How strong is your cash flow management? Particularly when a business is just starting or undergoing some form of transition, cash flow can be a deciding factor in whether it survives.

Some people may be asking, what is cash flow?

Cash flow meaning in accounting, is defined as the net cash flow coming into and going out of a business.

A healthy cash flow ensures that you have sufficient cash to meet your expenses at all times.

Here we look at the components of cash flow and consider several cash management techniques in financial management that can assist in keeping your cash flow running smoothly.

What is cash flow management?

Cash flow management means taking control of your cash flow.

Through the use of an appropriate cash management control system, it should be possible to ensure that your cash inflow is more than enough to cover your cash outflow needs.

This means you need to balance the amount of money flowing into your business from customer payments, credits, rentals or other sources, and outgoing costs such as paying suppliers, paying wages, paying for overheads, servicing debt or investing in new equipment.

Otherwise known as the net cash flow formula, cash inflow minus cash outflow will give you your net cash flow.

By putting pro-active financial management at the heart of your business, it’s often possible to exceed performance and profit targets, putting your business in a strong position for future growth.

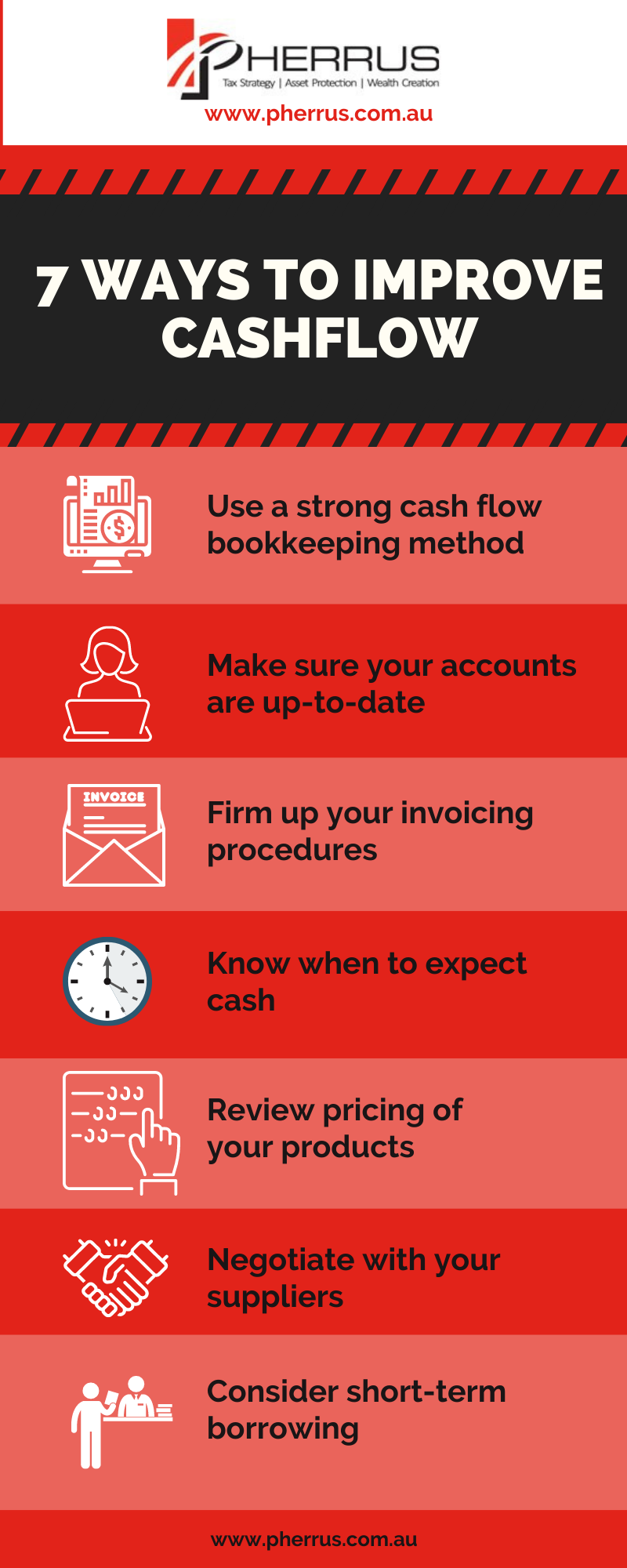

Use a strong cash flow bookkeeping method

Before you make any adjustments or changes to how you operate, it’s vital to know how much money you’ve got coming in, how much needs paying out and what your current operating balance is. Robust bookkeeping systems are a must to achieve this goal.

In addition to appropriate bookkeeping software, it’s also essential to have a suitably qualified professional available to make sure the software is up-to-date and to ensure that financial reporting is as good as it can be.

As any information on the current financial situation should underpin decision-making, your bookkeeper must provide the high-calibre cash flow information you need.

Make sure your accounts are up-to-date to support your cash flow

Even the best cash flow statement isn’t going to provide much helpful information if the figures used to compile it are inaccurate or out-of-date.

Particularly for start-up businesses, or those running a couple of years but still don’t have a dedicated bookkeeping resource, it’s all too easy for financial information to be stored in an ad hoc manner.

