Workers’ Compensation is a protection for employees, but it can be difficult to understand the system.

For example, do you know

- When you’re entitled to a payout?

- How to file for workers’ compensation?

- How much of a payout you’re entitled to?

- How you’ll be paid?

This workers’ compensation payout guide for NSW employees is here to help answer those questions, empowering you to confidently access the support and benefits you deserve.

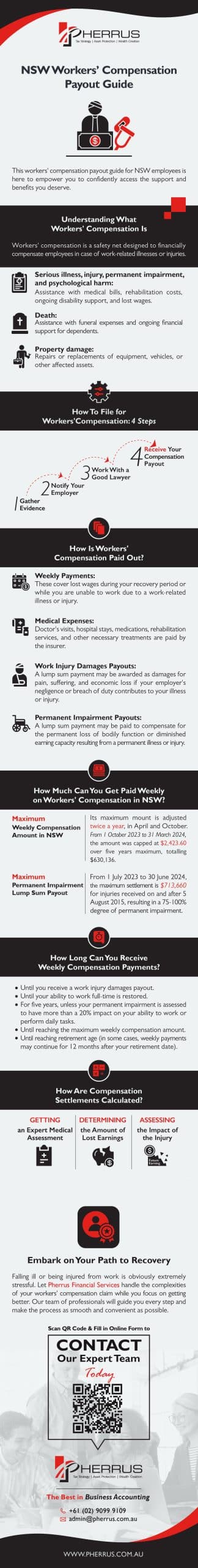

Understanding What Workers’ Compensation Is

Workers’ compensation is a safety net designed to financially compensate employees in case of work-related illnesses or injuries.

Here’s what it covers:

- Serious illness, injury, permanent impairment, and psychological harm: Assistance with medical bills, rehabilitation costs, ongoing disability support, and lost wages.

- Death: Assistance with funeral expenses and ongoing financial support for dependents.

- Property damage: Repairs or replacements of equipment, vehicles, or other affected assets.

How To File for Workers’ Compensation: 4 Steps

1. Gather Evidence

Gather any documentation or evidence of your work-related illness or injury, including medical records, incident reports, and witness statements, to support your workers’ compensation claim.

2. Notify Your Employer

Inform your employer about your illness or injury as soon as it occurs, following your workplace’s procedures for reporting accidents or incidents.

3. Work With a Good Lawyer

Consider seeking legal advice and representation from a lawyer experienced in workers’ compensation cases to guide you through the claims process, ensure your rights are protected, and maximise your chances of receiving fair compensation.

4. Receive Your Compensation Payout

Once your claim is approved, you’ll receive your workers’ compensation payout.

Depending on the nature and severity of your illness or injury, this payout may include reimbursement for medical expenses, rehabilitation costs, lost wages, and other related benefits.

How Is Workers’ Compensation Paid Out?

Workers’ compensation is paid out in four main ways:

- Weekly payments: These cover lost wages during your recovery period or while you are unable to work due to a work-related illness or injury.

- Medical expenses: Doctor’s visits, hospital stays, medications, rehabilitation services, and other necessary treatments are paid by the insurer.

- Work injury damages payouts: A lump sum payment may be awarded as damages for pain, suffering, and economic loss if your employer’s negligence or breach of duty contributes to your illness or injury.

- Permanent impairment payouts: A lump sum payment may be paid to compensate for the permanent loss of bodily function or diminished earning capacity resulting from a permanent illness or injury.

How Much Can You Get Paid Weekly on Workers’ Compensation in NSW?

The maximum weekly compensation amount in NSW is adjusted twice a year, in April and October.

This adjustment, known as indexing, is based on changes in the cost of living.

From 1 October 2023 to 31 March 2024, the weekly compensation amount was capped at $2,423.60 over five years maximum, totalling $630,136.

Your weekly payout couldn’t exceed this cap if you were eligible for workers’ compensation payments during this period.

Here’s the breakdown of workers’ compensation weekly payouts based on different time periods and work capacities.

| Weeks After Illness or Injury | Work Capacity | Workers’ Compensation Weekly Payments |

| 0-13 | Up to 95% of pre-accident earnings | |

| 14-130 | None | Up to 80% of pre-accident earnings |

| 14-130 | Some | Up to 80% of pre-accident earnings (payments increase to 95% if you were working 15 hours per week and earning at least $202 per week) |

| 131-260 | None | Up to 80% of pre-accident earnings |

| 131-260 | Some | Weekly benefits stop for most, but some exceptions apply |

| After 5 years | Weekly payments are provided if your injuries are assessed as having a significant impact, typically greater than 20%, on your ability to work or perform daily tasks |

What Is the Maximum Permanent Impairment Lump Sum Payout?

The maximum permanent impairment lump sum workers’ compensation settlement for injuries received on and after 5 August 2015, resulting in a 75-100% degree of permanent impairment, is $713,660.

This figure is in effect from July 2023 to June 2024.

How Long Can You Receive Weekly Compensation Payments?

You can receive weekly compensation payments

- Until you receive a work injury damages payout.

- Until your ability to work full-time is restored.

- For five years, unless your permanent impairment is assessed to have more than a 20% impact on your ability to work or perform daily tasks.

- Until reaching the maximum weekly compensation amount.

- Until reaching retirement age (in some cases, weekly payments may continue for 12 months after your retirement date)

How Are Compensation Settlements Calculated?

Compensation settlements are typically calculated by

- Getting an expert medical assessment to determine the extent of the illness or injury and its long-term effects on the worker’s health and well-being.

- Determining the amount of lost earnings due to the illness or injury, including any time off work for medical treatment or recovery.

- Assessing the impact of the injury on the worker’s future earning potential, such as reduced work capacity or limitations on job opportunities.

Embark on Your Path to Recovery

We hope this workers’ compensation payout guide for NSW employees has helped you understand what you’re entitled to if you suffer from a work-related illness or injury.

Falling ill or being injured from work is obviously extremely stressful.

You have to deal with pain, recovery, medical appointments, and financial uncertainty, affecting not just you but also your family.

You should have peace of mind knowing your medical bills are covered and your lost wages are compensated- without the added stress of dealing with paperwork and legalities.

Let Pherrus Financial Services handle the complexities of your workers’ compensation claim while you focus on getting better.

Our team of professionals will guide you every step of the way to help you receive the compensation you rightfully deserve and make the process as smooth and convenient as possible.

Contact Pherrus today to experience the confidence that comes with expert financial advice and support.

Fill out our online form or call +61 (02) 9099 9109 to book an appointment at our Bella Vista office in Sydney, NSW.