Are you looking for answers to some of the top questions about filing tax returns in Australia?

This guide will provide you with the information you need to get your taxes lodged correctly.

We’ll cover how to do a tax return, how to lodge online, and other answers to some of the most common questions about filing taxes in Australia.

So let’s get started and get your taxes sorted.

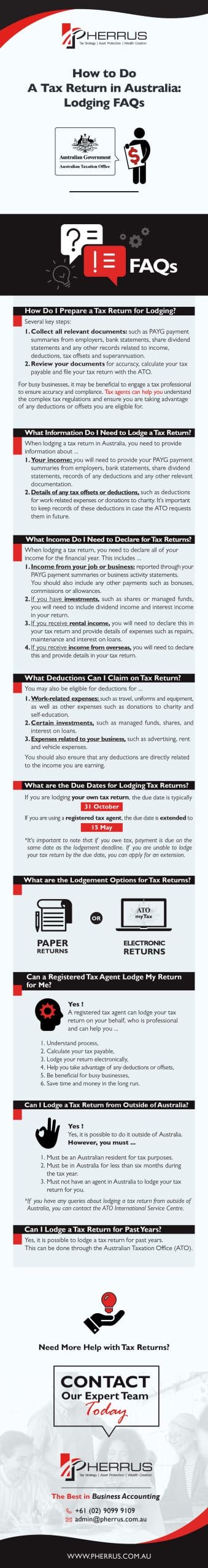

How Do I Prepare a Tax Return for Lodging

Tax returns are important documents that summarise your income, deductions and tax payable for a financial year.

When lodging your tax return in Australia, there are several key steps to take to ensure accuracy and compliance with Australian Taxation Office (ATO) regulations.

Firstly, you’ll need to collect all relevant documents such as PAYG payment summaries from employers, bank statements, share dividend statements and any other records related to income, deductions, tax offsets and superannuation.

You’ll then need to review your documents for accuracy, calculate your tax payable and file your tax return with the ATO.

The exact filing process will depend on whether you are lodging online or via a paper return.

For busy businesses, it may be beneficial to engage a tax professional to ensure accuracy and compliance.

Tax agents can help you understand the complex tax regulations and ensure you are taking advantage of any deductions or offsets you are eligible for.

No matter how you do a tax return, it’s important to keep copies of all your documents for your records.

It’s also important to ensure you meet your lodgement and payment deadlines.

What Information Do I Need to Lodge a Tax Return?

When lodging a tax return in Australia, you need to provide information about your income, deductions, tax offsets and superannuation.

To ensure accuracy and compliance with ATO regulations, it’s important to have the right documentation to hand.

You will need to provide your PAYG payment summaries from employers, bank statements, share dividend statements, records of any deductions and any other relevant documentation.

You’ll also need to provide details of any tax offsets or deductions you are eligible for, such as deductions for work-related expenses or donations to charity. It’s important to keep records of these deductions in case the ATO requests them in future.

If you are lodging a paper return, you’ll need to fill in a tax return form.

The ATO website has a range of tax return forms available for download.

Alternatively, if you are lodging electronically, the process is much simpler.

You can use myTax, a free service offered by the ATO which allows you to lodge your return online.

What Income Do I Need to Declare for Tax Returns?

When lodging a tax return, you need to declare all of your income for the financial year.

This includes income from full-time or part-time employment, business activities, investments and rental properties.

Income from your job or business should be reported through your PAYG payment summaries or business activity statements.

You should also include any other payments such as bonuses, commissions or allowances.

If you have investments such as shares or managed funds, you will need to include dividend income and interest income in your return.

If you receive rental income, you will need to declare this in your tax return and provide details of expenses such as repairs, maintenance and interest on loans.

If you receive income from overseas, you will need to declare this and provide details in your tax return.

What Deductions Can I Claim on Tax Return?

When lodging your tax return, you may be eligible to claim deductions for certain expenses. These deductions will reduce your taxable income, meaning you may pay less tax.

You can claim deductions for work-related expenses such as travel, uniforms and equipment, as well as other expenses such as donations to charity and self-education.

You may also be eligible for deductions for certain investments such as managed funds, shares, and interest on loans.

If you are self-employed, you may be able to claim deductions for expenses related to your business such as advertising, rent and vehicle expenses.

It’s important to keep records of all deductions, as the ATO may request them in future.

You should also ensure that any deductions are directly related to the income you are earning.

What are the Due Dates for Lodging Tax Returns?

