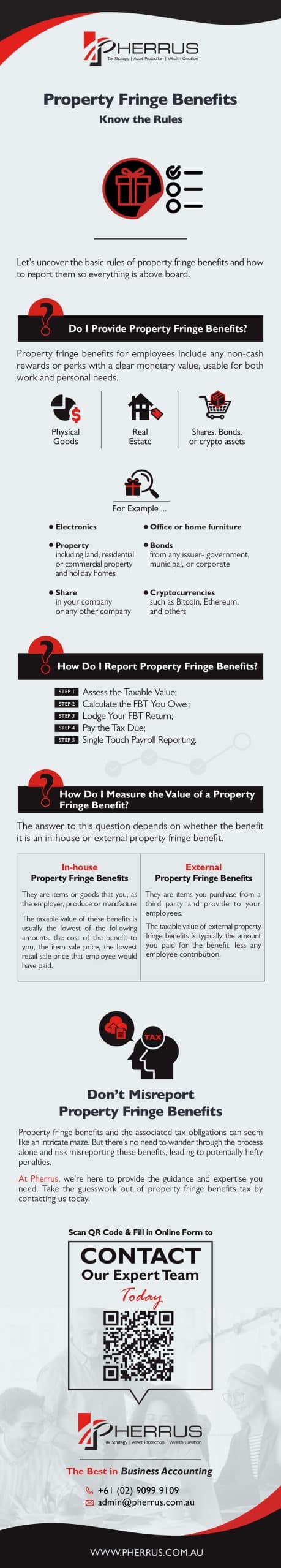

Do I Provide Property Fringe Benefits?

What qualifies as property fringe benefits you can provide your employees?

Essentially, any non-cash reward or perk that has a clear monetary value.

Employees can use these benefits for work or personal purposes.

Property fringe benefits can include

- Physical goods

- Real estate

- Shares, bonds, or crypto assets

To give you more context, here are some examples:

- Electronics, such as a laptop, mobile phone, or tablet

- Office or home furniture

- Property including land, residential or commercial property and holiday homes

- Shares in your company or any other company

- Bonds from any issuer- government, municipal, or corporate

- Cryptocurrencies such as Bitcoin, Ethereum, and others

How Do I Report Property Fringe Benefits?

Step 1: Assess the Taxable Value

To report property fringe benefits, start by calculating the taxable value of the benefit.

The method to calculate this varies depending on the type of benefit provided.

For most property benefits, the taxable value is the amount you paid for the property minus any employee contributions.

Step 2: Calculate the FBT You Owe

Calculating the Fringe Benefits Tax (FBT) you owe involves a process called ‘grossing-up.’

It’s a way to represent the amount your employees would need to earn (at the highest tax rate) if they were to purchase the benefits themselves.

After finding the ‘grossed-up’ amount, multiply it by the FBT rate (currently 47%) to determine the exact amount of FBT you need to pay.

Step 3: Lodge Your FBT Return

Once you have determined the taxable value of the property fringe benefit and the FBT you owe, you must report this on your FBT return, due by May 21 each year.

If you are unsure how to lodge a FBT return, consult a tax professional or the ATO.

Step 4: Pay the Tax Due

After you have lodged your FBT return, you must pay the tax due.

Again, the FBT rate is 47% of the total taxable value of the fringe benefits you have provided.

You can pay this tax to the ATO in several ways, including BPAY, credit or debit card, and direct credit.

Step 5: Single Touch Payroll Reporting

Lastly, if the total taxable value of the fringe benefits you have provided to an employee exceeds a certain threshold (currently $2,000), you must report this on your employee’s payment summary or through Single Touch Payroll (STP).

This amount is known as the ‘Reportable Fringe Benefits Amount’.

While these steps provide a general overview of reporting property fringe benefits, the specific rules can be complex and vary depending on your circumstances.

Always check the latest information on the ATO website or consult with a tax professional.

How Do I Measure the Value of a Property Fringe Benefit?

The answer to this question depends on whether the benefit it is an in-house or external property fringe benefit.

In-House Property Fringe Benefits

In-house property fringe benefits are items or goods that you, as the employer, produce or manufacture.

These benefits are directly connected to your business. For example:

- If you are a furniture manufacturer and give an employee a chair you made.

- If your company manufactures laptops and you provide one for your employee.

- If you own a bakery and you give bread to your employees.

The taxable value of these benefits is usually the lowest of the following amounts:

- The cost of the benefit to you.

- The price at which you generally sell the item.

- The price the employee would have paid for the benefit in the lowest retail sale of the FBT year (April 1 to March 31).

External Property Fringe Benefits

External property fringe benefits are items you purchase from a third party and provide to your employees.

These items are not directly associated with the goods or services provided by your business.

For example:

- If you own a software company and provide a car to an employee.

- If you own a marketing agency and offer an employee a gym membership.

- If you own a restaurant and give an employee a mobile phone.

The taxable value of external property fringe benefits is typically the amount you paid for the benefit, less any employee contribution.

With both in-house or external property fringe benefits, the valuation of the benefits may vary based on whether the benefit is provided frequently or at or near the employer’s business premises.

Don’t Misreport Property Fringe Benefits

Property fringe benefits and the associated tax obligations can seem like an intricate maze.

But there’s no need to wander through the process alone and risk misreporting these benefits, leading to potentially hefty penalties.

At Pherrus, we’re here to provide the guidance and expertise you need.

Our team of tax professionals understands the intricacies of Australian tax law to help you meet all your FBT obligations accurately and efficiently.

Take the guesswork out of property fringe benefits tax by contacting us today.

Fill in our online form or call +61 (02) 9099 9109 to book an appointment at our Bella Vista office in Sydney, NSW.