Property investment is an attractive way of building net worth, but first-time investors can often be intimidated by the perceived difficulty of building and managing a property portfolio.

This is not surprising since the investment industry loves to use industry jargon to make the process of investing sound more complicated than it is.

Take negative gearing, for example. You will often hear real estate agents, investment professionals and mortgage advisors talking about it. But what exactly is negative gearing and how can ordinary investors like you use it to build a tax-efficient property portfolio ?

Well in this article, we are going to remove the cloak of obscurity from negative gearing. We’ll discuss what it is, how it can be used, the benefits of the strategy and the risks involved, so that by the end of this article, you should have a pretty good idea of what negative gearing is and whether it’s the right strategy for you.

What is negative gearing ?

Before we do anything else, we should explain what negative gearing is. Gearing itself is a term used by financial professionals to describe the amount of debt an individual or company holds.

A company can have low gearing which means it has a low debt to equity ratio or a high gearing which means it carries lots of debt.

So what is negative gearing? When it comes to property, gearing can be described as either positive or negative. Positive gearing means that a property generates a net return after all interest and other payments have been made.

While negative gearing means that the rental income is not enough to cover interest payments and maintenance costs.

Why is negative gearing Australia’s most popular investment strategy ?

So if negative gearing makes a loss, why is it that close to 10% of all Australians and 22% of high-income earners use the strategy? The answer is twofold. Most property investors aim to benefit from rising property values over the long term.

Plus, any loss you make in your property portfolio can be offset against other income, which makes negative gearing a tax-advantaged investment.

With house prices in Australia increasing by an average of 412% over the past 25 years, it’s easy to see how a negatively geared property can still provide a positive return over the long term.

In most cases, the increase in the value of the property will more than offset the cost of paying interest and maintenance costs.

Of course, there is no guarantee that property prices will keep rising in the future, but with the demand for housing stock still outstripping supply in all regions across Australia, there is no reason to suspect that property prices won’t continue to rise.

The consensus is that property values will rise at a rate of 6.4% annually until at least 2043.

How does negative gearing work?

When investing in a negatively geared property, the aim is to generate medium-term tax losses which can be offset against other income.

This strategy allows you to reduce your overall tax bill by an amount equal to your marginal tax rate, multiplied by the excess of deductible expenses – this is effectively the tax loss on your property.

For example, if you rent out a property for $580 per week in the 2020/2021 financial year, your total rental income will be $30,180. After deducting your total expenses of $50,000, you are left with a net loss of $19,840.

If we assume your taxable income for the year is $90,000 (excluding the rental loss), the negative gearing benefit is calculated as follows: 19,840 (total loss) x 30% (marginal tax rate) = $5,946.

Put simply, the amount of tax you offset each year will contribute towards (but not exceed) your overall investment expenses. This is the primary reason why negative gearing has become one of the most popular tax saving schemes in Australia.

