Whether you’re a savvy online startup or a seasoned e-commerce seller, as a digital entrepreneur, you know that financial fuel is essential for your business to take off.

But cash isn’t always easy to come by! So we’ve got the lowdown on the top financing options tailored to online businesses like yours.

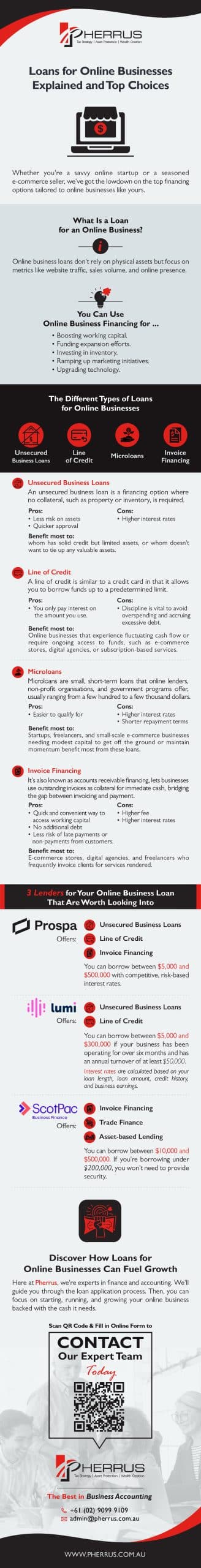

What Is a Loan for an Online Business?

Loans for online businesses don’t rely on physical assets like property or inventory, as these businesses often lack physical storefronts. Instead, they leverage the digital nature of online businesses, focusing on metrics like website traffic, sales volume, and online presence.

These metrics can also be the evaluation criteria for obtaining an online business loan, as opposed to the extensive paperwork or collateral required to secure traditional loans.

Such unique approval criteria can make these loans more attainable for digital entrepreneurs who may not have physical assets to pledge as collateral.

What can you use online business financing for?

The possibilities are virtually endless!

They include

- Boosting working capital.

- Funding expansion efforts.

- Investing in inventory.

- Ramping up marketing initiatives.

- Upgrading technology.

The Different Types of Loans for Online Businesses

Unsecured Business Loans

An unsecured business loan is a financing option where no collateral, such as property or inventory, is required, which can be less risky for online business owners who don’t want to put assets on the line.

These loans can be approved quicker than traditional secured loans but can come with higher interest rates.

If your online business has solid credit but limited assets, or you don’t want to tie up any valuable assets, unsecured loans can be a game-changer.

Line of Credit

A line of credit is similar to a credit card in that it allows you to borrow funds up to a predetermined limit.

The main advantage of this financing option is that you only pay interest on the amount you use.

However, discipline is vital when managing your credit line to avoid overspending and accruing excessive debt.

Online businesses that experience fluctuating cash flow or require ongoing access to funds, such as e-commerce stores, digital agencies, or subscription-based services, benefit most from a line of credit.

Microloans

Microloans are small, short-term loans that online lenders, non-profit organisations, and government programs offer, usually ranging from a few hundred to a few thousand dollars.

Microloans are highly accessible for online business owners because they can be easier to qualify for, especially for new businesses with either limited credit history or collateral.

The downside is that microloans can come with higher interest rates and shorter repayment terms, which could pose challenges for businesses with limited cash flow or uncertain revenue streams.

Startups, freelancers, and small-scale e-commerce businesses needing modest capital to get off the ground or maintain momentum benefit most from these loans.

Invoice Financing

Invoice financing, also known as accounts receivable financing, is a funding solution where businesses use their outstanding invoices as collateral to access immediate cash.

Instead of waiting for customers to pay their invoices, your business can leverage invoice financing to bridge the gap between invoicing and receiving payment.

This financing provides a quick and convenient way to access working capital without taking on additional debt.

Additionally, it can help mitigate the risk of late payments or non-payments from customers.

Disadvantages include fees and interest rates, which can affect profitability if not managed carefully.

Invoice financing works for e-commerce stores, digital agencies, and freelancers who frequently invoice clients for services rendered.

3 Lenders for Your Online Business Loan That Are Worth Looking Into

Prospa

Prospa offers unsecured business loans, lines of credit, and invoice financing.

You can borrow between $5,000 and $500,000 with competitive, risk-based interest rates.

Lumi

Lumi offers unsecured business loans and lines of credit.

If your business has been operating for over six months and has an annual turnover of at least $50,000, you can borrow $5,000 to $300,000.

Interest rates aren’t calculated based on an annual figure but on your loan length, loan amount, credit history, and business earnings.

ScotPac

ScotPac offers invoice financing, trade finance, and asset-based lending.

Your business can borrow between $10,000 and $500,000. If you’re borrowing under $200,000, you won’t need to provide security.

Loans are funded quickly, typically within 24 hours of approval.

Discover How Loans for Online Businesses Can Fuel Growth

Unleash the power of loans for your online business and watch your success soar!

But, knowing your loan options and which is best for your business can be confusing and overwhelming.

Here at Pherrus, we’re experts in finance and accounting.

We’ll guide you through the loan application process, from understanding the loans for online businesses available to business planning so you can manage your loans.

Then, you can focus on starting, running, and growing your online business backed with the cash it needs.

Fill out this online form or call +61 (02) 9099 9109 to book an appointment with one of our financial experts at our Bella Vista office in Sydney, NSW.