Property tax can seem confusing, but it’s not impossible to understand. In this blog post, we provide tips on how you can understand these numbers across different states and properties, but it’s worth noting that other factors can sometimes impact these calculations.

Property tax rates in Australia for land tax

There are four main types of property tax, including general, trust surcharge, general with absentee owner surcharge, and trust surcharge with absentee surcharge.

Their 2022 land tax year rates are as follows:

Land tax general rates

< $300,000 Nil

$300,000 to < $6,000,000 – $375 and 0.2% of the amount over $300,000

$300,000,000+$27,975 and 2.55% of the amount over $3,000,000

Land tax trust surcharge rates

< $25,000 Nil

$25,000 to < $250,000 – $82 and 0.375% of the amount over $25,000

$300,000,000+ $27,975 and 2.55% of the amount above $3,000,000.

The surcharge rate is identical to the general rate.

Land tax general rates with absentee owner surcharge

< $300,000 Nil

$300,000 to < $6,000,000 – $6,375 and 2.2% of the amount over $300,000

$300,000,000+ $87,975 and 4.55% of the amount over $3,000,000

Land tax trust surcharge rates with absentee owner surcharge

< $25,000 Nil

$25,000 to < $250,000 – $582 and 2.375% of the amount over $25,000

$300,000,000+ $87,975 and 4.55% of the amount over $3,000,000

Historical rates of land tax

Knowing how land tax has evolved can help you see how it could change in the future, and some situations still involve previous rates.

As the dollar fluctuates, taxation shifts to accommodate this.

For example, land tax general rates with absentee owner surcharges can sometimes be triple their value today compared to in 2016.

These values change all the time, making it essential that you try to keep up with their current rates – with an awareness of their previous values.

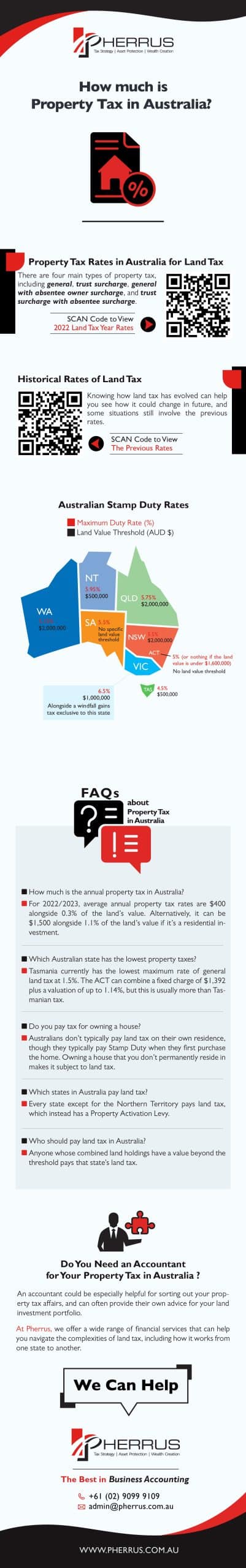

Australian Stamp Duty rates

Australian state governments levy stamp duties on people who buy properties, with this forming a significant part of any real estate transaction within the country.

One factor in determining the stamp duty rate is the state’s land value threshold, the value where land and stamp duties begin to apply. Some properties also incur a surcharge of 7-8% if the buyer is from outside the country.

• The Northern Territory has a maximum duty rate of 5.95% and a land value threshold of $500,000.

• Queensland has a maximum duty rate of 5.75% and a land value threshold of $2,000,000.

• Western Australia has a maximum duty rate of 5.15% and a land value threshold of $2,000,000.

• South Australia has a maximum duty rate of 5.5% and no specific land value threshold.

• New South Wales has a maximum duty rate of 5.5% and a land value threshold of $2,000,000.

• The ACT has a maximum duty rate of 5% (or nothing if the land value is under $1,600,000) and no land value threshold.

• Victoria has a maximum duty rate of 6.5% and a land value threshold of $1,000,000, alongside a windfall gains tax exclusive to this state.

• Tasmania has a maximum duty rate of 4.5% and a land value threshold of $500,000.

FAQs about property tax in Australia

Here are the answers to some questions you might have about Australian property taxes:

How much is the annual property tax in Australia?

For 2022/2023, average annual property tax rates are $400 alongside 0.3% of the land’s value. Alternatively, it can be $1,500 alongside 1.1% of the land’s value if it’s a residential investment.

Which Australian state has the lowest property taxes?

Tasmania currently has the lowest maximum rate of general land tax at 1.5%. The ACT can combine a fixed charge of $1,392 plus a valuation of up to 1.14%, but this is usually more than Tasmanian tax.

Do you pay tax for owning a house?

Australians don’t typically pay land tax on their own residence, though they typically pay Stamp Duty when they first purchase a home. Owning a house that you don’t permanently reside in makes it subject to land tax.

Which states in Australia pay land tax?

Every state except the Northern Territory pays land tax, which instead has a Property Activation Levy.

Who should pay land tax in Australia?

Anyone whose combined land holdings have a value beyond the threshold pays that state’s land tax.

Do you need an accountant for your property tax in Australia?

An accountant can be especially helpful in sorting out your property tax affairs, and can often provide their own advice for your land investment portfolio.

At Pherrus, we offer a wide range of financial services that can help you navigate the complexities of land tax, including how it works from one state to another.

Contact us today so we can help you with your land tax needs.