The due date for lodging a tax return in Australia depends on whether you are lodging yourself or with the help of a tax agent.

If you are lodging your own tax return, the due date is typically 31 October. However, if you are using a registered tax agent, the due date is extended to 15 May.

It’s important to note that if you owe tax, payment is due on the same date as the lodgement deadline. If you are unable to lodge your tax return by the due date, you can apply for an extension.

The ATO will consider your request and may grant an extension, depending on the circumstances.

It’s also important to note that if you are lodging a tax return late, you may be liable for interest and penalty charges.

For more information on lodgement due dates and extensions, you can visit the ATO website.

Professional tax advice can also be beneficial for busy businesses who want to ensure their tax return is lodged on time.

What are the Lodgement Options for Tax Returns?

When lodging a tax return, there are two main lodgement options available: paper returns and electronic returns.

Paper returns are typically used for individuals and small businesses who don’t have complex tax affairs. You can download a tax return form from the ATO website, fill it in, and mail it back to the ATO.

Alternatively, you can lodge your tax return electronically.

The ATO offers a free online service called myTax which allows you to lodge your return online.

This is a convenient option for busy businesses and individuals.

If you use a registered tax agent to lodge your tax return, they will typically use electronic lodgement.

Can a Registered Tax Agent Lodge My Return for Me?

Yes, a registered tax agent can lodge your tax return on your behalf.

A tax agent is a professional who is registered with the Tax Practitioners Board and has the expertise to help you understand complex tax regulations.

Tax agents can help you understand the tax return process, calculate your tax payable and lodge your return electronically.

They can also help you take advantage of any deductions or offsets you are eligible for.

Engaging a tax agent can be beneficial for busy businesses that want to ensure accuracy and compliance with ATO regulations.

It can also help to save time and money in the long run.

The ATO website provides a list of registered tax agents for you to choose from.

When using a registered tax agent to lodge your return, the due date is extended from 31 October to 15 May.

It’s important to note that if you owe tax, payment is due on the same date as the lodgement deadline.

Can I Lodge a Tax Return from Outside of Australia?

Yes, it is possible to lodge a tax return from outside of Australia.

However, you must meet certain eligibility requirements.

First, you must be an Australian resident for tax purposes.

Second, you must be in Australia for less than six months during the tax year.

Third, you must not have an agent in Australia to lodge your tax return for you.

You can lodge your tax return from overseas using either myTax or a paper tax return. Before you lodge, you will need to fill out the Overseas Lodgment Declaration form.

This form is available on the ATO website.

If you are lodging a paper tax return, you need to mail it to the ATO International Service Centre.

You can also lodge your tax return online through ATO’s online services.

If you have any queries about lodging a tax return from outside of Australia, you can contact the ATO International Service Centre.

Can I Lodge a Tax Return for Past Years?

Yes, it is possible to lodge a tax return for past years.

This can be done through the Australian Taxation Office (ATO).

You may need to lodge a return for past years if you have not lodged one before, or if you may be entitled to a refund or need to pay additional tax.

To lodge a past year tax return, you need to complete the relevant tax return form and provide all the information required.

Depending on the year you are lodging for, you may need to complete a paper form or an online form.

You can also check your eligibility for past year refunds or payments on the ATO website.

The ATO also provides useful information on how to lodge a prior-year tax return.

If you are in doubt about whether you should lodge a prior-year tax return, you should seek advice from a tax professional or contact the ATO.

The ATO can provide advice on the best way to lodge a prior-year tax return.

What should I Do if I Don’t Need to Lodge a Tax Return?

If you do not need to lodge a tax return, you should still keep records of your income and expenses.

This is so that you can prove your income and tax deductions if necessary.

If the ATO does not expect you to lodge a tax return, you should notify them by lodging non-lodgement advice.

This is a form that you can complete online or via a paper form.

If you do not need to lodge a tax return for the current year, you should also lodge a non-lodgment advice for any preceding years where you have not lodged a tax return.

This is to ensure that you are not charged a penalty for failure to lodge.

You should also keep any documents that may be relevant to your tax affairs, such as payslips and bank statements, for five years.

This is in case the ATO requests them in the future.

Finally, it is a good idea to check your eligibility for any tax offsets or entitlements that you may be eligible for.

This can help to reduce your tax liability and ensure that you are not overpaying tax.

Need More Help with Tax Returns?

If you require further help and assistance with your tax return, contact our expert team today : https://www.pherrus.com.au/contact-us/