Are you tired of waiting for your business dream to take flight? A business loan could be your “plane” ticket, so to speak!

Don’t let confusion or doubt about the business loan application process hold you back.

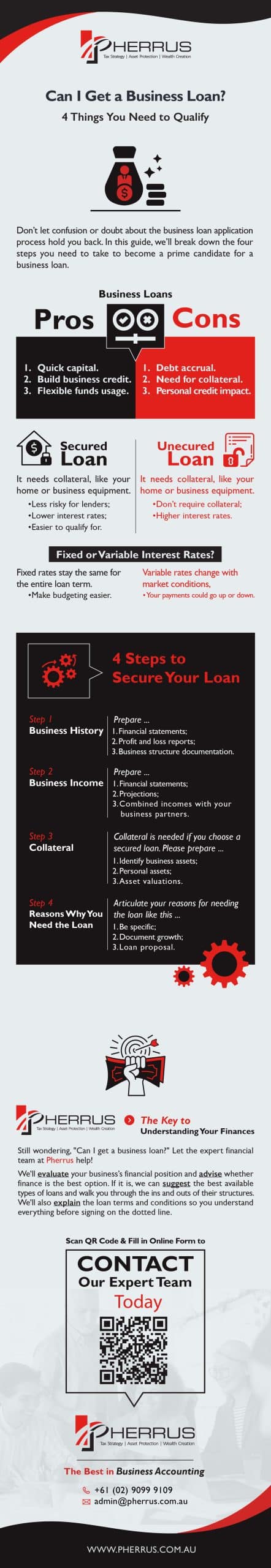

In this guide, we’ll break down the four steps you need to take to become a prime candidate for a business loan.

Business Loans Pros and Cons

As with most things in life, business loans have pros and cons that are important to weigh up.

Pros:

- Quick capital. Business loans can offer fast access to money, so you can cover expenses, invest in new equipment, or launch a killer marketing campaign.

- Build business credit. When you take out a business loan and pay it back on time, you build your business credit. Good credit can help you get better loan terms in the future.

- Flexible funds usage. Unlike some loans that dictate how you must use the money, business loans often come with flexibility. You can decide where the funds will make the most impact on your business.

Cons:

- Debt accrual. Falling behind on loan payments isn’t just stressful; it can also rack up additional interest and fees.

- Need for collateral. Some loans require collateral, like property or business equipment. If you fail to repay, you risk losing these assets.

- Personal credit impact. Your personal credit can take a hit if your business loan repayments fall behind.

Key Takeaway BoxThe likelihood of securing a business loan hinges on four key factors: a solid business history, steady income, valuable collateral, and a clear purpose for the loan. By carefully preparing in these areas, you’ll significantly improve your chances of convincing lenders to approve your business loan application. |

The Differences Between a Secured or Unsecured Loan

Lenders offer secured or unsecured business loans, but it’s up to you to decide which one aligns with your financial situation and comfort level.

So, understanding the difference between the two is crucial.

Secured loans need collateral, like your home or business equipment.

This type of loan is less risky for lenders, so they usually offer lower interest rates.

Also, secured loans can be easier to qualify for.

On the other hand, unsecured loans don’t require collateral.

That means you don’t risk losing any assets if you can’t make repayments.

However, the trade-off is typically higher interest rates, making these loans more expensive over time.

Fixed or Variable Interest Rates?

Another key factor in deciding “Can I get a business loan?” is the choice between fixed or variable interest rates.

Fixed rates stay the same for the entire loan term.

You’ll always know exactly how much your payments will be, which makes budgeting easier.

Variable rates, however, change with market conditions, meaning your payments could go up or down.

While this adds an element of unpredictability, you might save money if rates decrease.

4 Steps to Secure Your Loan

So, you’ve decided to go ahead and apply for a loan.

Let’s look at four common eligibility steps banks require as part of the business loan application process.

While these four steps won’t guarantee you’ll qualify for a loan—that’s ultimately up to the lender—they will set you on the path to becoming a more attractive candidate.

Step 1: Business History

Get ready to roll out the red carpet and dazzle lenders with your business history!

Lenders want to see this history as proof that you know how to manage your finances, in turn determining your likeliness to repay the loan.

Prepare the following documents to show your business history.

- Financial statements: Gather your income statements and balance sheets for the last few years to illustrate your revenue and growth.

- Profit and loss reports: Showcase your profitability through clear, up-to-date, and accurate profit and loss reports.

- Business structure documentation: If you’re a Proprietary Limited (Pty Ltd), have your articles of association handy. If you’re a sole proprietor, consider transitioning to a more established structure to improve your odds. Pty Ltds often get the nod for loan approval over sole proprietorships, as this structure indicates a level of seriousness and commitment that lenders appreciate.

Step 2: Business Income

Now, it’s time to shine the spotlight on your suitability for a loan by showcasing your business income.

Lenders want assurance that you have enough steady revenue to cover your loan payments.

To showcase your business income, prepare these documents.

- Financial statements: Include recent, detailed financial statements to demonstrate your revenue stream.

- Projections: Don’t just show where you’ve been—show where you’re going. Provide financial projections that illustrate your ability to repay the loan.

- Combined incomes: If you have business partners, combine their incomes with yours to make your application more appealing to lenders.

Step 3: Collateral

As discussed earlier, collateral is needed if you choose a secured loan.

Collateral acts as insurance for lenders should you fail to make repayments.

Prepare your collateral as follows.

- Identify business assets: List assets like equipment, accounts receivable, or even real estate that you can offer as collateral.

- Personal assets: If your business lacks enough collateral, personal assets can be used. Just be aware that you’ll be personally responsible for the loan if things go south.

- Asset valuation: The more valuable the assets, the better the loan terms you’re likely to get. So get those assets appraised, if possible, by hiring a certified appraiser who specialises in the type of asset you have. They’ll evaluate the asset and provide a documented estimate of its current market value, which you can then present to the lender.

Step 4: Reasons Why You Need the Loan

You’re on the home stretch! Think of this step as your closing argument—the “why” that justifies the “what” and “how” of your business loan application.

Lenders care about the “why” because they want to know that you have a well-thought-out business plan for utilising the loan.

Articulate your reasons for needing the loan like this:

- Be specific. Saying you need the loan “for business growth” won’t cut it! Vague explanations can be red flags for lenders, making them question your credibility. Whether it’s for purchasing equipment or expanding to a new location, specify what you’ll use the loan for.

- Document growth. Show how the loan will directly contribute to your business growth. Use facts, figures, and even charts to make your case.

- Loan proposal. Prepare a detailed loan proposal that includes ROI (Return on Investment) projections to add another layer of credibility to your application.

Pherrus: The Key to Understanding Your Finances

By meticulously preparing your business history, income, collateral, and reasons for the loan, you’ll increase your chances of loan approval success.

Still wondering, “Can I get a business loan?” Let the expert financial team at Pherrus help!

We’ll evaluate your business’s financial position and advise whether finance is the best option.

If it is, we can suggest the best available types of loans and walk you through the ins and outs of their structures.

We’ll also explain the loan terms and conditions so you understand everything before signing on the dotted line.

Get one step closer to success by filling in our online form today or calling +61 (02) 9099 9109 to book an appointment at our Bella Vista office in Sydney, NSW.