Federal Court Upholds Tax Credit, Despite Non Reporting of PAYG Withheld Amounts

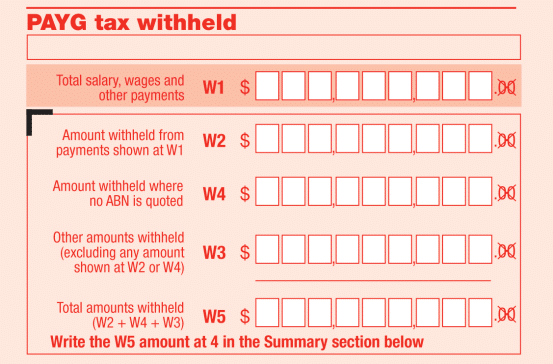

It is commonly understood that all PAYG amounts classed as “withheld” from the salary or wages of a taxpayer, must be reported to the ATO. This is a standard element of tax compliance, and is something that the vast majority of Australian tax entities do each and every year.

However, a recent Federal Court ruling has complicated matters somewhat, after it ruled that a taxpayer was in fact entitled to a tax credit, even though her PAYG withheld amounts that had not been remitted to the ATO by her employers.

The ruling came at the end of a case heard by the Full Federal Court in November of 2018. The case concerned an office clerk for a tax and accounting firm, but who was also employed by three service companies. The tax payer’s employers did not notify the tax office regarding PAYG withholding amounts. This meant, when it came to submitting her own tax return, the Commissioner decided to deny the taxpayer’s claim for entitlement to a tax credit.

The taxpayer decided to appeal, first to the Commissioner directly. She provided the Commissioner with evidence which, she claimed, showed that the payments were net pay amounts, and demonstrating that she was indeed entitled to the tax credit as requested. However, the Commissioner denied this claim, and so the matter was referred to the Federal Court.

The Federal Court overruled the decision made by the Commissioner, and found that the evidence provided by the tax payer was indeed truthful and authentic, and that she should be entitled to the tax credit she applied for. The Commissioner then lodged an appeal of its own, bringing the veracity of the submitted evidence into question. This is the legal right of the ATO Commissioner, which is provided with legal powers designed to make it easier to secure unpaid taxes and to remove tax credit entitlements in certain qualifying cases.

However, the appeal from the ATO was rejected. The Full Federal Court instead ruled that the primary judge had accepted the tax payer’s initially submitted evidence as legitimate and relevant; directly contradicting the ATO’s view that the evidence was insufficient. As a result, the court upheld the taxpayer’s request for a tax credit.

The case underlines the need for clear and robust reporting protocols. As a business owner or other tax paying entity, you are legally required to disclose all relevant details, and to actively report these to the ATO. This includes any PAYG withheld amounts with regard to employees, both short term and permanent. Failure to do so could lead to fines or other legal action being taken against your business, and could cause serious problems for any employees in your organisation.

To learn more about the ATO requirements regarding PAYG withheld amounts, or to discover just how Pherrus’ services could benefit your organisation, get in touch with us today.