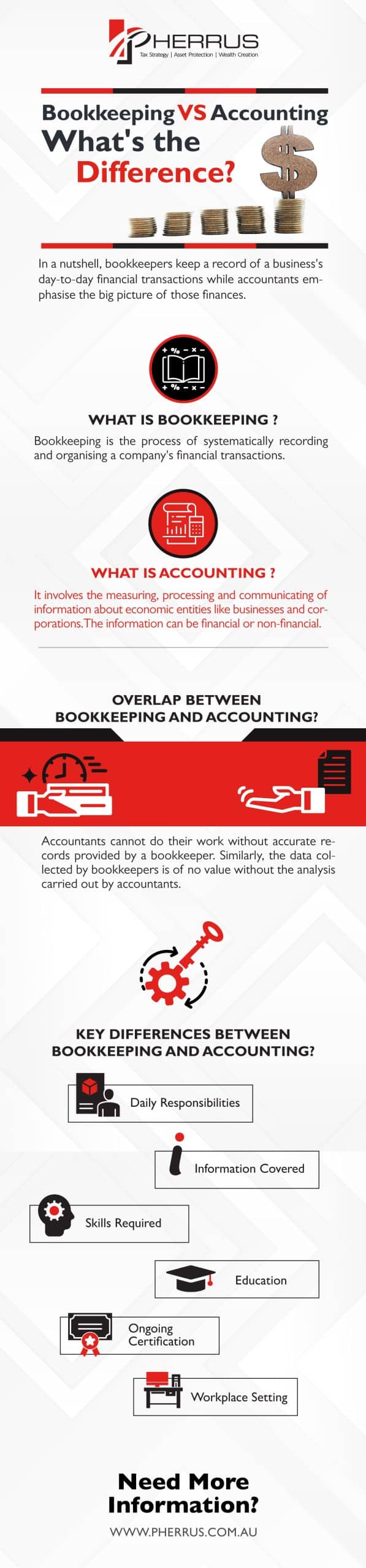

The differences between bookkeeping and accounting are often quite subtle, but they are very distinct for anyone looking to enter either career. In a nutshell, bookkeepers keep a record of a business’s day-to-day financial transactions while accountants emphasise the big picture of those finances.

Bookkeepers have to pay close attention to the minute details as accuracy is all-important.

The input of a bookkeeper is often used by an accountant to create financial reports and statements.

This work is then used to analyse the data collected by bookkeepers, enabling the accountant to conduct audits and make projections about future business needs.

There are similarities between the two roles and many of the same skills and attributes are required.

However, the type of work undertaken is different. In this guide, we will look more closely at the differences between a bookkeeper and an accountant.

What is Bookkeeping?

Bookkeeping is the process of systematically recording and organising a company’s financial transactions.

These transactions must be recorded daily to ensure the records of every transaction are accurate, up-to-date and comprehensive.

There is no room for error in bookkeeping.

The information a bookkeeper records is the basis for the preparation of the business accounts.

It is a distinct process in its own right, but it falls under the broader scope of accounting.

Any transaction that pertains to either a purchase or a sale has to be recorded. Bookkeeping has predetermined structures in a place known as ‘quality controls’.

This helps ensure records are timely and accurate at all times.

Businesses need bookkeeping to keep their finances organised and ensure there are no errors in their accounting.

But bookkeepers can be useful for individuals and non-profit organisations as well.

The person (or persons) responsible for bookkeeping records transactions such as:

- Customer payments for invoices

- Expense payments to suppliers

- Loan payments

- Asset depreciation monitoring

- Financial reporting

‘Bookkeeping’ and ‘accounting’ are often used interchangeably.

But bookkeeping is a more specific process than accounting.

This is crucial for businesses of any size, and it gets more complex as things like taxes, loans, assets and investments come into the equation.

The core purpose of bookkeeping is the tracking of all financial activities, keeping a constantly up-to-date record of income and outgoings, amounts the business owes and amounts owed to the business by customers, among other things.

Advances in technology have changed the way bookkeeping is carried out, as it is a centuries-old profession.

Where once it would have involved multiple ledgers, it moved on to multiple spreadsheets, and storage has always been a key concern.

Even with computer-based systems, the software could be slow and the hard drive space is limited.

Today, many systems utilise cloud storage as a safe, reliable way to store and process data.

There are even apps for mobile devices to facilitate bookkeeping on the go.

What is Accounting?

Accounting is also known as accountancy.

It involves the measuring, processing and communicating of information about economic entities like businesses and corporations.

This information can be financial or non-financial, and it measures the economic activities of a business.

