Attention homeowners and investors in Australia! Property tax might not be the most exciting topic, but it’s one you can’t afford to ignore!

So, we’ve put together this guide to cover the essentials of calculating Australian property tax rates in a way that’s easy to understand.

With our expertise, navigating property tax becomes less of a chore and more of an opportunity to enhance your financial strategy.

But first things first. Let’s make sure you fully understand what property tax is before answering the question, “How much property tax will I pay?”

What Is Property Tax in Australia?

In Australia, what’s commonly referred to as “property tax” is a range of taxes and charges related to property ownership.

- Land tax: A tax applied on the value of investment and commercial property land you own, separate from the structures on it. Each state has different thresholds and rates for land tax, and properties below a certain value may be exempt.

- Stamp duty: Also known as “transfer duty”, this tax applies to a property’s price or market value when you purchase it. Different rates may apply for residential, commercial, or investment properties, with each state and territory having its own stamp duty rates and rules. Additionally, first-home buyers, pensioners, and other groups may be eligible for concessions or exemptions.

- Capital Gains Tax (CGT): This is not a separate tax but part of your income tax. It’s applied to the capital gain (the difference between the sale and purchase price after accounting for expenses and concessions) from selling an investment property. Properties held by individuals for over 12 months generally qualify for a 50% CGT discount.

- Council rates: This form of property tax is levied by local councils on residential and commercial properties, depending on the property’s value. Rates vary between councils.

Property Tax in Different Australian States

Property tax in Australia varies from state to state, with each having its own exemptions, concessions, and thresholds impacting the amount of tax payable.

- New South Wales: First-home buyers are exempt from transfer duty on new or existing homes they purchase valued up to a certain amount. Regarding land tax, this is charged on properties above a certain threshold, excluding the primary residence.

- Victoria: Similar land tax structure to NSW with varying rates based on the property’s value. Stamp duty is also a significant cost when purchasing property.

- Queensland: Known for relatively lower stamp duty rates than NSW and Victoria. Land tax applies to properties over a certain value, excluding the primary residence.

- Western Australia: Stamp duty rates here are among the highest, but the land tax is only on properties above a specific value.

- South Australia: Similar to Western Australia regarding stamp duty but with a different land tax structure, where rates increase progressively based on land value.

- Tasmania: Lower stamp duty rates and a progressive land tax system based on the value of the land.

- ACT: Phasing out stamp duty in favour of a broad-based land tax, which applies to all property owners.

- Northern Territory: Generally has lower stamp duty rates and no land tax. The NT has a unique Property Activation Levy imposed on unoccupied properties to encourage their development or occupancy.

