Finding the right tax accountant can be more challenging than you might think.

While you may be tempted to go with the first name you find on your search engine results or the first company you come across, knowing how to find a good tax accountant is a skill of its own.

Pick well, and your tax accountant will ensure your finances and accounts are in order and ready to go when tax season rolls around.

Picky poorly, and you could end up with a tax accountant that doesn’t do their job properly, leaving you with fines and penalties to pay.

If you’re searching for how to find a tax accountant in Australia, we’re here to help.

If you want to choose the right tax accountant for your personal goals and requirements, we’ve covered everything you should know before.

Get started to learn how to find a tax accountant today:

Get Referrals from other businesses

A referral or reference from a friend or acquaintance can be an ideal way to find a trustworthy, professional accountant based on first-hand knowledge.

If you have a friend who is in a similar situation to you or you know someone who always has their finances in order in plenty of time for the end of the tax year, asking for their recommendation can be helpful.

Many accountants gain new customers on a word-of-mouth basis, particularly if the standard of their work is good.

When you receive a recommendation from someone you know for a particular accountant, you have a better idea of whether that tax accountant may suit you.

However, you should be wary of recommendations from people that haven’t used that accountant’s service – just because they are your partner’s sister’s best friend doesn’t mean that they will be the right accountant for you.

Tax Accountant Reviews

If you’re looking further afield for a tax accountant or there are no great recommendations to use from friends or family, looking at online reviews is an excellent next step.

Reviews and testimonials can give you a usually fair idea of the work an accountant has done for past clients.

This insight can give you a strong idea of whether or not an accountant is right for you.

Where to start with finding reviews?

If possible, use websites like Yelp to check for reviews of specific accountants to get a third-party idea of what they are like.

Local review platforms are also an excellent example of where to check for reviews.

Lastly, you can check the accountant’s website for direct testimonials and information.

Many accountants will connect up with review sites to give you an idea, but some will only list testimonials themselves.

If you can’t find any reviews on sites beyond the accountant’s own, this could be a sign that they are a newer or smaller business.

Do Your Own Tax Accountant Research

Taking the time to do your research is always a good idea when finding out more about local accountants.

Of course, you may have already used a platform like Google to search for reviews of specific accountants, but you can also look for tax accountants in your local area in general.

Search for ‘tax accountants near me’ or similar wording to find options for how to find a tax accountant.

Once you’ve carried out your online research, you can use the information on the sites your find to figure out which accountant you want to know more about.

Video testimonials, service pages and even about pages can provide good insight into the accountant service.

If you’ve chosen a few tax accountants that you like the sound of, the next step is an initial meeting, whether over the phone or in person.

This is your chance to get to know them a little better and ask a few questions, such as:

