If you’re a company director for an Australian company, you’ve probably heard about plans to phase in new legislation surrounding Director Identification Numbers.

Known as the Director ID scheme, the new rules are designed to ensure directors are held accountable if their business fails.

Why is the law changing?

Although most company directors take their responsibilities very seriously, previous corporate loopholes meant some bad actors were able to avoid repaying their debts.

Adopting a tactic commonly referred to as “phoenixing”, these directors would transfer their existing assets to a new company and continue to trade, while leaving debts from their failed business unpaid.

The new Director Identification Number legislation represents an amendment to the Corporations Act 2001.

Prior to this amendment, tackling the problem of phoenixing was very tricky as the Australian Securities and Investments Commission (ASIC) did not verify director identities.

As such, lawbreakers could operate businesses under different aliases and addresses, making it very difficult to ascertain the true identity of people engaged in illegal activity.

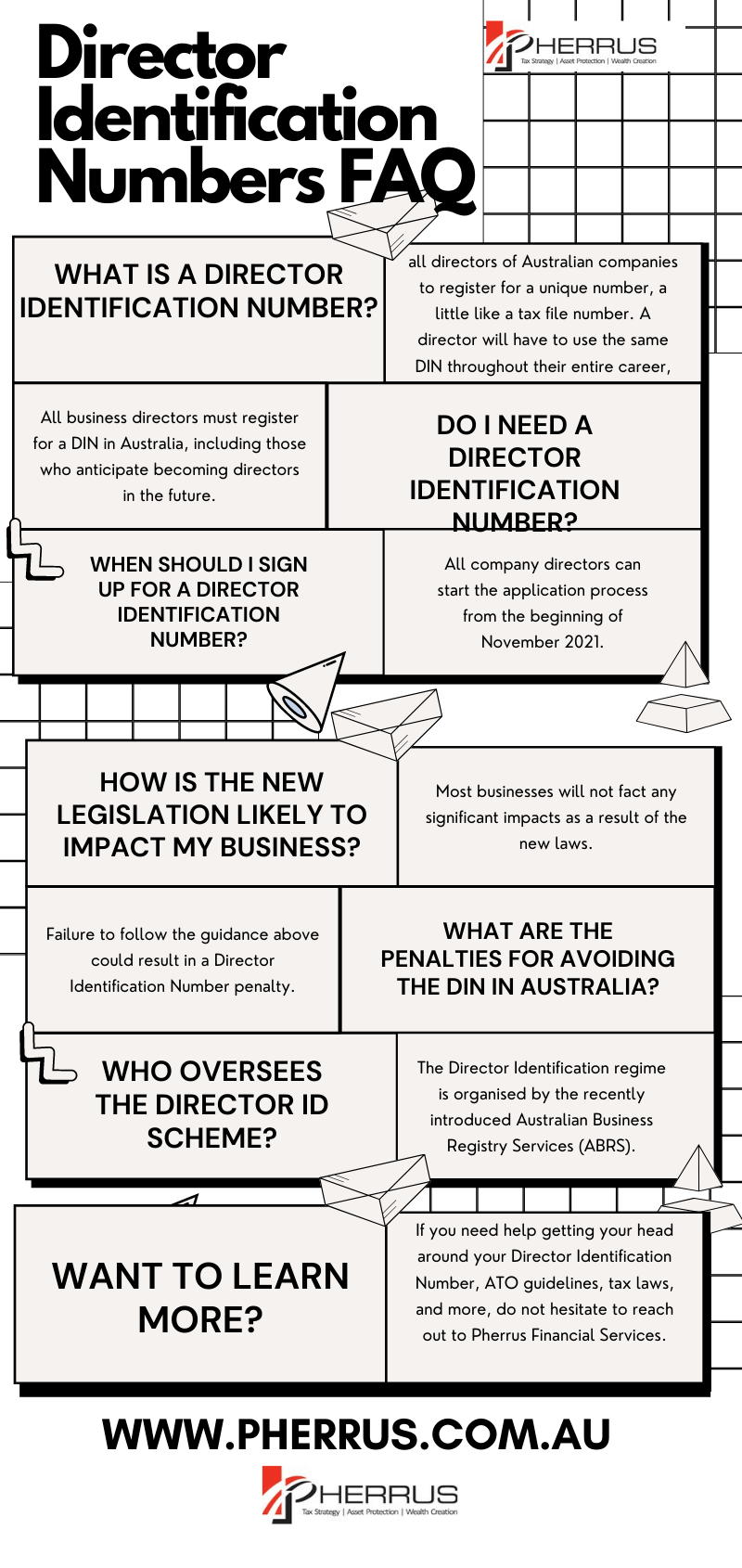

What is a Director Identification Number?

