The ins and outs of running a brand-new business can be an uphill challenge, and grappling with finances is one of the first things on your plate as a business owner.

Understanding money is crucial to keep your business ticking over from budgets to funding.

As you bring in employees and grow your business, payroll should be top of your list to make sure everything runs like clockwork.

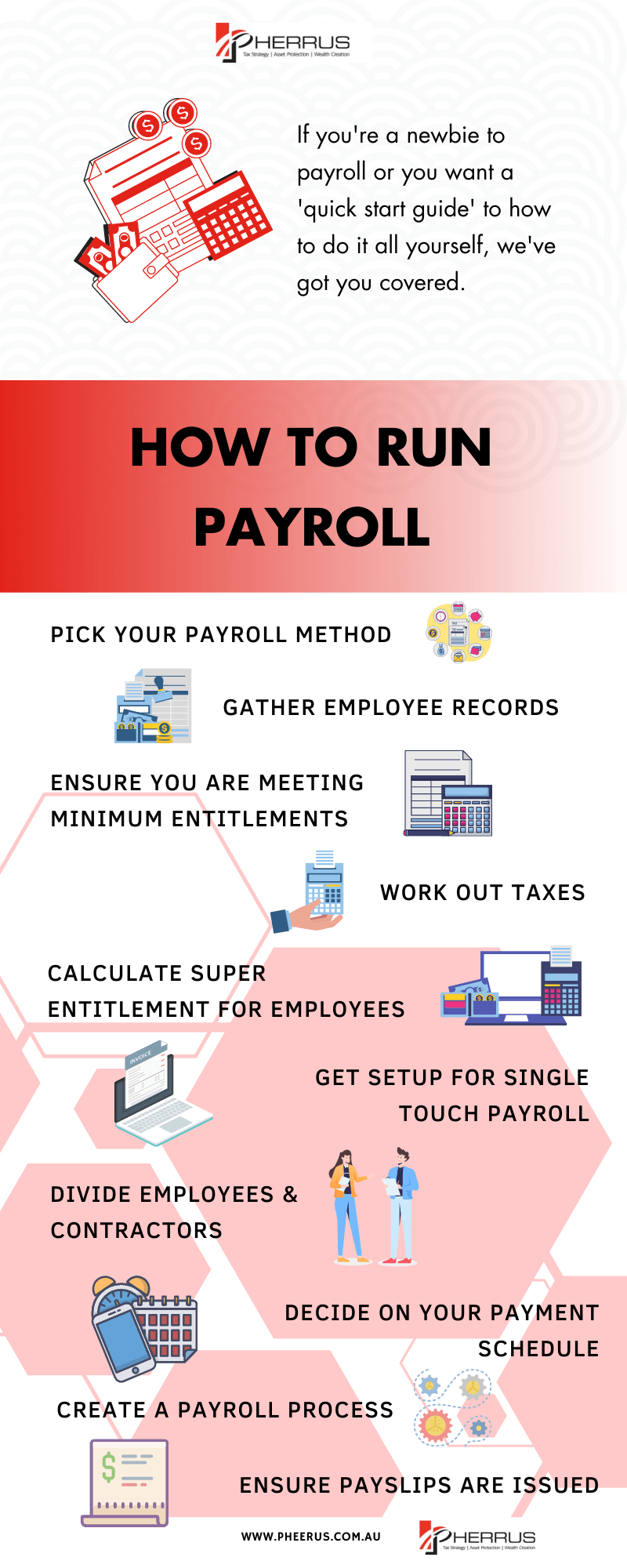

If you’re a newbie to payroll or you want a ‘quick start guide’ to how to do it all yourself, we’ve got you covered.

Payroll doesn’t have to be a steep learning curve with the right resources and knowledge in place from day one.

Read on for a full checklist of everything you need to consider for paying your employees from start to finish:

Step 1: Pick Your Payroll Method

Before you can get into the finer details of how to handle payslips and taxes, your first stop should be figuring out how you’re going to do payroll in the first place and what different types of payroll methods there are.

As a small business, you have three options available to you: using a good old-fashioned spreadsheet, outsourcing to an expert service, or using dedicated online payroll software.

Once you’ve decided on the payroll method that works best, you’ll be in a good place to start planning how payroll will work for your company.

Your choice of payroll method will make a difference to what you need to handle for payroll.

For example, if you work with an outsourced payroll specialist, you won’t need to handle all the admin involved in payroll.

If you use dedicated payroll software, you may have some processes automated and completed for you.

If you’re planning to go old-school with pen and paper or a spreadsheet, however, you’ll need to account for every other step in the payroll process.