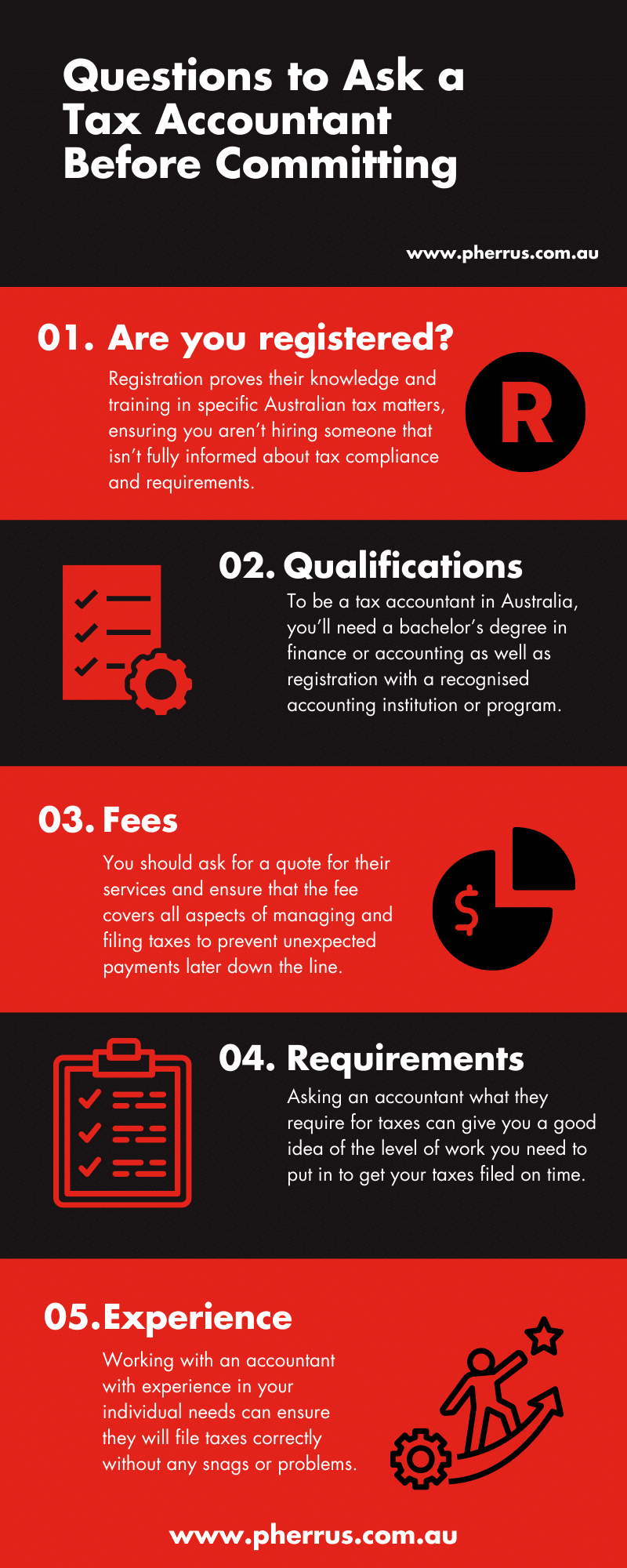

Questions to Ask a Tax Accountant Before Committing

Asking the right questions can make the process of how to find a tax accountant that’s right for you a far easier task.

Before you agree to anything, you should take the time to sit down – in person or virtually – with an accountant and ask a few questions.

Here are some of the queries you could consider:

Are you registered with the Tax Practitioners Board?

A legitimate tax accountant in Australia will be registered with the Tax Practitioners Board.

This registration proves their knowledge and training in specific Australian tax matters, ensuring you aren’t hiring someone that isn’t fully informed about tax compliance and requirements.

What qualifications do you have?

To be a tax accountant in Australia, you’ll need a bachelor’s degree in finance or accounting as well as registration with a recognised accounting institution or program.

Some tax accountants may also hold extra qualifications and training in specific areas of taxes, so it’s worth asking if you require specialised service.

What fees do you charge for filing my taxes?

As with any other financial arrangement, you don’t want to reach any agreements with an accountant without taking money.

You should ask for a quote for their services and ensure that the fee covers all aspects of managing and filing taxes to prevent unexpected payments later down the line.

What do you require of me to file my taxes?

Asking an accountant what they require for taxes can give you a good idea of the level of work you need to put in to get your taxes filed on time.

If you’re hiring an accountant for bookkeeping and tax accountancy, they may need access to more information and financial details.

Have you managed similar tax accounts before?

Every business and individual in Australia are required to file taxes, but the requirements and specifications will differ for many.

Working with an accountant with experience in your individual needs can ensure they will file taxes correctly without any snags or problems.

Summary

Finding a good tax accountant can make a real difference to tax season.

If you want to make filing your taxes as stress-free as possible, doing your research and asking the right questions can prevent tax time headaches before they happen.

A qualified, trained accountant will always make your taxes more manageable, so doing your due diligence is vital in finding the right one for your needs.

If you’re searching for a good personal tax accountant in Australia, Pherrus can help.

Our specialist team of tax accountants have the insight, expertise, and knowledge to support you year on year. Get in touch with us today to discuss your requirements and get to know us better.