How to calculate negative gearing

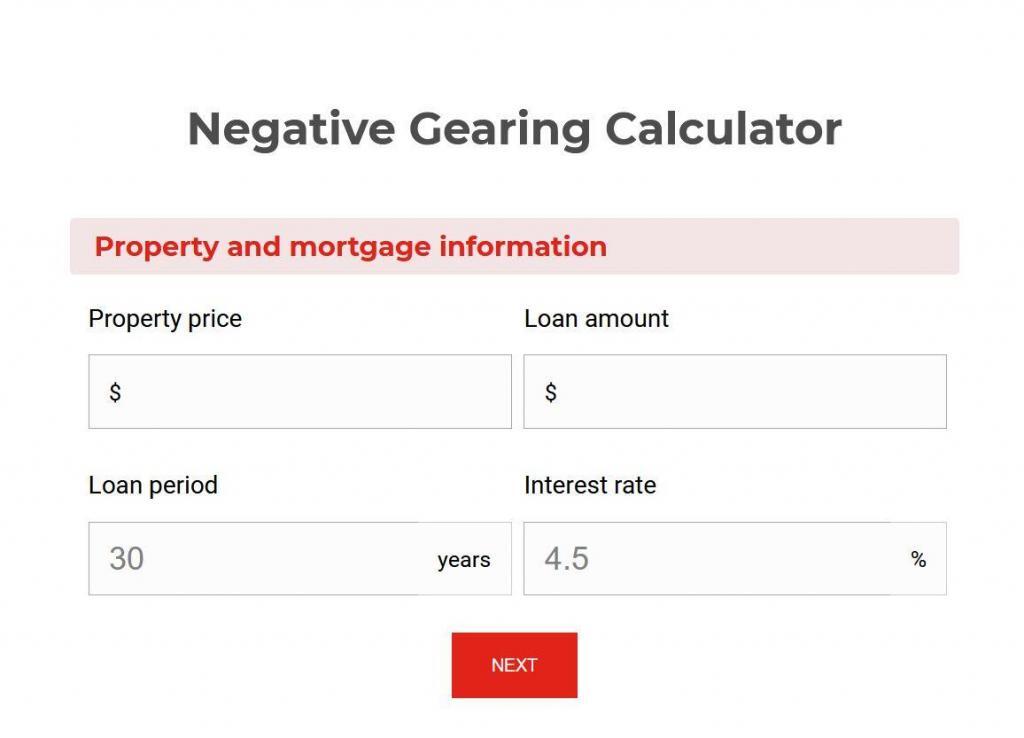

Now you know how negative gearing works, you need to know how to calculate the total negative gearing loss for any prospective property.

This is quite simple, you just need to complete the following three steps :

- Calculate your property income – This is the total amount of income you receive from tenants. But you may also receive income from other sources such as solar panels or phone masts located on the property.

- Calculate your property expenses – Your expenses will consist of any loan repayments incurred along with stamp duty, council and water rates (if these are not paid by the tenant), maintenance costs, refurbishment costs, and property management fees.

- Deduct depreciation costs – You can also deduct depreciation costs under Division 40* and 43** of the Income Tax Assessment Act 1936.

* Division 40 allows you to deduct depreciation costs on interior fittings including appliances, carpets, curtains and hardwood flooring.

**Division 43 allows you to deduct construction costs at a rate of 2.5% per year on a new build for 10 years.

Please take into consideration that the property accounting experts at Pherrus Financial Services can help set you with the setup of a depreciation schedule tailored to your specific property.

You may also find our Negative Gearing Calculator helpful.

A negative gearing example

Now you know what negative gearing is and how to calculate it, let’s look at a hypothetical example :

Noah is looking to buy his first investment property. He has saved a deposit of $100,000 and is looking to buy a $400,000 property.

His next step is to arrange a $300,000 mortgage from a lender.

He arranges an interest-only mortgage with an APR of 4.2%. This means his initial interest charges amount to $1050 per month ($12,600 a year).

Now Noah is ready to find a suitable property. He chooses a two-bedroom flat in an up and coming area which generates $300 per week in rental income ($15,600 a year).

Before a new tenant moves in, some refurbishment is required which costs $1000.

He also needs to account for annual running costs such as property management fees ($2000), strata fees ($2100), maintenance costs ($1000) and insurance ($1000).

When added together, these costs come to $18,700, which is $3100 more than Noah collects in rent.

Since Noah has a marginal tax rate of 30%, he can offset that loss against his taxable income as follows: $3,100 (total loss) x 30% (marginal tax rate) = $930. This reduces Noah’s total loss on the property to just $2170 per year.

With property prices set to increase by 4.5% over the next five years, by 2025 Noah’s property will be worth $498,472. Once we take away Noah’s annual loss (2170 x 5 = $10,850), he is left with a profit of $87,622.

Negative gearing vs positive gearing

We already covered the difference between negative and positive gearing earlier in this article, but let’s look at the two strategies in more detail.

As a quick refresher, negative gearing means the rental income from tenants does not cover the cost of purchasing the property, while positive gearing means a profit is left over once interest payments and other expenses have been met.

This begs the question, why bother with negative gearing at all? By buying a positively geared property you will have a nice income from day one and you won’t be out of pocket on any expenses.

Sure you won’t have any tax to defer, but you will have an increased income instead.

On the face of it, this makes perfect sense, however, the property market doesn’t work that way. Positively geared properties generate a return immediately because they have limited upside potential. So a positively geared property won’t increase in value as much as a negatively geared one.

