As a restaurant owner, you want your financial records to be like a masterfully crafted, perfectly seasoned dish, with every number in its proper place and every expense accounted for.

But let’s face it, in the fast-paced world of the culinary industry, your finances can sometimes look more like a chaotic kitchen after a Saturday dinner rush!

You’re not alone in feeling the heat of those financial challenges unique to the restaurant business.

But what if we told you there’s a secret ingredient to streamline your bookkeeping processes?

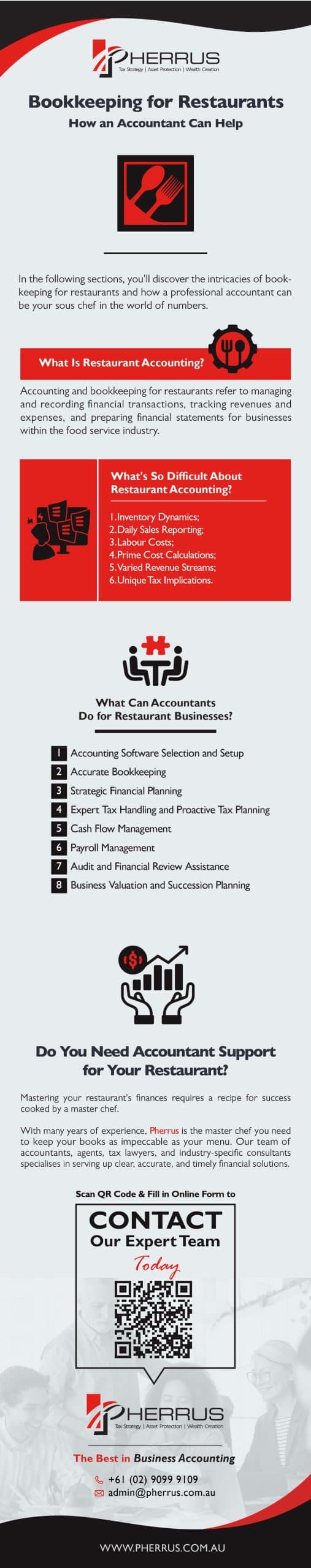

In the following sections, you’ll discover the intricacies of bookkeeping for restaurants and how a professional accountant can be your sous chef in the world of numbers.

What Is Restaurant Accounting?

Accounting and bookkeeping for restaurants refer to managing and recording financial transactions, tracking revenues and expenses, and preparing financial statements for businesses within the food service industry.

What sets bookkeeping for restaurants apart from accounting for other businesses?

- Frequent inventory changes due to perishable goods and daily sales.

- High frequency of transactions.

- Distinct labour cost structures with tips, hourly wages, and salaried staff.

- Unique tax implications specific to the industry.

- Varied revenue streams, from dine-in and takeout to catering and merchandise sales.

What’s So Difficult About Restaurant Accounting?

Inventory Dynamics

In the bustling world of restaurants, inventory constantly evolves.

Perishable goods are a ticking clock, necessitating frequent orders and close monitoring.

A single evening’s rush or an unexpectedly slow night can drastically alter inventory needs, leading to disparities between anticipated and actual costs.

Accounting for restaurants requires frequent adjustments in financial records and profitability analyses to account for these inconsistencies.

Daily Sales Reporting

Unlike some businesses that might deal with periodic or weekly sales reports, restaurants typically grapple with a whirlwind of daily transactions.

This high volume of transactions demands careful recording and reconciling of financial statements.

Miss a day, and the whole monthly or yearly overview could be skewed!

Labour Costs

The diverse team behind a successful restaurant brings with it a mix of payment structures.

There’s the hourly waiter, the salaried manager, and the variable of tips.

Accounting for every dollar, wage, and tip is tedious, requiring dedicated focus and expertise.

Prime Cost Calculations

Prime cost calculations combine labour and food costs to indicate a restaurant’s financial health.

Regular, correct calculations are a must to help business owners make informed pricing and operational decisions for profitability and customer satisfaction.

Varied Revenue Streams

For many restaurants, revenue isn’t solely from the dishes served at the tables.

It also streams in from takeouts, catering gigs, and merchandise sales.

Each stream, with its distinct financial blueprint, needs separate accounting attention to paint a complete and precise fiscal picture.

Unique Tax Implications

The food and beverage world has a specific set of tax obligations.

Think alcohol taxes, special levies on certain types of food, or locality-specific taxes.

Staying compliant isn’t just about paying these, but also understanding when and how they apply.

What Can Accountants Do for Restaurant Businesses?

Accounting Software Selection and Setup

Accounting software for restaurants must integrate systems with supplier databases, reservation platforms, and CRM systems to streamline your business’s finances.

The right software will do this, plus enhance billing accuracy and simplify compliance with industry regulations.

Accounting software for restaurants automates these vital bookkeeping tasks:

- Sales and expense tracking

- Inventory management

- Payroll processing

- Tax calculations

- Financial reporting

- Invoice payment processing

- Bank reconciliation

- Cash flow forecasting

An accountant who understands the nuances of bookkeeping for the restaurant world can recommend the best accounting software for restaurants.