Step 2: Gather Employee Records

To complete payroll, you’ll need information on all your employees.

Typically, you can gather all the data you need for your records when you onboard a new employee, making it easier to have all the information ready to go in time for the next payroll period to roll around.

You need to ensure that the employee records are accurate from month to month.

For example, if an employee’s pay changes, you’ll need to make sure this is reflected accurately in their payroll.

At a minimum, you should have all of the following information ready to go for payroll:

- The full name and address of the employee

- Employee tax information

- The start date of the employee

- Their employment, whether it’s full-time, part-time, or casual

- Their salary or hourly wage with deductions

- Any allowances, bonuses or benefits the employee receives

- The employee’s super fund and amount

- The leave entitlements or holiday time for the employee

- Payment details for direct deposit payment

Step 3: Ensure You’re Meeting Minimum Entitlements

It’s important as an employer to ensure you’re meeting all the necessary minimum requirements when paying your employees.

These requirements are defined by Australian law, and you may face penalties or punishment if your payroll doesn’t reflect these specific entitlements.

You’ll need to consider the current national minimum wage and National Employment Standards, known as NES, when preparing your payroll.

In addition to these factors, you’ll also need to abide by the entitlements defined by the Fair Work Ombudsman under modern awards.

These outline specific minimum pay rates and conditions of employment across more than 100 different industries in Australia.

You’ll need to know which area your employees fall under and ensure their entitlements match each individually defined requirement.

Step 4: Work Out Taxes

If you’re a business owner, you’re likely already familiar with the ins and outs of business tax.

For each employee you have on staff, you’ll also need to figure out exactly how much tax is owed per payday to ensure you meet your PAYG withholding obligations.

This obligation is money you take out of the employee’s pay which is then paid to the ATO.

You’ll need to make sure your business is fully registered with the ATO before you begin paying employees.

In addition to taxes that you need to take from employees, you may also need to pay payroll taxes depending on which state and territory you are in.

It’s essential to research the specific tax requirements in your area, so you have a good overview of what you’ll need to account for and pay each year when tax season rolls around.

Step 5: Calculate Super Entitlement for Employees

As an Australian business, you have a legal obligation to offer eligible employees a choice of super fund for superannuation.

You should also identify a default fund you plan to use for employees that don’t have a preferred option.

Before you bring in any employees, you’ll need to have all this information and set up ready to go for their first payslip.

Superannuation is the money that businesses pay for eligible workers towards their retirement.

The minimum amount you must pay as a business is the super guarantee, which is 10% of the employee’s standard earnings.

Companies may use increased superannuation contributions as a bonus or incentive.

If you plan to offer this, you should use a calculator or tool to ensure the superannuation you pay is accurate each month.

Step 6: Get Set Up for Single Touch Payroll

Single Touch Payroll was introduced in 2018 and expanded to employers with less than 19 employees in 2019. Under STP, businesses are required to submit their tax and super information in real-time.

That means when you pay your employees, you’ll also need to provide that information to the ATO at the same time.

Most options for payroll software allow you to send reports quickly and easily to the ATO directly.

For businesses with less than four employees, where the use of an expensive or complex payroll system is required, there is the option for low-cost STP solutions.

These are options from providers that cost less than $10 and can be used alongside a more basic payroll system to ensure regular reporting.

As of this year, there is no exception for businesses of any shape and size not to use the STP system.

Step 7: Divide Employees and Contractors

If you hire both employees and contractors into your business, it’s crucial that you know the difference between the two and process them separately through your payroll system.

Different obligations are placed on your business for taxes and superannuation between contractors and employees.

Ensuring you classify each in the right way can help to prevent costly penalties from getting it wrong.

Step 8: Decide on your Payment Schedule

Once you’ve done all the groundwork, the next thing you’ll want to do is decide on when you want to pay your employees.

Looking at what other companies in your sector do can be a good indicator of what your employees may expect for payment.

Payment schedules generally fall into three different options: weekly, fortnightly, or monthly.

Once you’ve decided on your payment schedule, you need to ensure this is clearly stated to employees when onboarding them.

You’ll also want to set reminders, alerts or schedule recurring direct deposit payments for your payment schedule to ensure your employees are paid on time, every time.

If pay is variable, you should ensure you plan ahead of time to ensure everything is correct ahead of your set payday.

Step 9: Create a Payroll Process

Whether you plan to input information into payroll software or you’re using a manual spreadsheet to figure out how much your employees need to be paid, having a workflow in place is an excellent next step to setting yourself up for success.

Your payroll process may differ depending on your requirements.

Still, it’s good practice to set aside at least a few hours to a day before each payment period to input information, double-check payments and ensure everything is ready to go.

