You’re house hunting, and then it happens: you find THE house. But your current home hasn’t sold yet!

In no time, excitement turns to stress. Do you let go of the perfect house and hope another will come along?

Or is there a solution that will allow you to buy this house without the cash from the sale of your current property?

Bridging finance will help secure your new home while giving you breathing room to sell your existing one.

No rushed sales, no scrambling for temporary housing—just a seamless transition from one house to the next.

What is bridging finance, and how does it work for Australian property buyers and sellers?

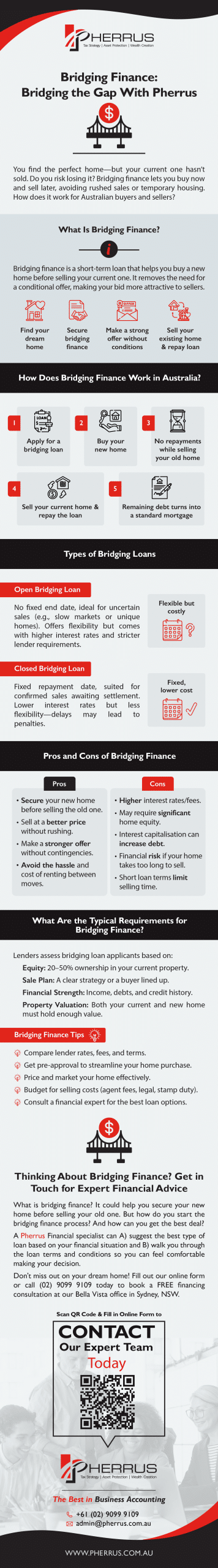

What Is Bridging Finance?

Bridging finance is a temporary, short-term property loan that “bridges” the gap between buying a new property and selling an existing one.

This way, you won’t risk losing your dream home because the timing isn’t perfect.

You also won’t have to make a contingent offer on the house you want—an offer that depends on selling your current property first.

Contingent (or conditional) offers are generally less attractive to sellers because they come with more risk and uncertainty.

With bridging finance, you’ll already have the funds to buy the house, so you can make a stronger, more appealing offer.

How Does Bridging Finance Work in Australia?

You can apply for bridging finance through a bank or lender, often the same one handling your current mortgage.

They’ll assess your equity (how much of your current home you own outright) and your ability to repay the loan before approving it.

Instead of requiring you to make monthly interest payments, the lender will likely add the interest to the loan balance.

This interest capitalisation means you don’t have extra repayments while you wait to sell your current home and fully repay the bridging loan.

After selling your property, the proceeds from the sale will pay off the bridging loan.

If any loan amount remains, it becomes your “end debt” or new mortgage, which you’ll repay under standard home loan terms.

Bridging loans are usually structured to last a few months to a year.

If your loan transitions to a standard mortgage once the bridging period ends, the repayment term typically follows the usual home loan length—up to 25 or 30 years, depending on your agreement with the lender.

Types of Bridging Loans

Open Bridging Loan

An open bridging loan has no fixed end date for the sale of the existing property.

It’s suitable for situations where the sale timeline is uncertain:

- Selling in a slow or unpredictable property market.

- Waiting for the right buyer to get the best possible sale price.

- Dealing with complex sales, such as properties with legal or structural issues.

- Selling a unique or high-end home that may take longer to find a buyer.

While this loan gives you the flexibility to wait for the best sale scenario, it comes at a price.

Since there’s no guaranteed sale date and timeline for repaying the loan, the lender takes on more risk.

To offset this, they may charge higher interest rates, require proof that you’re actively marketing the property, or impose stricter lending criteria.

Closed Bridging Loan

A closed bridging loan has a fixed repayment date, so it only works if you have a confirmed sale contract and are waiting for settlement.

Since the sale is secured, lenders offer lower interest rates and better terms than open bridging loans.

However, the fixed timeline means there’s little flexibility—if the settlement delays, you may face penalties or additional costs.

Pros and Cons of Bridging Finance

Pros:

- Secure the home you want in a competitive market before your current property sells.

- Potential to sell at a better price without rushing.

- Position yourself as a more attractive buyer by not having to make a contingent offer.

- Avoid the hassle and cost of renting between homes.

Cons:

- Potential high interest rates and fees.

- Possible need for a high level of equity to qualify.

- Interest capitalisation can increase the overall loan balance.

- Risk of financial strain if your existing property doesn’t sell within the expected timeframe.

- Short loan terms mean limited time to sell your home.

What Are the Typical Requirements for Bridging Finance?

Here’s what lenders consider.

- Do you have 20–50% equity in your current property?

- Do you have a realistic plan to sell your property? Lenders prefer borrowers who already have a buyer lined up or can show they are actively selling.

- Is your financial position strong? They’ll check your income, debts, and credit history to ensure you can manage repayments if your home takes longer to sell.

- What is the valuation of your current home? Your current home is the primary collateral, and its valuation helps determine how much the lender will lend. If your property doesn’t sell for the expected price, the lender wants to know that there is enough value to recover the loan amount.

- What is the valuation of the property you want to buy? Your new home may also be used as collateral, depending on the lender’s requirements and the loan size. Its valuation ensures the lender isn’t taking on excessive risk.

Bridging Finance Tips

- Research and compare lenders’ interest rates, fees, loan terms, and repayment options.

- Get pre-approval for your bridging loan before making an offer on a property so you know how much you can borrow, show the seller you’re a serious buyer, and avoid financing delays later.

- Develop a realistic selling strategy for your existing property, including setting a competitive sale price, working with a good real estate agent, and effectively marketing the home.

- Factor in all loan costs and potential selling costs, such as real estate agent commissions, marketing expenses, legal fees, and stamp duty.

- Seek professional financial advice from experts like Pherrus to understand the best loan options and make informed decisions.

Thinking About Bridging Finance? Get in Touch for Expert Financial Advice

What is bridging finance?

It could be the answer to your dilemma of finding the perfect new home before selling your old one!

But how do you start the bridging finance process? And how can you get the best deal?

A Pherrus Financial specialist can A) suggest the best type of loan based on your financial situation and B) walk you through the loan terms and conditions so you can feel comfortable making your decision.

Don’t miss out on your dream home! Fill out our online form or call (02) 9099 9109 today to book a FREE financing consultation at our Bella Vista office in Sydney, NSW.