Do you have dreams of expanding your business?

Successful expansion often comes down to securing the right financial support via a business loan.

A business loan can also help you manage cash flow, invest in necessary equipment or inventory, and employ additional team members.

In this guide, you’ll find straightforward, actionable steps to light the path to loan approval.

You’ll learn what’s required, how long the process typically takes, and valuable strategies to boost your chances of success.

The world of business doesn’t wait, and neither should you!

So let’s find out how to apply for a business loan.

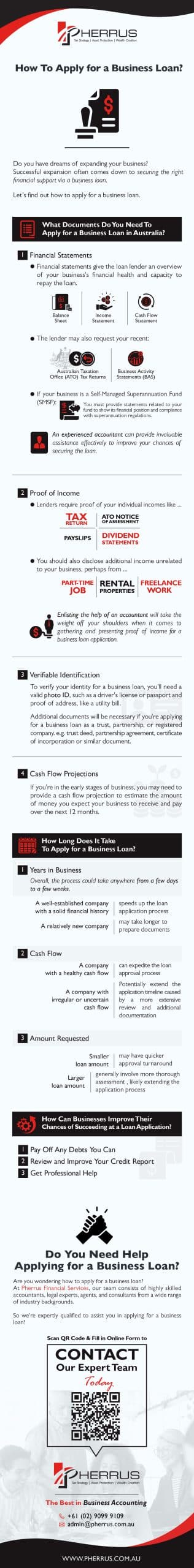

What Documents Do You Need To Apply for a Business Loan in Australia?

Financial Statements

Financial statements give the loan lender an overview of your business’s financial health and capacity to repay the loan.

What financial statements are required?

- Balance sheet: This shows what your company owns (assets), what it owes (liabilities), and what’s left over for you as the owner (owner’s equity).

- Income statement: This reports your company’s financial performance over a specific period, summarising its revenues, costs, and expenses leading to the net income or net loss.

- Cash flow statement: This statement shows how changes in the balance sheet and income statement affect cash and cash equivalents, breaking the analysis down to operating, investing, and financing activities.

The lender may also request your recent Australian Taxation Office (ATO) tax returns and Business Activity Statements (BAS).

A BAS is a form submitted to the ATO by businesses registered for GST to report their taxation obligations, including pay as you go (PAYG) instalments and withholding.

If your business is a Self-Managed Superannuation Fund (SMSF), you must provide statements related to your fund to show its financial position and compliance with superannuation regulations.

An experienced accountant can provide invaluable assistance in preparing your financial statements for a business loan application, ensuring the data is accurate and presented effectively to improve your chances of securing the loan.

Proof of Income

Lenders require proof of your individual income as a director or shareholder of a company in the form of tax returns, an ATO Notice of Assessment, payslips, or dividend statements.

You should also disclose additional income unrelated to your business, perhaps from a part-time job, rental properties, or freelance work.

Providing this information allows lenders to gauge your personal financial stability and assess your ability to manage loan repayments, particularly if your business faces unexpected difficulties.

You’re undoubtedly busy running your business.

Enlisting the help of an accountant will take the weight off your shoulders when it comes to gathering and presenting proof of income for a business loan application.

Verifiable Identification

To verify your identity for a business loan, you’ll need a valid photo ID, such as a driver’s license or passport and proof of address, like a utility bill.

Additional documents will be necessary to verify your business’s legal existence and structure if you’re applying for a business loan as a trust, partnership, or registered company.

For a trust, you’ll need a copy of your trust deed.

A copy of your partnership agreement will be required if you’re a partner.

And for a registered company, lenders usually request a copy of your certificate of incorporation or similar document confirming your company’s registration.

Cash Flow Projections

If you’re in the early stages of business, you may need to provide a cash flow projection to estimate the amount of money you expect your business to receive and pay over the next 12 months.

This projection offers insights into your business’s potential profitability and loan repayment ability.

An accountant can prepare a realistic, well-reasoned cash flow projection and present it in a way that enhances your credibility with lenders.

How Long Does It Take To Apply for a Business Loan?

The time it takes to apply for a business loan can vary widely based on several factors.

Years in Business

If your company is well-established with a solid financial history and you have all the required documents, this could speed up the loan application process.

However, if your company is relatively new, it may take longer as you’ll need to prepare additional documents like a business plan and cash flow projections.

Overall, the process could take anywhere from a few days to a few weeks.

Cash Flow

If you have a healthy cash flow that’s well-documented, this can expedite the loan approval process as it reassures lenders of your capacity to repay the loan.

On the other hand, if your cash flow is irregular or uncertain, a more extensive review and additional documentation may be required, potentially extending the application timeline.

Amount Requested

Smaller loan amounts may have a quicker approval turnaround as they involve less comprehensive evaluation and require fewer supporting documents.

Larger loan amounts generally involve more scrutiny and a more thorough assessment of your financials and business plan, likely extending the application process.

How Can Businesses Improve Their Chances of Succeeding at a Loan Application?

Pay Off Any Debts You Can

You can increase your chances of success in a loan application by paying off existing debts whenever possible.

By reducing your overall debt burden, you demonstrate financial responsibility and improve your debt-to-income ratio, making your business more attractive to lenders.

An accountant can assist by identifying areas for debt reduction and developing a repayment strategy that aligns with the loan application process.

Review and Improve Your Credit Report

Your credit report provides a comprehensive overview of your financial history, including credit accounts, repayment history, and outstanding debts.

You can obtain a free copy of your credit report from credit reporting agencies such as Equifax, Experian, or Illion once a year.

An accountant can review your credit report, identify areas for improvement, and recommend strategies to enhance your creditworthiness, ultimately bolstering your chances of securing the loan you need.

Get Professional Help

To improve your chances of succeeding at a loan application, seeking professional help from an accountant is highly beneficial.

The right accountant can provide expert assistance in analysing your business’s financial health, preparing your financial statements, and presenting your documentation clearly and compellingly to a lender.

Do You Need Help Applying for a Business Loan?

Are you wondering how to apply for a business loan?

At Pherrus Financial Services, our team consists of highly skilled accountants, legal experts, agents, and consultants from a wide range of industry backgrounds.

So we’re expertly qualified to assist you in applying for a business loan!

Let us take the stress out of the application process and help turn your business expansion dream into reality.

Fill in our online form, and we’ll be in touch shortly.

Alternatively, call us on +61 (02) 9099 9109 to book an appointment at our Bella Vista office in Sydney, NSW.