Your payroll process can also provide a guideline for employees to submit specific information to you.

For example, employees that work overtime may need to submit that overtime by the 25th of the month for it to be included in the pay they receive on the 28th.

This deadline method allows the payroll process to run far more smoothly, taking less time each month to complete.

Step 10: Ensure Payslips are Issued

You are required as an Australian business to provide your employees with a form of payslip that includes all of the specific information about their pay.

This slip should be issued within one working day of payday and can be either a hard copy or electronic form or both if necessary.

Payslips must include all of the following information:

- The name of the employee

- The employees ABN if they have one

- The date of payment

- Details of the pay period

- Gross and net payment

- Details of loading, bonuses allowances, and anything else relevant

- Rate or hourly pay or salary as applicable

- Any deductions

- The amount of superannuation contribution and details of the fund

Step 11: Keep All Records Up to Date

Once your first payroll has been completed, you’ve got the basics down.

But that doesn’t mean it’s time to relax and go with the flow quite yet. As an employer, you must keep up-to-date records for all of your employees.

These records must span a total of seven years, so even ex-employee information must be kept on file until you pass that specific deadline.

If you use payroll software or a spreadsheet, you’ll need to keep all of that information backed up and stored safely, according to privacy standards and data protection requirements.

If you work with an outsourced company, they may keep a backlog of records for you.

However, it’s also best practice to have a history of payroll stored safely within your business too.

Step 12: Double Check Every Time

The final step in setting up payroll: don’t be afraid the check, check, and check again.

As with any form of finance, payroll can be challenging to get your head around when you first start.

With penalties and employee satisfaction directly tied to you carrying out payroll successfully, it’s never a bad idea to double and triple-check that everything is correct and ready to go.

For the first few months with a new payroll system, try and set aside extra time a couple of days before payment is due to review everything.

The ATO has a range of tools and calculators to help you ensure your payroll is up to scratch.

Over time, the payroll process will become more natural, but it’s always worth taking a second look to ensure your payroll is completed correctly and on time every time.

FAQs About Running Payroll

Do you need to be qualified to run payroll?

No specific payroll 101 qualifications are required in Australia to run payroll for your business.

In fact, for many small companies, it doesn’t make sense to bring in a trained specialist for straightforward payroll that could be handled in-house or through small business payroll software.

However, that doesn’t mean payroll doesn’t require you to learn how to use specific systems and processes to carry it out successfully.

The benefit of working with an outsourced payroll specialist is that they have the experience and knowledge of handling payroll professionally.

The specialists provide your business with the service needed to take the responsibility off your hands.

If you don’t have the time to learn payroll within your company, working with a professional might be the right choice for you.

Is running payroll difficult?

The difficulty of payroll will depend on the size of your business and the complexity of your employees.

For example, a small business with two full-time employees would have a relatively straightforward payroll process month after month.

On the other hand, a business with dozens of seasonal employees, contractors and different employee setups may find it more challenging to handle the difference in payroll each month.

What happens if I don’t run payroll?

You are legally obligated to run payroll in Australia.

With the new Single Touch Payroll system in place, it is a requirement that your business submits payroll to the ATO in real-time month after month.

Failure to do so can lead to penalties and other severe problems for your business.

You should ensure your payroll is completed and submitted on time every month, not only for the stability of your business but to ensure your employees receive the money they are owed for the work they have completed.

How do I manually calculate payroll?

If you’d prefer to use traditional methods to figure out payroll, there are plenty of different calculators and tools available through the ATO and similar resources to support you.

If possible, using a payroll software system can reduce the time spent on manual calculations.

Working with a professional, outsourced service means you don’t need to do any of the accounting for payroll in-house, leaving the facts and figures in the hands of the professionals.

How do small businesses pay employees?

Small businesses typically pay employees through direct deposit, from a business bank account directly to their personal bank account.

While larger companies may have specific systems that automate these payments, smaller companies may need to go the extra step to set up recurring payments, making manual adjustments as and when needed to ensure payroll is correct month after month.

Download Your Free Payroll Checklist!

Ready to start with payroll 101?

Our quick and easy checklist is the ideal way to work through the payroll process from start to finish.

Download our checklist infographic here:

Summary

Whether you employ one person or one hundred, working with a payroll system can take a lot of time and effort to master.

Working with an outsourced, professional payroll service is one way to take the pressure off, providing your business with high-quality payroll solutions that don’t take you away from the day job.

At Pherrus, we specialist in payroll for businesses of all shapes and sizes.

If you want to standardise your finances and make payroll easy, we’re the best team for the job.

Get in touch with our team today to learn more about how we could help you.