So if you are looking for capital appreciation, rather than income, negatively geared properties will prove to be more profitable over time. That doesn’t mean you should ignore positively geared properties altogether. A well-balanced property portfolio should contain a mix of both types to guard against the risks involved.

What are the risks involved with negative gearing ?

As with all leveraged investments, there is a risk to your capital should things not go to plan. When it comes to negative gearing, the risks are limited to the following three areas :

-

- Lack of cash flow

Because you have to make up any shortfall between the rental income and the loan repayments, you will need to make sure you have enough cash left over each month to cover the difference. Failure to keep up loan repayments will result in your property being repossessed and the loss of your deposit.

You can guard against this by knowing what your monthly outgoings are and doing your maths carefully. Alternatively, work with an investment income tax Australia specialist to create a monthly cash flow plan which you can use to budget for monthly income and outgoings.

-

- No tenants

Not having any tenants or leaving the property unoccupied for a long period will lead to a loss of rental income. This will greatly increase your annual losses. Yes, you will still be able to offset the loss against taxable income, but unless you have enough savings to cover the difference, you will end up with severe cash flow problems.

You can guard against not having tenants by ensuring you only buy properties in desirable or up and coming neighbourhoods. Any reputable real estate agent will be able to show you where these neighbourhoods are. Don’t be tempted to buy a property in a poor area, no matter how good a deal you think you’ve found.

-

- Property depreciation

Finally, there is a risk that the property you buy depreciates. The property market sees peaks and troughs, but the dynamics of the Australian property market mean that over the long term property values should continue to rise. So even if you are unlucky enough to buy just before prices tumble, just wait it out and see what happens.

You can’t completely guard against variations of the property market, but you can reduce the risk by only buying properties in desirable and up and coming neighbourhoods. These properties will likely see the least amount of depreciation and will rebound first when prices recover.

Despite the above risks, negative gearing is still seen as a pretty sound investment. If you do your homework you should see a tidy profit after five-years, even if the economy crashes and house prices tumble. But as with all investments, you should understand the risks before making the jump.

Negative gearing pros

Low rental fees – Because negative gearing investors are not seeking a positive return, they can price their rentals competitively. This allows them to benefit from long-term relationships with tenants, thereby reducing agency fees. It also reduces the amount of time the property stands vacant.

Tax-deductible – Because the loss you make on the property can be offset against other taxable income, you stand to benefit from lower tax bills while still reaping the rewards of higher property prices.

Long-term capital appreciation – Properties which are negatively geared are often the ones which outperform the market. Invest in an up and coming area and you could see the value of your property increase significantly.

Negative gearing cons

The risk to capital – As with all leveraged investments, there is a risk to your capital should something go wrong. You can limit this by doing your homework and only buying properties in select neighbourhoods.

Negative cash flow – Because negatively geared properties make a loss each year, you will need to make sure you have enough spare cash to make up the difference. Failure to keep up loan or interest payments will result in your property being repossessed.

Locks up capital for long periods – Investing in property is a long-term strategy, so you need to allow for capital being tied up for several years. Don’t invest funds you think you may need in the next five-to-ten years.

Is negative gearing right for you?

The answer to this question will depend on your circumstances. Negative gearing is ideal for investors seeking long-term capital gain. As a result, it is most suitable for young professionals who can afford to have capital tied up in a property portfolio for several years.

The strategy is less suitable for investors seeking to supplement their regular income, such as retirees. Such investors would be better advised to invest in a positively geared property portfolio or a high-dividend Exchange Traded Fund (ETF) which delivers a regular consistent income.

If you would like more information about building a tax-efficient property portfolio using negative gearing, get in touch with the tax planning experts at Pherrus Financial Services. Our team has more than 25 years of experience providing tax advice to private property investors across Australia.

So, if you are looking to make your first property investment or are a seasoned property investor. Our dedicated tax experts can help evaluate your portfolio to ensure it is optimised in the most tax-efficient manner possible. Because while tax is a necessity in life, you shouldn’t be paying more than you have to.

Get in touch with us today by completing the contact form here or give us a call on 02 9099 9109.