Could you build a structurally sound house without building plans? Impossible!

The same goes for your building business- running a successful company without proper accounting is impossible!

The construction industry contributed to 9% of all goods and services produced in Australia in 2022.

This statistic highlights the industry’s significant role in the economy, meaning there’s a lot of money and activity in your field.

Reliable accounting is essential to help you manage your finances effectively so your business can be a substantial part of that 9%.

Inaccurate job costing, poor expense tracking, or mismanaged cash flow can quickly eat into your profits and jeopardise your business.

In the upcoming sections, you’ll discover the unique challenges of accounting for home builders and how the right accountants can help you nail these challenges so your business stands as strong as the homes you build.

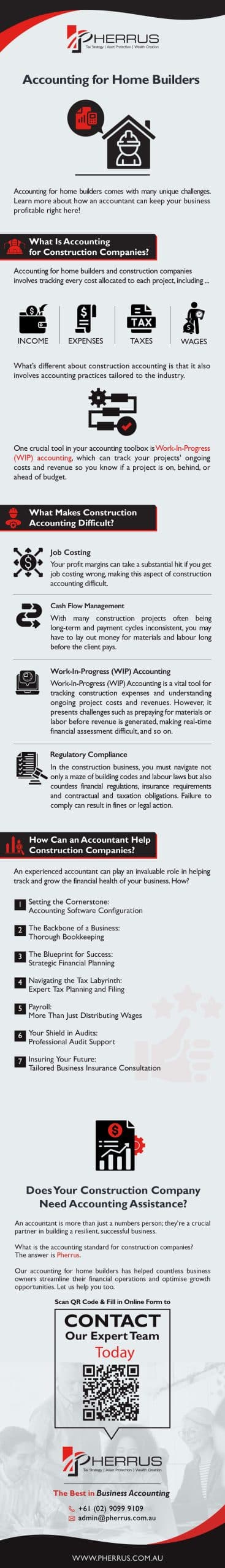

What Is Accounting for Construction Companies?

Accounting for home builders and construction companies involves tracking every cost allocated to each project, including

- Income

- Expenses

- Taxes

- Wages

What’s different about construction accounting is that it also involves accounting practices tailored to the industry.

These help you manage projects from start to finish to stay on budget and maximise profitability.

One crucial tool in your accounting toolbox is Work-In-Progress (WIP) accounting.

This system tracks your projects’ ongoing costs and revenue so you know if a project is on, behind, or ahead of budget.

WIP Accounting can be done through specialised construction accounting software or integrated into broader accounting platforms with modules for construction needs.

Such software provides features that simplify tracking, generate detailed reports, and offer real-time insights into each project’s financial status.

Using this software also minimises errors and saves time.

What Makes Construction Accounting Difficult?

Job Costing

In construction, every project has its unique set of costs: materials, labour, overhead, and so on.

Job costing can be like aiming at a moving target. Material costs can fluctuate, and unexpected weather setbacks or supply chain issues can throw off your estimates.

Even labour costs can vary if a project takes longer than planned or requires unexpected specialised skills.

Your profit margins can take a substantial hit if you get job costing wrong, making this aspect of construction accounting difficult.

Cash Flow Management

Cash flow is the lifeblood of your business.

With many construction projects often being long-term and payment cycles inconsistent, you may have to lay out money for materials and labour long before the client pays.

You must manage cash flow effectively to cover costs and keep the business running smoothly, even during dry spells.

Work-In-Progress (WIP) Accounting

How do you keep track of construction expenses?

WIP Accounting lets you understand each project’s ongoing costs and revenues. However, it comes with its own challenges.

You may pay for materials or labour well before any revenue comes in, making it hard to get an accurate financial picture of a project at any given moment.

Another issue is the constant change in project conditions, like unexpected delays, cost overruns, and scope changes.

These call for regular WIP Accounting adjustments, which can be hard to stay on top of when you’re already busy with your other responsibilities as a business owner.

Despite these challenges, WIP Accounting remains an indispensable tool, helping you keep a finger on each project’s financial pulse.

Regulatory Compliance

In the construction business, you must navigate not only a maze of building codes and labour laws but also countless financial regulations, insurance requirements and contractual and taxation obligations.

Failure to comply can result in fines or legal action.

Staying compliant will keep your business profitable while operating within the law.

This is a challenge for business owners because juggling all these regulations takes time, expertise, and attention to detail.

How Can an Accountant Help Construction Companies?

An experienced accountant can play an invaluable role in helping track and grow the financial health of your business. How?

Setting the Cornerstone: Accounting Software Configuration

Selecting the right accounting software is like choosing the right materials for a construction project; both affect the outcome’s quality.

Accounting software for home builders will streamline your business’s financial management, making it easier to track costs, manage invoices, and assess the profitability of each project in real-time.

A knowledgeable accountant can identify the software most compatible with your business’s size, needs, and operations.

Beyond the initial setup, they can customise the software features to help you get the most value from it.

Customisation can include

- Automated invoicing

- Integration with time-tracking tools

- Tailored financial reports.

- WIP accounting management.

The Backbone of a Business: Thorough Bookkeeping

Let’s face it: meticulous bookkeeping can be a drain on your time.

This time could be better spent elsewhere, like on-site managing projects or even unwinding from the stress of running your business!

An accountant can handle the nitty-gritty of bookkeeping, including correct invoice recording, reconciliation of accounts, and cash flow analysis.

They’ll serve as a vigilant monitor, letting you know where your money is going and catching any discrepancies before they become problems.

The Blueprint for Success: Strategic Financial Planning

Understanding your financial position is one thing; planning for the future is another.

An accountant will delve deep into your financial history, current balance sheets, and market trends to carve out a viable economic strategy for your business.

This strategy can encompass everything from optimising operational costs to investment planning for sustainable growth.

Navigating the Tax Labyrinth: Expert Tax Planning and Filing

Tax laws are complicated, so you need an accountant well-versed in Australian taxation laws and regulations on your side.

From employment tax issues related to subcontractors to capital allowances on machinery and Business Activity Statements, an accountant can identify ways to reduce your tax liability while ensuring compliance.

They’ll also track filing deadlines to spare you from potential penalties for late submissions.

Payroll: More Than Just Distributing Wages

As well as paying wages, payroll involves calculating tax withholdings, employee benefits, and reimbursements.

And don’t forget compliance with labour laws and payroll tax obligations!

Accountants can simplify this complex process by automating routine tasks using advanced payroll software and tools.

This assistance reduces the possibility of manual errors and eases a significant administrative burden from you.

Payroll precision also promotes employee satisfaction and retention.

Your Shield in Audits: Professional Audit Support

Just mentioning an audit can make even the most seasoned business owner uneasy.

A professional accountant can make the audit process less daunting and more manageable by collating and presenting all necessary documents and offering guidance on what to expect.

They can also help your company avoid audits by maintaining impeccable financial statements and records and addressing potential red flags well in advance.

Insuring Your Future: Tailored Business Insurance Consultation

When it comes to liability and property insurance, your construction business faces risks and requirements that demand specialised coverage.

An experienced accountant can guide you towards cost-effective insurance policies that offer adequate coverage for your business scale, the projects you handle, and the associated risks.

Does Your Construction Company Need Accounting Assistance?

An accountant is more than just a numbers person; they’re a crucial partner in building a resilient, successful business.

What is the accounting standard for construction companies? The answer is Pherrus.

Our accounting for home builders has helped countless business owners streamline their financial operations and optimise growth opportunities.

Let us help you too. Fill in our online form or call +61 (02) 9099 9109 to book an appointment at our Bella Vista office in Sydney, NSW.