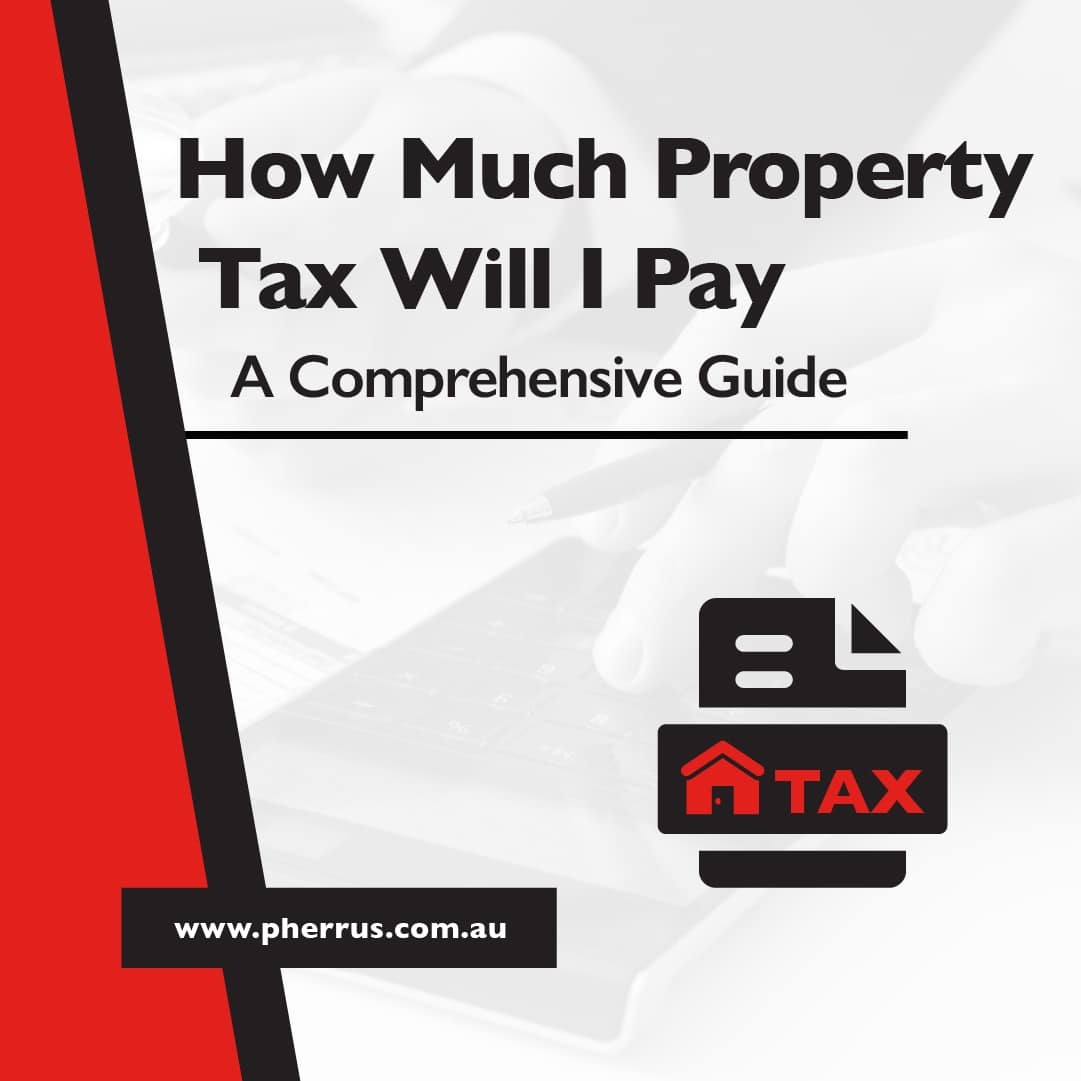

How To Calculate Your Property Tax

Property tax calculations in Australia vary by state and tax type. Below is a general guide with some examples.

Property Tax for Sydney Homeowners

Under the First Home Buyer Choice Scheme, first-home buyers in NSW could pay either stamp duty, a significant upfront cost, or a smaller annual property tax for certain home or land purchases between November 11, 2022, and June 30, 2023.

If you chose to pay the annual property tax, you’ll pay it for as long as you own the home you bought under the scheme.

However! On July 1, 2023, the First Home Buyer Choice Scheme was replaced by the First Home Buyers Assistance Scheme.

Now, eligible first-home buyers are exempt from transfer duty (stamp duty) on new or existing homes they purchase valued up to $800,000.

Homes over $800,000 and less than $1,000,000 may qualify for a concessional rate.

You also won’t have to pay transfer duty if you buy vacant land you intend to build a house on for $350,000 or less.

If the land costs between $350,000 and $450,000, you’ll pay transfer duty at a reduced rate.

To qualify for this scheme, you must start living in the property within 12 months of buying or building it and stay there for at least a year.

Land Tax Calculation

In Victoria, land tax is calculated based on the total value of all taxable land you own, excluding your primary residence.

Effective from January 1, 2024, the general land tax rates in Victoria are as follows:

| Total taxable value of land | Land tax payable |

| $50,000 – $100,000 | $500 |

| $100,000 – $300,000 | $975 |

| $300,000 – $600,000 | $1,350 plus 0.3% on the value that exceeds $300,000 |

| $600,000 – $1,000,000 | $2,250 plus 0.6% on the value that exceeds $600,000 |

| $1,000,000 – $1,800,000 | $4,650 plus 0.9% on the value that exceeds $1,000,000 |

Example: Suppose you own land worth $500,000. The first $50,000 is tax-free.

Here’s how to calculate the land tax on the remaining $450,000:

- 0.3% of $150,000 (the amount over $300,000) = $450

- $450 + $1,350 fixed rate = $1,800 land tax

Stamp Duty Calculation

In Queensland, stamp duty is calculated based on a property’s purchase price or market value, whichever is higher.

The first $5,000 is tax-free, and then on the remaining property value, the tax calculation follows a sliding scale of rates for different portions of the property value, with the rates increasing as the property value increases.

Rates may vary for different properties (e.g., residential, investment) and buyers (e.g., first-home buyers may be eligible for concessions).