Once chosen, they can assist you and your team with proper software setup, training, and possible migration from an old system for a smooth transition.

Accurate Bookkeeping

Beyond merely recording transactions, accurate bookkeeping for restaurants involves managing vendor invoices, keeping tabs on wastage, and tracking promotional offers and discounts.

An accountant can introduce systematic ways of categorising expenses, reconciling bank statements, and monitoring gift card liabilities.

This meticulous approach clarifies where your business’s money is going, highlighting areas for potential savings or smarter spending.

Strategic Financial Planning

In the culinary world, strategy goes beyond planning the perfect menu.

An accountant will examine your historical data, current market trends, and potential setbacks.

They can then advise on

- Capital expenditure decisions like when to invest in renovations, new kitchen equipment, or digital marketing campaigns.

- Securing the most relevant insurance policies for your business.

- Sourcing and applying for the best business loans to give you the financial leverage to expand, relocate, or hire more staff.

With this comprehensive approach, your accountant can create a resilient and agile financial roadmap in the face of industry fluctuations to help your business grow and maintain profitability.

Expert Tax Handling and Proactive Tax Planning

Tax return preparation is time-consuming and challenging for busy restaurant owners.

An expert accountant will file your business’s tax returns correctly and on time to avoid penalties and fines from the government.

They will compile all necessary financial records and utilise every available deduction to minimise your tax bill.

An accountant also has in-depth knowledge to keep your business compliant with all relevant tax laws.

Beyond basic compliance, accountants dive into industry-specific tax codes to garner benefits.

This includes understanding depreciation on restaurant equipment, exploring potential credits for sustainable or eco-friendly practices, and accounting for franchising or licensing fees.

It’s important to keep tax obligations in mind all year round, not just at tax time. Why?

Consistent tax planning throughout the year ensures compliance, maximises deductions and avoids unexpected financial burdens.

In Australia, restaurant businesses face certain tax considerations, incentives, and regulations. Your accountant can navigate these for you.

- Fringe Benefits Tax (FBT): If a restaurant provides particular perks or benefits to its employees outside their salary (e.g., meals), they may be liable for FBT.

- Wine Equalisation Tax: This tax is levied at 29% of the taxable value of wine for restaurants that produce or import wine.

- State-specific levies and charges: Depending on the state or territory, there might be additional levies or charges, especially related to liquor licensing.

- Capital works deductions: Special tax deductions can be claimed on the construction costs of buildings or extensions restaurant owners might undertake.

- Tax concessions for small businesses: Depending on the restaurant’s turnover, it may qualify for small business tax concessions, such as simplified depreciation rules.

Cash Flow Management

Liquidity involves more than just monitoring the cash register.

Accountants analyse payment cycles to understand when bulk orders are due, when seasonal increases in utility bills might occur, or when a deposit for a private event might come in.

They’ll provide insights on optimal times to make investments or cut back, creating a buffer for leaner times and helping your business capitalise on peak seasons.

Payroll Management

Beyond basic salary calculations, accountants handle complexities like overtime, holiday pay, sick leave, and superannuation contributions.

They also keep up to date with changes in employment legislation so your restaurant is always compliant.

Plus, they can advise on tools or platforms to facilitate employee time tracking, making payroll calculations more efficient and transparent.

Audit and Financial Review Assistance

In an audit, every detail counts. An experienced accountant will prepare every receipt, invoice, and transaction for scrutiny.

They’ll also implement internal controls to prevent fraud or financial mismanagement.

Beyond the occasional audit, an accountant will conduct periodic checks, comparing your financial performance against industry benchmarks and suggesting areas for improvement.

Having an accountant on your side during an audit will significantly alleviate your stress.

Getting your financial records in order and addressing auditor queries will give you peace of mind in a potentially tense situation.

Business Valuation and Succession Planning

Whether you are contemplating selling your restaurant, seeking new investors, or handing over the reins to the next generation, understanding the true value of your business is crucial.

Accountants can provide comprehensive business valuations, considering tangible assets like property and equipment and intangible ones such as brand reputation, customer loyalty, and future revenue streams.

If you’re planning retirement or a change in direction, an accountant can guide you through succession planning for a seamless transition.

That process includes a tax-efficient transfer of ownership and a secure financial future for both outgoing and incoming proprietors.

Do You Need Accountant Support for Your Restaurant?

Mastering your restaurant’s finances requires a recipe for success cooked by a master chef.

With many years of experience, Pherrus is the master chef you need to keep your books as impeccable as your menu.

Our team of accountants, agents, tax lawyers, and industry-specific consultants specialises in serving up clear, accurate, and timely financial solutions.

For expert bookkeeping and accounting for restaurants, fill in our online form or call +61 (02) 9099 9109 to book an appointment at our Bella Vista office in Sydney, NSW.