If you are in the market for a financial professional to help you out with your taxes and other financials, you have probably come across accountants and certified public accountants (CPA) in your search.

Understandably, you are probably wondering what the difference is between a public accountant vs CPA and how much their jobs or services differ.

When it comes to choosing between an accountant vs CPA, it can often be a difficult choice as which type you should choose is going to depend on what you need your accountant to do for you.

Certified Public Accountants have a strong focus on accounting but they also have a broader focus on business management as well.

Accountants, on the other hand, focus more on the technical aspects of accounting such as complex tax matters.

The easiest way to differentiate between the two is to remember that every CPA can be an accountant but not every accountant can be a CPA. In this article, we explore a CPA vs. an accountant in more detail…

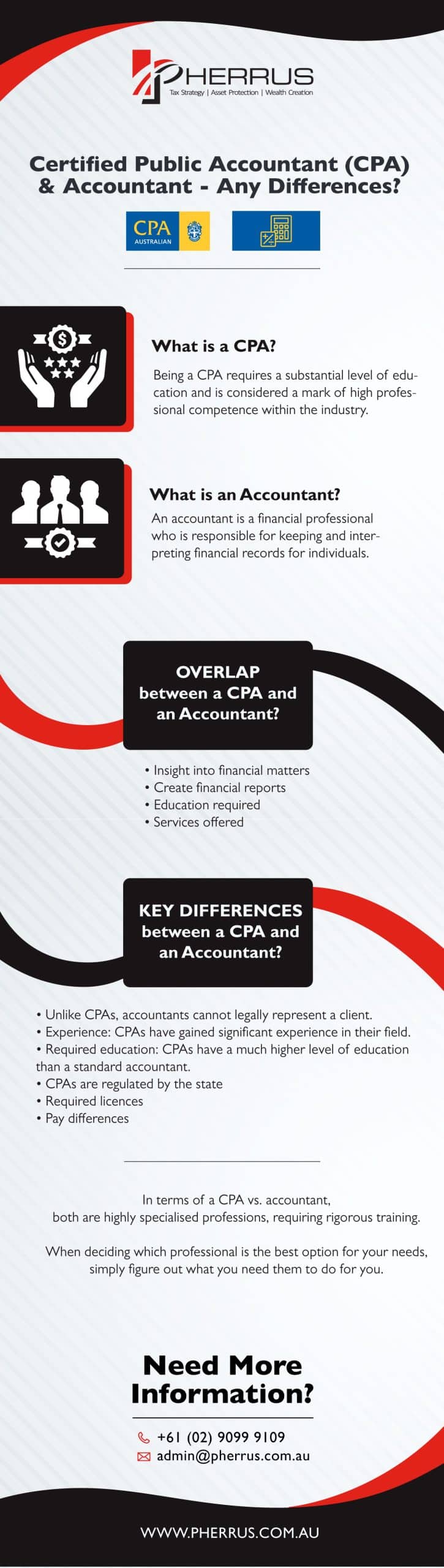

What is a CPA?

Are you wondering what a CPA does? A Certified Practising Accountant (CPA) is a finance, accounting and business professional with specific qualifications that allow them to conduct many financial and business practices that accountants cannot.

Being a CPA requires a substantial level of education and is considered a mark of high professional competence within the industry.

It illustrates that the CPA in question has achieved a thorough depth, breadth and quality of accountancy training and knowledge.

CPAs are highly respected by employers and members of the community due to the difficulty required to obtain professional qualifications.

Members who successfully gain their CPA title are provided with an internationally recognised qualification as well as the opportunity to complete specialist training.

They are also able to continue their professional development and undergo further training if they so choose to.

To qualify as a certified public accountant, individuals need to complete the following:

• Complete a degree or a postgraduate award that is recognised by CPA Australia

• Enrol in and complete the CPA Program. The program includes three years of professional experience in the finance, accounting or business industries

• Regularly partake in CPD activities every year

• Understand and comply with a strict code of conduct set by CPA Australia.

What is an Accountant?