Many owner-operators do their books when they have time, leading to poorly presented or outdated information.

A few hours of bookkeeping expertise from a professional is often all that’s needed to get your books in top condition, making it much easier to get a handle on your cash flow situation.

Firm up your invoicing procedures

One of the biggest reasons businesses end up with insufficient funds to meet their obligations is that their customers don’t pay them on time. This can be for a whole host of reasons, including:

– A flawed invoice system, which means customers receive invoices and reminders late.

– Limited payment methods, which make it complex for customers to pay.

– Inadequate systems for chasing debt.

The solution to all these problems is prioritising prompt, effective invoicing and clear deadlines for payment.

Some companies encourage early payment by offering a discount for customers who pay within a week or fourteen days.

If you’re not sure how to resolve your invoicing issues, it’s worth investing in the services of an experienced bookkeeper.

They can potentially save you hundreds of dollars by introducing and operating a high-grade invoice management system.

Know when to expect cash

If your customers usually pay you at the point of purchase, it’s relatively easy to know when your income will arrive.

Conversely, if you are a business that sends out invoices, clients may keep you waiting for weeks. Analysing when your Sales (Invoices) are likely to hit your account is an integral part of the cash flow management process.

Your bookkeeper should provide you with real-time information on any patterns of payment delay that need addressing.

Revisiting your debts is part of Cash Flow Management

When you’ve got debts, they’re probably going to take a considerable amount of your cash flow each month.

To make your cash flow healthier, take a look at your current debts and see if it’s possible to reduce the amount of interest you pay on them each month, pay them back early, or negotiate smaller monthly repayments.

Debt in itself isn’t always a bad thing – sometimes borrowing is necessary to enable a business to thrive and grow.

Take a look at your expenses

Many businesses struggle with a mismatch between the amount of money in their bank account and their predicted outgoings. One of the reasons for this may be that expenses are simply too high.

This may be due to poor planning and prediction or be due to poor cost control. It’s worth looking at both the assumptions on which predicted expenses are made and the reasons why the actual figures are higher than intended.

There may be a need to revisit and revise forecasted figures, then look at alternative ways of reducing costs.

Review pricing of your products

If you’re experiencing limited cash flow, despite managing your outgoings carefully and invoicing promptly, it could be the case that your price point is wrong.

Several variables influence price, including:

– Changes in production costs.

– Changes in competitor pricing.

– Shifts in audience expectation and demand.

– A shifting selling environment.

– The state of the economy.

– The state of the market – if it’s a buyers’ market, for example, your price may have to be low to remain competitive, but this puts a strain on your cash flow.

Depending on how your business operates, it may be worth investing in pricing software.

This type of software can analyse customer behaviour and suggest pricing alterations depending on the behaviour trends.

Negotiate with your suppliers

It can be the case that you pay suppliers promptly but aren’t receiving payment from your customers on the same timescales.

This can cause problems with cash flow – money has been expended on overheads and supplies, with no commensurate income.

A cash flow management example of handling this situation might be to negotiate with your suppliers.

Some suppliers, particularly larger ones, are prepared to extend payment timescales or allow goods to be bought on credit or on a “sale or return” basis.

It may also be possible to shift money from one supplier to another, perhaps paying off those who can’t or won’t negotiate whilst delaying payment to those prepared to wait.

Consider short-term borrowing

Suppose cash flow continues to be an issue, despite tackling debt, looking at ways to cut back your expenditure and working with suppliers to delay payment until the cash flow situation has eased.

In that case, it may be worth considering short-term borrowing.

The advantage of a fast, short-term loan is that you can pay the most urgent costs (typically staff wages and the materials needed to provide your goods and/or services), then repay the loan once your customers have paid you.

In some situations, short-term borrowing can allow businesses to trade their way out of trouble.

The downside of short-term borrowing is that it needs to be paid back with interest.

For short-term borrowing to work as a method of enhancing cash flow, it has to be backed up by a robust, longer-term plan to minimise the risk of further cash flow issues in the future.

The cost of the borrowing needs to be offset against the potential costs if the money isn’t borrowed.

A professional bookkeeper can make a positive difference to your financial situation

If you need someone to explain cash flow management and create the financial information you need for informed decision-making, using a professional bookkeeper is essential.

Even if you’re a smaller business and can’t afford a full-time bookkeeper, just a few hours a week of professional support is all that’s needed to see a noticeable improvement in your cash flow situation.

Bookkeepers can provide a cash flow management model that matches your business requirements.

They have a wealth of financial systems experience and interpret financial data, giving you the insight needed to adjust your cash flow accordingly.

Based on their experience working for a wide range of businesses, bookkeepers can often provide shrewd financial insights on how best to manage your cash flow effectively.

A bookkeeper will know a fair bit about business studies and financial processes, procedures, and management.

For your business to be successful, sound financial management has got to be at the heart of decision-making.

If you’re experiencing cash flow issues or would like to find out more about the benefits a professional bookkeeper can bring to your business, don’t hesitate to contact pherrus financial services for further information.