Whether it’s a “buy nine, get the 10th coffee free” deal, happy hour, or a 12-month gym membership for the price of 11, we all love a perk!

Fringe benefits are non-cash perks employers can offer sought-after prospective employees to make an employment position more desirable.

But, there’s a catch- the Fringe Benefits Tax (FBT).

While it’s employers who pay FBT, employees should still understand this tax.

Why? Because it can affect their overall compensation and tax situation and help them negotiate their salary packages more effectively.

We know the word “tax” can strike fear into the hearts of employers and employees alike, but never fear!

This guide is here to walk you through the essentials of the fringe benefits tax rate, from understanding different types of benefits to decoding the FBT calculation and shedding light on the rates and thresholds that come into play.

Then, you’ll be equipped to make the most of these benefits without getting caught off guard by the tax man.

The Different Types of Fringe Benefits

Employers can offer various fringe benefits to their employees to add significant value to the standard salary package.

These benefits are all subject to the Fringe Benefits Tax.

Common types of fringe benefits include

- Car benefits: A company car for personal use.

- Entertainment benefits: Meals, drinks, and tickets to events.

- Health and wellness benefits: A gym membership.

- Expense payment benefits: Personal expenses like school fees or utility bills.

- Housing benefits: Either rent-free or reduced-rate accommodation.

- Health insurance benefits: Private health insurance.

- Loan benefits: A loan lent at a reduced interest rate.

- Living away from home allowances: Accommodation and food costs for employees required to live away from their usual residence for work.

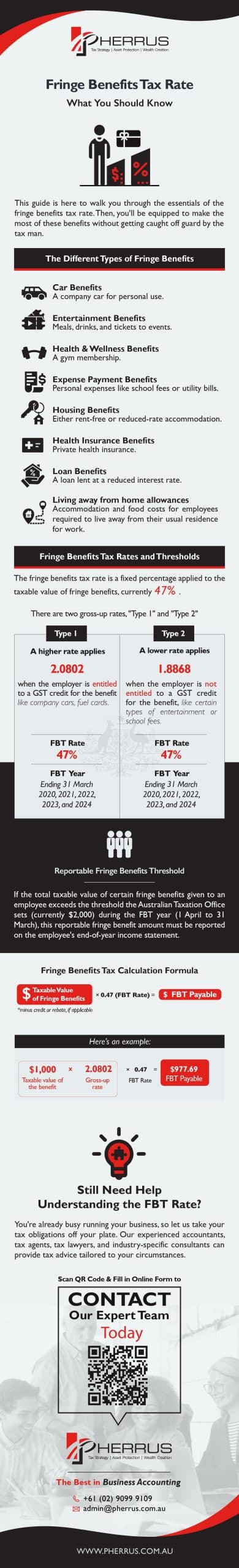

Fringe Benefits Tax Rates and Thresholds

The fringe benefits tax rate is a fixed percentage applied to the taxable value of fringe benefits, currently 47%.

There are also various thresholds set by the Australian Taxation Office that determine when certain fringe benefits become taxable or are exempt from FBT.

For example, there’s a minor benefits exemption for low-value benefits.

Additionally, there are gross-up rates used to calculate the taxable value of fringe benefits.

These essentially increase the value of the benefit to reflect the gross salary an employee would have to earn to purchase the benefit themselves after paying income tax.

This adjusted value is what the FBT is calculated on.

It ensures that the tax liability reflects the true cost of the benefit to the employee.

Understanding the Gross-Up Rate

There are two gross-up rates, “Type 1” and “Type 2”.

The type 1 gross-up rate calculates the taxable value of fringe benefits for which an employer can claim a Goods and Services Tax (GST) credit.

This rate accounts for the fact that the employer can claim said credits on these benefits.

The type 1 gross-up rate is currently 2.0802.

Benefits incurring this rate typically include company cars, fuel cards, or any benefit where the employer pays GST.

The type 2 gross-up rate is applied when the employer is not entitled to claim a GST credit for the fringe benefit.

This rate is lower because it does not need to account for said credit.

The type 2 gross-up rate is currently 1.8868.

Benefits incurring this rate commonly include non-GST-paid items, like certain types of entertainment or school fees.

We’ve been talking a lot of figures, so let’s lay it all out just to be clear!

| Gross-Up Type | FBT Year | FBT Rate | Gross-Up Rate |

| Type 1 | Ending 31 March 2020, 2021, 2022, 2023, and 2024 | 47% | 2.0802 |

| Type 2 | Ending 31 March 2020, 2021, 2022, 2023, and 2024 | 47% | 1.8868 |

Reportable Fringe Benefits Threshold

If the total taxable value of certain fringe benefits given to an employee exceeds the threshold the Australian Taxation Office sets (currently $2,000) during the FBT year (1 April to 31 March), this reportable fringe benefit amount must be reported on the employee’s end-of-year income statement.

This reporting helps to accurately reflect the employee’s total earnings for tax purposes.

The threshold value is subject to change, so it’s important to always check the current amount set by the ATO.

Fringe Benefits Tax Calculation Formula

To calculate FBT, follow these steps:

- Determine the taxable value of each fringe benefit provided to employees, depending on the type of benefit.

- Apply the appropriate gross-up rate (Type 1 or Type 2) to the taxable value.

- Multiply the grossed-up taxable value by the current FBT rate (47%) to find the FBT amount payable.

Here’s an example.

You provide a fringe benefit with a taxable value of $1,000 (GST-inclusive) to an employee.

To work out the FBT you must pay, you would use this equation:

$1,000 (taxable value of the benefit) × 2.0802 (gross-up rate) × 0.47 (FBT rate) = $977.69 (FBT payable).

Still Need Help Understanding the FBT Rate?

While we’ve tried to keep this guide as easy to understand as possible, there’s no denying that deciphering the fringe benefits tax rate can be tricky!

As a business owner, you already wear a lot of hats.

If “taxation expert” is pushing it, we completely understand!

You’re already busy running your business, so let us take your tax obligations off your plate.

Our experienced accountants, tax agents, tax lawyers, and industry-specific consultants can provide tax advice tailored to your circumstances.

For stress-free and efficient tax management, contact us today by filling out this online form or calling +61 (02) 9099 9109 to book an appointment at our Bella Vista office in Sydney, NSW.