An accountant is a financial professional who is responsible for keeping and interpreting financial records for individuals.

Most accountants are responsible for a wide range of finance-related tasks, from compiling reports to assisting a business with its financials.

Accountants can work for both individual clients or for larger businesses and organisations.

An accountant looks after financial records for both individuals and businesses.

An accountant is expected to have a thorough knowledge of equity, cash flow, business/personal accounts and balance sheets.

Additionally, they should understand how these are going to impact the business or individual.

What does an accountant do in their role?

An accountant’s daily routine will be fairly standard on a day-to-day basis.

Some of the regular tasks or activities that they will complete can include:

• Assessing and checking the accuracy of financial documents.

• Ensuring that their client’s finances and financial reports are compliant with the relevant laws and regulations

• Preparing and maintaining important financial reports for their clients

• Preparing tax returns and ensuring that taxes are paid properly and on time

• Evaluating financial operations to recommend best practices. They will identify any issues and make suggestions on how to solve them

• Offering financial solutions to help their clients run their businesses efficiently identifying areas where cost reduction, revenue enhancement, and profit maximisation can be improved

• Conducting financial forecasting and risk analysis assessments of their client’s businesses and assets

Additionally, accountants are also responsible for ensuring that their clients’ financial records are compliant with the relevant laws and regulations.

If they find that their finances do not comply with relevant law and legislation, they are required by law to honestly disclose this to their clients and find a solution.

Overlap between a CPA and an Accountant?

When it comes to CPA vs. accountant, there are a few similarities that you should be aware of. These similarities include:

• Insight into financial matters: Both CPAs and accountants offer insight into financial matters, however, CPAs are able to offer more in-depth insight and recommendations than accountants can.

• Create financial reports: Creating financial reports is a part of both an accountant’s and CPA’s jobs. The types of reports that they create are going to differ in subject matter, however.

• Education required: To become either an accountant or a CPA you are required to undergo further education and gain on-the-job experience.

Accountants generally have an undergraduate degree, while CPAs will take their education a step further and obtain postgraduate level education as well as specific CPA qualifications.

• Services offered: Accountants and CPAs both offer financial expertise and services to the general public and businesses.

Key Differences between a CPA and an Accountant?

It is easy to fall into the general thinking that certified practising accountants are practically the same as accountants. However, there are some key differences that should be noted. These differences are important as they determine what each individual is able to do within their job. These differences include:

• Unlike CPAs, accountants cannot legally represent a client.

• Experience: CPAs have gained significant experience in their field.

They regularly fill senior financial positions that would be unsuitable for standard accountants.

CPAs are regularly the first consideration for jobs are they have demonstrated the fact that they are highly qualified and knowledgeable.

• Required education: CPAs have a much higher level of education than a standard accountant.

In fact, the CPA educational requirement is considered the most demanding among all accounting and finance qualifications that you can complete.

Generally, you need to have majored in accounting specifically or have taken enough credit hours to demonstrate the same level of knowledge and expertise before you will be accepted into the course.

• CPAs are regulated by the state: A CPA is a professional who is overseen and regulated by the state due to the involvement and complexity of their career.

This is due to the fact that rigorous education, training and knowledge are required to become a CPA.

• Required licences: There are significant differences in licensing requirements between the two professions.

There is no licence required to be an accountant.

A CPA on the other hand is required to obtain a licence to practice.

As a CPA license holder, people have comfort in your education level and will often elect to work with you due to your level of training and attainment.

• Pay differences: due to the higher level of professional training as well as responsibility, a CPA is going to earn a significantly higher wage than an accountant.

This means that they are also likely to charge a higher fee for their services.

Summary

In terms of CPA vs. accountant, both are highly specialised professions, requiring rigorous training.

When deciding which professional is the best option for your needs, simply figure out what you need them to do for you.

If interested in attaining overall business management as well as accounting services, a CPA could be the right choice.

If, on the other hand, you are simply looking for a professional to help you out with your taxes and finances you will be able to utilise the service of an accountant.

When you decide which route you would like to take, get in with our team today and have a chat with us about our accounting services.