The Director Identification regime requires all directors of Australian companies to register for a unique number, a little like a tax file number.

Once registered, a director will have to use the same Director Identification Number (or DIN) throughout their entire career, even if they choose to relinquish their role at a given company.

If you direct several companies, you only need one director ID to be used across every organisation.

Similarly, you will retain your director ID if you switch companies, legally change your name, or move overseas.

Who oversees the Director ID scheme?

The Director Identification regime is organised by the recently introduced Australian Business Registry Services (ABRS).

It is borne of Australia’s recent Modernising Business Registers (MBR) initiative and is overseen by the Australian tax office (ATO).

Identification numbers will be used by regulators to monitor the business activities of directors, including their movements across organisations.

Do I need a Director Identification Number?

All business directors must register for a DIN in Australia, including those who anticipate becoming directors in the future.

This includes leaders of any of the following:

- A standard company

- An Aboriginal and Torres Strait Islander organisation

- Corporate trustee, for example, of a self-managed super fund

- A non-profit organisation or charity that falls under the category of a standard company or an Aboriginal and Torres Strait Islander corporation

- A foreign company operating within Australia and registered with ASIC

- An Australian ASIC-registered body

You will also need to register for a DIN if you have a role as an alternate or deputy director.

Some entities are not required to sign up for the Director ID scheme. These include:

- Company secretaries without director roles

- Sole traders

- External administrators

- Professionals with ‘director’ in their job title who have not officially been appointed as a company director in accordance with the CATSI Act or the Corporations Act

- Directors of registered charities that are not ASIC-registered

How do I sign up for a Direct Identification Number?

Applying for a DIN is relatively simple and involves three key steps. These include:

1. Register for your myGovID

If you have not yet registered for a myGovID, it is the first thing you should do before applying for a DIN.

If you’re unsure what a myGovID is or how to apply for one, you can find plenty of helpful information on the government’s useful app.

2. Organise your identification documents

Next, you will need to collate several documents to help verify your identity.

First, you will need to find your tax file number and the residential address you used to register with the ATO.

You will also need to find at least two documents from the following list:

- Centrelink payment overview

- Bank account details

- A dividend statement(s)

- Pay As You Go (PAYG) payment summary

- ATO Notice of Assessment

Most of this information can be found quickly and easily on your myGov profile, so we recommend exploring this service before you start applying for your DIN.

Do note, however, that your myGov profile is different from your myGovID.

The former allows users to access online services offered by official bodies including the ATO, Medicare, and Centrelink.

Your myGovID profile, on the other hand, is designed to verify your identity and allow you to securely access an array of online government services.

3. Fill out your Director ID application

Finally, you must fill out the application form for your DIN.

If you have the relevant documents at hand, this process should only take a few minutes.

If you’re still a little confused about the process, you can find a step-by-step guide on the ABRS website.

When should I sign up for a Director Identification Number?

All company directors can start the application process from the beginning of November 2021.

The deadline for your application depends on when you became a company director.

Here are the deadlines of which to be aware:

- If you became a director on or before 31/10/2021: 30 November 2022

- If you became a director between 01/11/2021 and 04/04/2022: Within 28 days of your appointment

- From 05/04/2022: Before your appointment

Remember that you cannot get someone else (such as a financial advisor) to apply on your behalf, as you will need to offer proof of your identity.

How is the new legislation likely to impact my business?

Rest assured most businesses will not fact any significant impacts as a result of the new laws.

Non-Australian residents are likely to face the most disruption, as they will need to produce more documentation for the ATO.

What are the penalties for avoiding the DIN in Australia?

Failure to follow the guidance above could result in a Director Identification Number penalty.

Misrepresenting your ID, applying multiple times, or ignoring deadlines could result in a range of punishments, including imprisonment.

Need advice? Reach out to Pherrus Financial Services today

If you need help getting your head around your Director Identification Number, ATO guidelines, tax laws, and more, do not hesitate to reach out to Pherrus Financial Services – the best in business accounting.

One of our friendly advisors would love to speak with you.