This information can then be conveyed to tax authorities, investors, creditors, management and other key stakeholders.

Another common synonym for accounting is ‘financial reporting’.

There are various fields that fall under the main category of accounting.

You get financial accountants, tax accountants, management accountants and cost accountants.

In financial accounting, the emphasis is placed on reporting an organisation’s financial information in the form of statements.

More broadly, what an accountant does may include:

- Prepare financial statements

- Measuring and analysing information for internal use

- Calculate tax liabilities and provide the necessary documentation

The recording of financial transactions from bookkeepers forms the foundation upon which the work of an accountant is based.

This is why it is so important that the work of the bookkeeper is accurate and up-to-date.

Accounting has existed to varying degrees throughout human civilisation.

For example, the double-entry accounting system that is still used today was developed in medieval Europe.

The work today is typically carried out by accounting firms and other similar bodies, though some organisations still have in-house accounting departments.

Accounting firms usually prepare and/or audit financial statements in accordance with generally accepted accounting principles.

Accounting is an essential component of running a business.

It facilitates an ongoing record of business transactions which is important for both planning and strategising for the future and financial reporting to stakeholders and tax authorities. Management decisions are often based on reports produced by accountants.

The work communicates data-based results that indicate the financial health of an organisation. It also enables businesses to meet their legal obligations as economic entities under a nation’s laws.

Overlap between Bookkeeping and Accounting?

As previously mentioned, the work of bookkeepers and accountants is related, and the two professions often overlap.

For this reason, some accounting firms offer bookkeeping as part of their service, keeping everything under one roof for convenience.

Accountants cannot do their work without accurate records provided by a bookkeeper. Similarly, the data collected by bookkeepers is of no value without the analysis carried out by accountants.

Bookkeepers often produce basic financial reports that would usually be attributed to accountancy as part of their service.

These are usually not as detailed or comprehensive as those compiled by accountants, but they provide a brief snapshot that can inform business leaders of the state of their finances.

Key Differences between Bookkeeping and Accounting?

Though there are overlaps in their work, it is important to understand the distinction between a bookkeeper and an accountant.

Here is a summary of the key differences between the roles:

- Overall role: Bookkeeping is an administrative process of recording financial transactions, while accounting is all about assessing the financial position and communicating that information to the relevant parties.

- Daily responsibilities: Bookkeepers must ensure the financial data entry is up-to-date with the appropriate filings made, while accountants monitor and communicate the broader financial situation.

- Information covered: Bookkeepers don’t typically prepare financial and management information, but accountants analyse and interpret data to produce reports and statements that are key to decision-making/

- Skills required: Bookkeepers must know and understand the processes of bookkeeping and have a keen eye for detail. Accountants must be educated in more complex accounting matters and be able to apply that knowledge effectively.

- Education: Bookkeepers often have to complete a certified course. Registration as a BAS Agent is very desirable. An accountant, meanwhile, must have a Bachelor’s degree in accounting, provided by a recognised institution like a university.

- Ongoing certification: Certification is not mandatory for bookkeepers, but it is helpful for career prospects. Membership in a certifying body can be useful and offer ongoing training opportunities. Accountants must register with CPA Australia and are required to complete 120 hours of continued professional development every three years.

- Workplace setting: Many businesses have in-house bookkeepers – smaller firms often carry out their own bookkeeping using software or apps. There are bookkeeping firms to outsource the work to. Accountancy is almost always done by specialist firms to whom businesses outsource their accounting work. These firms often offer bookkeeping as part of their service.

Summary

When considering the differences between bookkeeper vs. accountant, it all comes down to the scope and complexity of the work.

Essentially, bookkeeping is a part of the wider accounting process, and it is the part where accounting is built.

Without an accurate, up-to-date record of business transactions, accountants will not have the data they need to compile reports and statements that detail the financial health of a business.

The work of a bookkeeper is skilled and the importance of accuracy cannot be understated.

But the work of accountants requires a breadth of specialist skills, with accuracy being equally important as legal duties are fulfilled and financial statements are compiled that will impact the decision-making of business leaders and stakeholders.

This is why accountants require more comprehensive education and regulation of their work, while the process of bookkeeping is permitted to be carried out in-house with no professional qualifications.

Pherrus are expert tax accountants based in Sydney offering a range of accounting solutions for various industries.

Our expertise and experience is second to none, with the goal of keeping your tax burden to a minimum no matter what stage your business is at.

If you would like to learn more about how we can help you, ,a href=”https://www.pherrus.com.au/contact-us/”>contact us at +61 (02) 9099 9109.