A lower, special rate is applied for the first $350,000 of a residential property’s value, and standard transfer duty rates are used for the remaining value.

The 2023 general stamp duty rates in Queensland are as follows:

| Property value | Stamp duty payable |

| $5,001 – $75,000 | $1.50 for each $100, or part of $100, over $5,000 |

| $75,001 – $540,000 | $1,050, plus $3.50 for each $100, or part of $100, over $75,000 |

| $540,001 – $1,000,000 | $17,325, plus $4.50 for each $100, or part of $100, over $540,000 |

| $1,000,001+ | $38,025, plus $5.75 for each $100, or part of $100, over $1,000,000 |

Example: If you buy a $750,000 property, you must pay stamp duty on $745,000.

To determine how much you owe, you could tackle the math yourself or use a handy stamp duty calculator!

This calculator will tell you the stamp duty on your $750,000 property will be $26,775.

Capital Gains Tax

CGT is calculated based on the profit (capital gain) you make from selling a property.

The ATO administers this tax Australia-wide.

If you’ve owned the property for over 12 months, you may be eligible for a 50% discount on the capital gain.

The taxable capital gain (after any discounts) is added to your income for the year and taxed at your marginal tax rate.

If you need to know, “How much Capital Gains Tax will I pay on property?” the following example can help.

Example: If you bought a property for $600,000 and sold it over 12 months later for $800,000, your capital gain is $200,000.

You’re eligible for the 50% discount, so the taxable capital gain reduces to $100,000.

This $100,000 is then added to your other income for the year and taxed according to your income tax bracket.

Property Tax Management Strategies

Effectively managing property tax is crucial for maximising your property investment and staying financially healthy.

Here are some strategies to help.

- Stay informed about tax laws. Australian property tax rates and laws can change, so keep up-to-date with any changes in your state or territory to avoid surprises.

- Understand your tax obligations. Know which property taxes apply to you and the due dates for each to avoid penalties.

- Maintain accurate records. Keep detailed records of all transactions, improvements, and expenses related to your property for accurate property tax calculations and claims.

- Plan for tax payments. Set aside funds regularly to cover your tax obligations, perhaps in a dedicated savings account.

- Consider timing in property transactions. The timing of buying or selling property can impact your tax liabilities (especially CGT), so plan your transactions strategically.

- Get regular property valuations. Ensure your property is valued correctly for tax purposes, as overvaluation can lead to higher tax liabilities.

- Leverage technology. Use software or apps designed for property tax management to track expenses, calculate taxes, and stay altogether organised.

- Stay proactive. Anticipate potential tax changes in your circumstances and plan accordingly to help save money and stress in the long run.

- Seek professional advice. Tax consultants, like those at Pherrus Financial Services, offer personalised advice based on your situation and financial goals. We’ll identify legal strategies to minimise your tax liabilities, such as taking advantage of exemptions or deductions.

FAQs About How Much Property Tax To Pay

Who Is Exempt From Paying Property Taxes?

Exemptions from property taxes such as land tax and council rates vary by state and territory but generally include

- Owner-occupied homes.

- Certain charities and non-profit organisations.

- Land used for agricultural production.

Do Australians Pay Property Taxes Yearly?

Australian property owners typically pay property taxes, like council rates, every year.

Land tax on the total value of all taxable land you own, excluding your principal residence, is also an annual obligation.

First home buyers in NSW who chose to pay the annual property tax instead of stamp duty under the now-replaced First Home Buyer Choice scheme must still pay this tax yearly for as long as they own the home bought under the scheme.

How Can I Reduce My Property Tax?

Regularly check your property valuation for accuracy, apply for any available exemptions or concessions (like those for pensioners or low-income earners), and efficiently manage your property to ensure it’s classified correctly (e.g., as your primary residence).

Additionally, consult a tax professional for help on how to reduce property tax based on your circumstances.

Maximise Your Financial Freedom With Pherrus Financial Services

Understanding and effectively managing your property taxes is a crucial step towards financial freedom.

You can reduce unnecessary expenses, plan better for your future, and make more informed investment decisions.

Are you wondering, “How much property tax will I pay?” You need to speak to the expert tax consultants here at Pherrus!

We’ll use our financial and taxation expertise to explore property tax minimisation and compliance strategies to contribute to your financial well-being.

To discover how our range of financial services can benefit you, fill out our online form or call +61 (02) 9099 9109 to book an appointment at our Bella Vista office in Sydney, NSW.