Fringe Benefits Tax (FBT) is tax employers must pay on non-cash benefits provided to their employees, their families, or associates.

Reportable fringe benefits include company cars, low-interest loans, private health insurance, and entertainment expenses.

Are you an employee or employer in Australia wondering- how does fringe benefits tax work? Read on for more information.

How Do Fringe Benefits Taxes Affect Me?

As an employer, fringe benefits taxes affect you if you provide non-cash benefits to your employees or their associates, as you must pay FBT on the grossed-up value of these benefits.

FBT can impact your business finances and cash flow, as it’s an additional tax expense on top of other payroll taxes.

However, exemptions and concessions are available for certain fringe benefits.

How do fringe benefits affect employees? Your employer may offer fringe benefits via salary sacrifice as part of a salary packaging plan.

Such benefits could potentially lower your tax bracket based on your circumstances, which is ideal if you’re a high-income earner.

Your salary or wages could also be affected, as your employer may reduce them to offset the cost of providing fringe benefits and paying FBT.

However, FBT does not directly impact your personal income tax obligations.

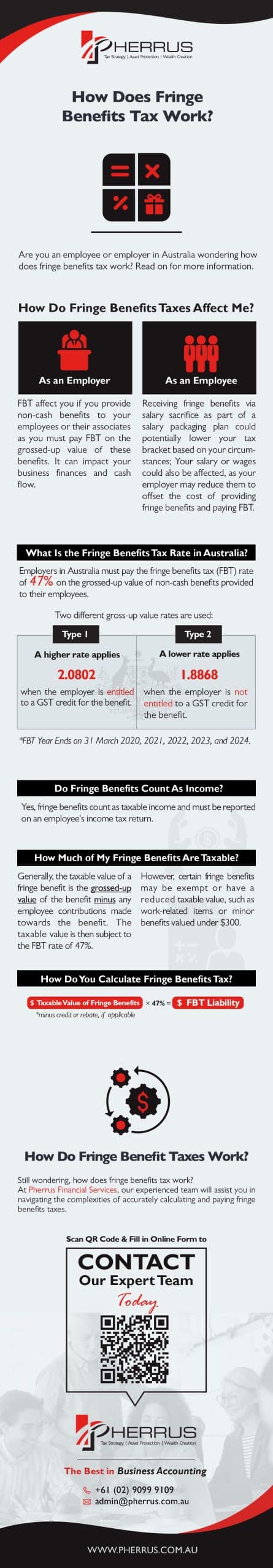

What Is the Fringe Benefits Tax Rate in Australia?

Employers in Australia must pay the fringe benefits tax (FBT) rate of 47% on the grossed-up value of non-cash benefits provided to their employees.

Grossed-up value refers to the total value of a fringe benefit provided to your employee, including any tax your employee would have to pay if they received the benefit as part of their salary or wages.

Two different gross-up value rates are used to calculate the taxable value of reportable fringe benefits.

- Type 1 higher gross-up rate applies when the employer is entitled to a GST credit for the benefit, such as when providing goods or services to employees for work-related purposes.

- Type 2 lower gross-up rate applies when the employer is not entitled to a GST credit for the benefit, such as when providing entertainment or other non-work-related benefits to employees.

The FBT rates are as follows.

| Gross-Up Type | FBT Year | FBT Rate | Gross-Up Rate |

| Type 1 | Ending 31 March 2020, 2021, 2022, 2023, and 2024 | 47% | 2.0802 |

| Type 2 | Ending 31 March 2020, 2021, 2022, 2023, and 2024 | 47% | 1.8868 |

Do Fringe Benefits Count As Income?

Yes, fringe benefits count as taxable income and must be reported on an employee’s income tax return.

The grossed-up value of the fringe benefit is included as assessable income and is subject to marginal tax rates.

Payroll tax applies to all taxable fringe benefits that fall under the Fringe Benefits Tax Assessment Act 1986.

However, any fringe benefit that is exempt or has no value is not subject to payroll tax.

How Much of My Fringe Benefits Are Taxable?

Generally, the taxable value of a fringe benefit is the grossed-up value of the benefit minus any employee contributions made towards the benefit.

The taxable value is then subject to the FBT rate of 47%.

However, certain fringe benefits may be exempt or have a reduced taxable value, such as work-related items or minor benefits valued under $300.

How Do You Calculate Fringe Benefits Tax?

Calculate fringe benefits tax using this formula:

Taxable value of fringe benefits x 47% FBT rate (minus credit or rebate, if applicable) = FBT liability.

The taxable value of fringe benefits is the grossed-up value of the benefit.

Calculate this by multiplying the actual value of the benefit by a specific gross-up rate.

The gross-up rate varies depending on the type of benefit and your employee’s taxable income.

- The type 1 gross-up rate of 2.0802 applies to employers entitled to a GST credit for the benefit.

- The type 2 gross-up rate of 1.8868 applies to employers not entitled to a GST credit for the benefit.

How Do Fringe Benefit Taxes Work?

Still wondering, how does fringe benefits tax work?

At Pherrus Financial Services, our experienced team will assist you in navigating the complexities of accurately calculating and paying fringe benefits taxes.

Fill in our online form, and we’ll contact you shortly.

Alternatively, call us to book an appointment at our Bella Vista office in Sydney, NSW.